As global markets continue to experience gains, with key indices like the Dow Jones and S&P 500 reaching record highs, small-cap stocks have also joined the rally, reflecting robust investor sentiment despite geopolitical uncertainties and tariff concerns. In this dynamic environment, identifying high-growth tech stocks requires a focus on companies that demonstrate resilience through innovation and adaptability to economic shifts.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1287 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Shanghai Baosight SoftwareLtd (SHSE:600845)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Baosight Software Co., Ltd. offers industrial solutions in China and has a market capitalization of CN¥68.38 billion.

Operations: Baosight Software focuses on delivering industrial solutions in China, generating revenue primarily through its software and system integration services. The company operates with a market capitalization of CN¥68.38 billion.

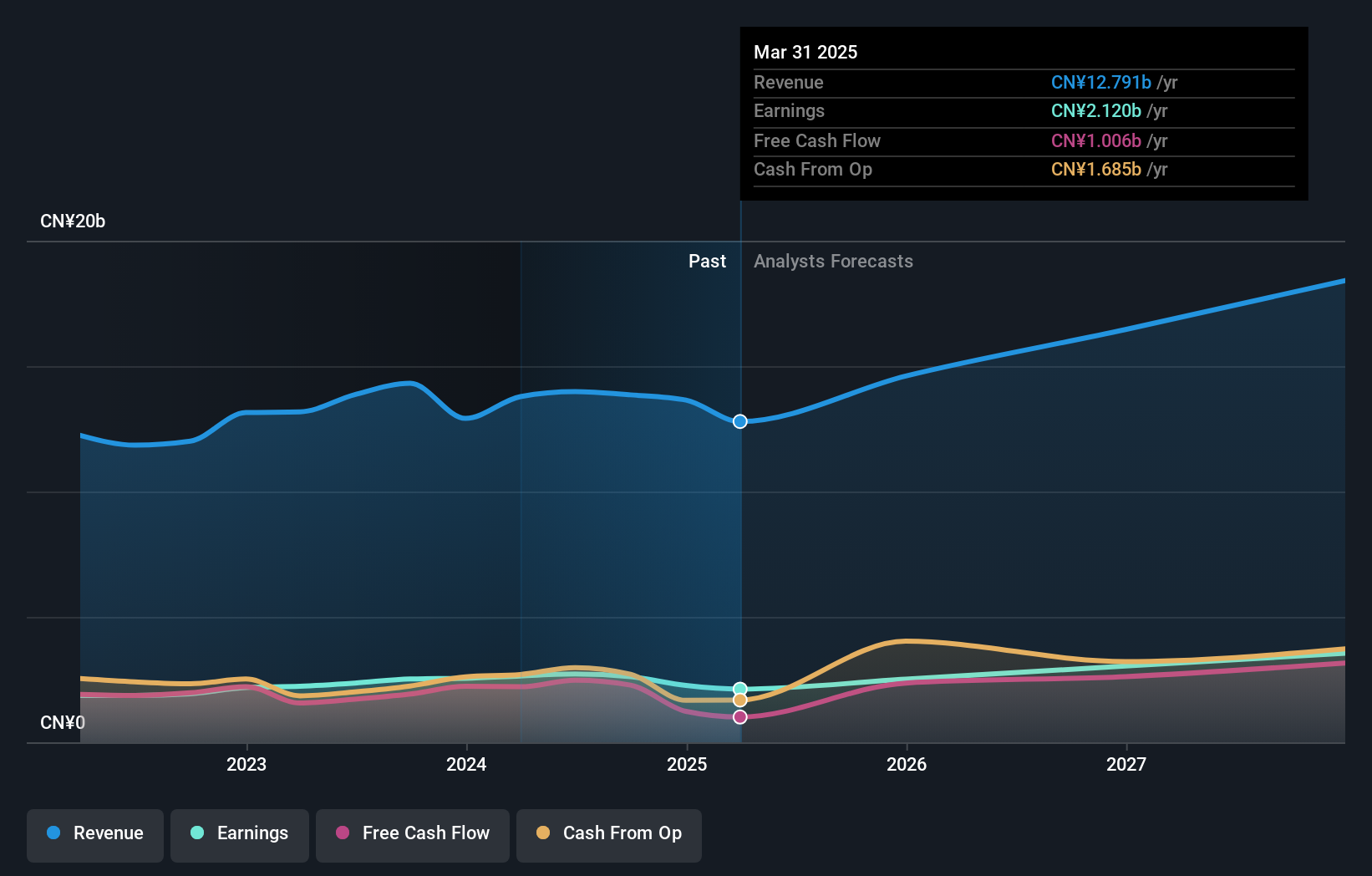

Shanghai Baosight Software Co., Ltd. has demonstrated a robust growth trajectory, with revenue surging by 10.66% to CNY 9.76 billion in the first nine months of 2024, underscoring its capacity to expand sales effectively amidst competitive market conditions. This performance is complemented by a notable increase in net income, rising to CNY 1.93 billion, reflecting a solid execution of operational efficiencies and strategic initiatives aimed at enhancing profitability. Significantly, the company's commitment to innovation is evident from its R&D investments which are crucial for sustaining long-term growth in the tech sector; these expenditures ensure that Shanghai Baosight remains at the forefront of technological advancements and maintains its competitive edge. Looking ahead, Shanghai Baosight is poised for continued success with an expected annual earnings growth rate of 23.9%, outpacing many peers within China's software industry where average market growth hovers around 26%. The company benefits from high-quality earnings and an anticipated Return on Equity (ROE) forecasted at an impressive 26.4% over three years, indicating strong potential for shareholder value creation through effective capital management and innovative product development strategies.

Nanjing Vazyme Biotech (SHSE:688105)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Nanjing Vazyme Biotech Co., Ltd provides technology solutions in life science, biomedicine, and in vitro diagnostics, with a market cap of CN¥9.72 billion.

Operations: Vazyme Biotech generates revenue primarily through its technology solutions in the fields of life science, biomedicine, and in vitro diagnostics. The company focuses on innovative products that cater to research institutions and healthcare providers. Its financial performance is reflected in its market capitalization of CN¥9.72 billion.

Nanjing Vazyme Biotech has pivoted impressively from a net loss to a profitable stance within the year, with its latest earnings report showing a leap in revenue to CNY 985.91 million, up from CNY 869.3 million, alongside a net income of CNY 18.16 million compared to last year's loss. This resurgence is underpinned by strategic R&D investments that have not only fueled innovation but also positioned the company for sustained growth; these expenses are crucial as they represent a commitment to advancing biotechnological capabilities. Additionally, the company repurchased shares worth CNY 104.01 million, enhancing shareholder value and reflecting confidence in its financial health and future prospects. With expected annual revenue growth at an impressive 23.7% and profit forecasted to surge by 90% annually, Vazyme is on track for rapid expansion well above industry norms.

- Click to explore a detailed breakdown of our findings in Nanjing Vazyme Biotech's health report.

Understand Nanjing Vazyme Biotech's track record by examining our Past report.

Ningbo Sunrise Elc TechnologyLtd (SZSE:002937)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ningbo Sunrise Elc Technology Co., Ltd specializes in the manufacturing and sale of precision components, with a market capitalization of CN¥5.17 billion.

Operations: The company focuses on producing and distributing precision components, generating its revenue primarily from this segment. It operates with a market capitalization of approximately CN¥5.17 billion.

Ningbo Sunrise Elc TechnologyLtd, despite a slight dip in sales from CNY 1,486.76 million to CNY 1,477.9 million year-over-year, has maintained a stable net income growth to CNY 192.44 million. This financial steadiness is bolstered by significant R&D investments which have positioned the company for future technological advancements; last year’s R&D expenses were notably high at 32.6% of revenue. Looking forward, earnings are expected to surge by an impressive 35.1% annually, reflecting strong potential in its operational efficiencies and market expansion strategies.

Seize The Opportunity

- Explore the 1287 names from our High Growth Tech and AI Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nanjing Vazyme Biotech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688105

Nanjing Vazyme Biotech

Offers technology solutions for life science, biomedicine, and in vitro diagnostics.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives