As global markets navigate a landscape marked by fluctuating corporate earnings and competitive pressures in the AI sector, recent developments have seen U.S. stocks experience volatility, with technology shares particularly impacted by emerging competition from Chinese AI firms like DeepSeek. Amidst these market dynamics, investors are keenly observing high-growth tech stocks that demonstrate resilience and innovation potential, especially those capable of capitalizing on technological advancements while managing competitive challenges effectively.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Pharma Mar | 23.24% | 44.74% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.62% | 56.70% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Travere Therapeutics | 30.46% | 62.05% | ★★★★★★ |

Click here to see the full list of 1233 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

China National Software & Service (SHSE:600536)

Simply Wall St Growth Rating: ★★★★☆☆

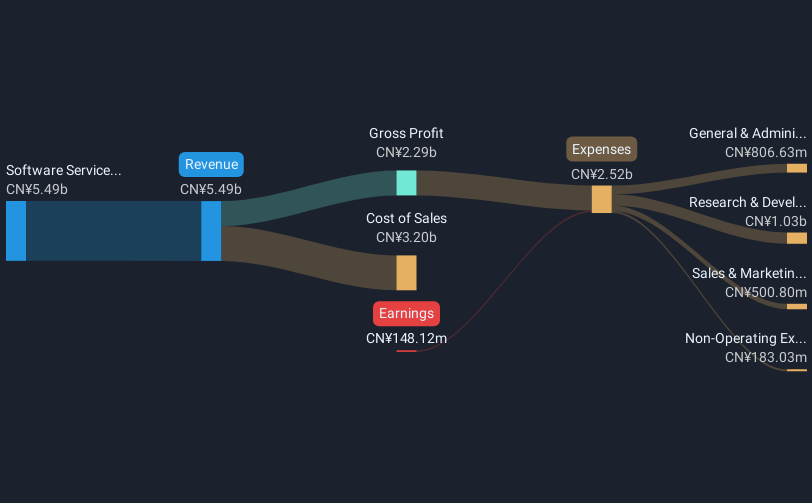

Overview: China National Software & Service Company Limited operates as a software company in China with a market cap of CN¥36.62 billion.

Operations: The company generates revenue primarily through its software service business, which amounts to CN¥5.49 billion.

China National Software & Service is navigating a challenging landscape with a forecasted annual revenue growth of 16.6%, outpacing the Chinese market's average of 13.3%. Despite current unprofitability, the company is expected to shift towards profitability with an impressive projected earnings growth rate of 88.5% annually over the next three years. Recent extraordinary shareholder meetings suggest strategic maneuvers that could further influence this trajectory. However, its R&D investment details remain crucial for sustaining innovation and competitiveness in the rapidly evolving tech sector, where robust development efforts are essential for maintaining technological leadership and market relevance.

Fujian Apex SoftwareLTD (SHSE:603383)

Simply Wall St Growth Rating: ★★★★☆☆

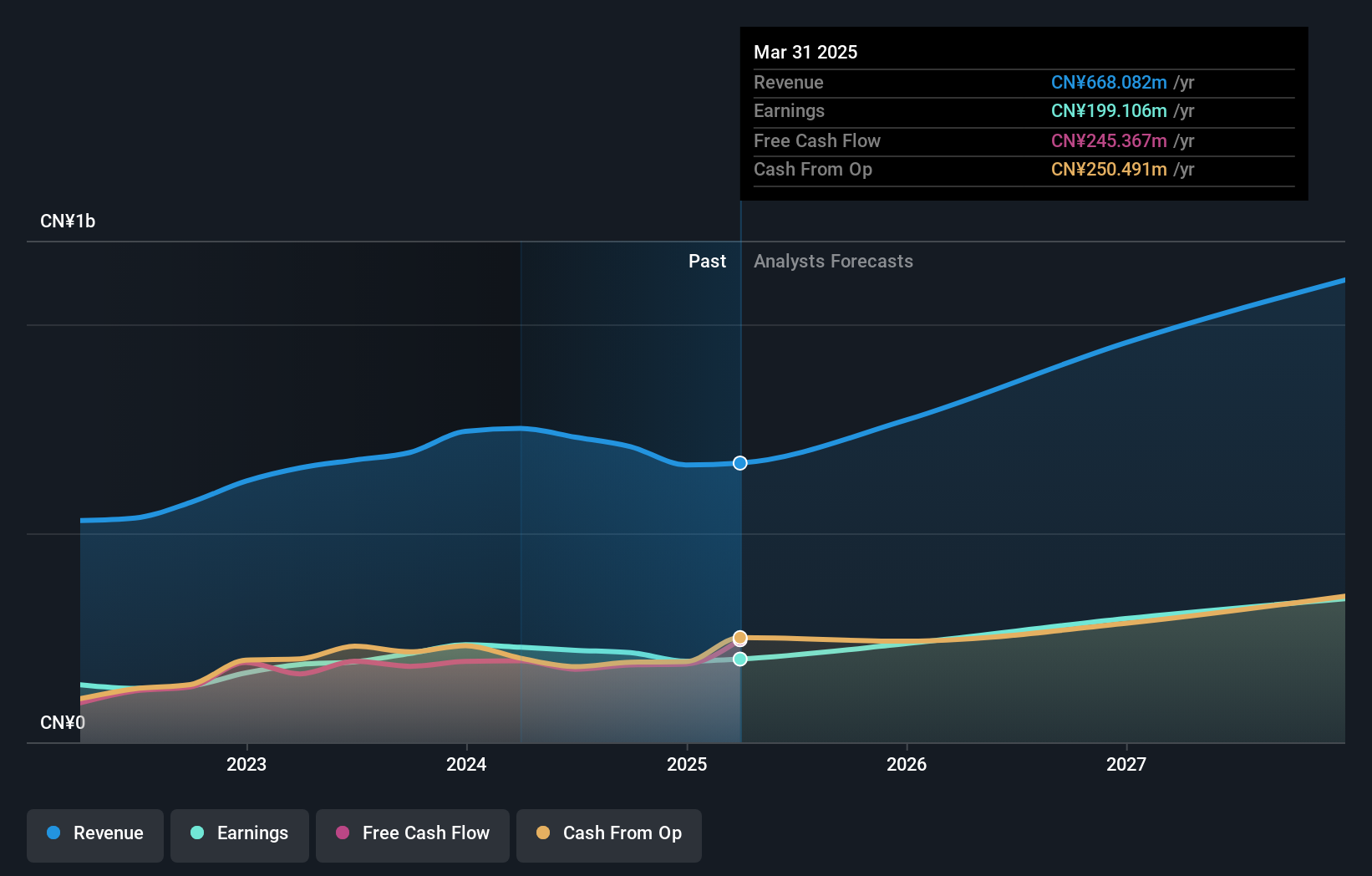

Overview: Fujian Apex Software Co., LTD is a platform-based digital service provider company in China with a market capitalization of CN¥7.20 billion.

Operations: Apex Software generates revenue primarily from its application software service industry, amounting to CN¥707.34 million. The company's focus on digital services positions it within the broader technology sector in China.

Fujian Apex Software Co., LTD, in its recent Q3 2024 earnings call, highlighted a robust trajectory with an annual revenue growth of 18.1%, surpassing the broader Chinese market's average of 13.3%. This growth is complemented by a significant earnings increase of 22.6% per year, showcasing strong financial health and operational efficiency. Importantly, the company's commitment to innovation is evident from its R&D spending trends which have consistently aligned with expanding its technological capabilities and maintaining competitive advantage in the dynamic software industry. These strategic investments in R&D not only underscore Fujian Apex’s forward-looking approach but also solidify its position in high-growth tech sectors poised for future expansions.

- Delve into the full analysis health report here for a deeper understanding of Fujian Apex SoftwareLTD.

Assess Fujian Apex SoftwareLTD's past performance with our detailed historical performance reports.

Shanghai Fengyuzhu Culture Technology (SHSE:603466)

Simply Wall St Growth Rating: ★★★★☆☆

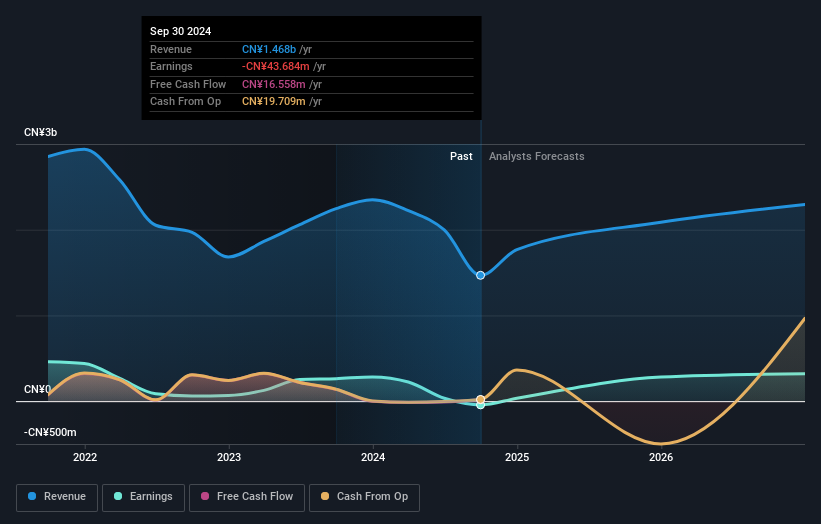

Overview: Shanghai Fengyuzhu Culture Technology Co., Ltd. is engaged in the creation and implementation of digital experience solutions, with a market cap of CN¥5.29 billion.

Operations: Fengyuzhu Culture Technology focuses on digital experience solutions, generating revenue of CN¥1.47 billion from this segment.

Shanghai Fengyuzhu Culture Technology, highlighted in its Q3 2024 earnings call, is navigating a path toward profitability with expectations to turn profitable within the next three years. The company's revenue growth rate stands at 17.8% annually, outpacing the Chinese market average of 13.3%, signaling robust sector performance despite current unprofitability. Moreover, with R&D expenses aligning strategically with future growth areas, Shanghai Fengyuzhu is investing in innovation to secure a competitive edge in the tech landscape. Despite a highly volatile share price recently, these investments and forecasted earnings growth of 98% per year underscore its potential as an emerging player in high-growth technology sectors.

Taking Advantage

- Take a closer look at our High Growth Tech and AI Stocks list of 1233 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603383

Fujian Apex SoftwareLTD

Operates as a platform-based digital service provider company in China.

Flawless balance sheet and fair value.

Market Insights

Community Narratives