Insigma Technology's (SHSE:600797) Anemic Earnings Might Be Worse Than You Think

The subdued market reaction suggests that Insigma Technology Co., Ltd.'s (SHSE:600797) recent earnings didn't contain any surprises. However, we believe that investors should be aware of some underlying factors which may be of concern.

See our latest analysis for Insigma Technology

How Do Unusual Items Influence Profit?

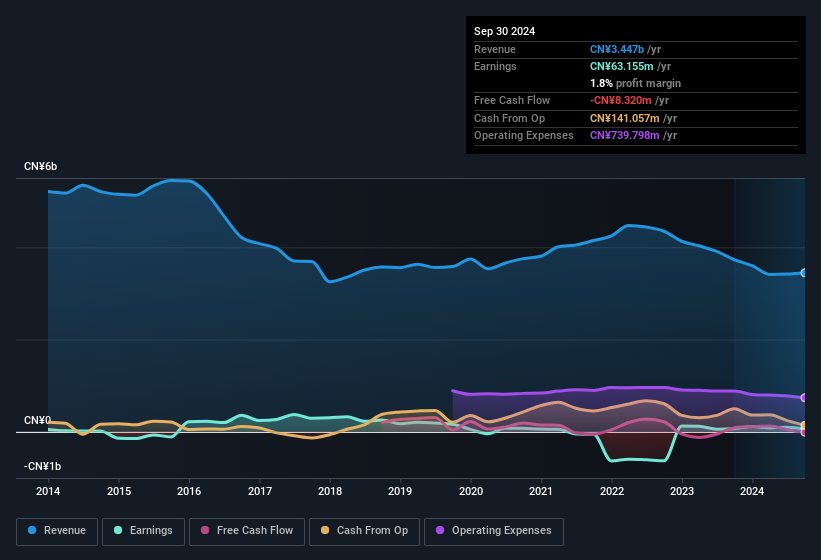

Importantly, our data indicates that Insigma Technology's profit received a boost of CN¥155m in unusual items, over the last year. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And, after all, that's exactly what the accounting terminology implies. We can see that Insigma Technology's positive unusual items were quite significant relative to its profit in the year to September 2024. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Insigma Technology.

Our Take On Insigma Technology's Profit Performance

As we discussed above, we think the significant positive unusual item makes Insigma Technology's earnings a poor guide to its underlying profitability. As a result, we think it may well be the case that Insigma Technology's underlying earnings power is lower than its statutory profit. Sadly, its EPS was down over the last twelve months. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. In terms of investment risks, we've identified 2 warning signs with Insigma Technology, and understanding these should be part of your investment process.

This note has only looked at a single factor that sheds light on the nature of Insigma Technology's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600797

Insigma Technology

Operates as an information technology consulting and service company in China.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives