Stock Analysis

China's recent announcement of robust stimulus measures has sparked a significant rally in its stock markets, with the Shanghai Composite Index climbing 12.8% and the blue-chip CSI 300 soaring 15.7%. As investors eye opportunities in this buoyant environment, it's essential to consider stocks that demonstrate strong growth potential, solid fundamentals, and alignment with China's economic recovery initiatives.

Top 10 High Growth Tech Companies In China

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Xi'an NovaStar Tech | 27.95% | 31.01% | ★★★★★★ |

| Zhejiang Meorient Commerce Exhibition | 26.41% | 32.59% | ★★★★★★ |

| Suzhou TFC Optical Communication | 32.61% | 31.78% | ★★★★★★ |

| Shanghai BOCHU Electronic Technology | 27.74% | 28.58% | ★★★★★★ |

| Zhongji Innolight | 32.37% | 31.70% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 23.53% | 29.96% | ★★★★★★ |

| Eoptolink Technology | 43.76% | 42.52% | ★★★★★★ |

| DongHua Testing Technology | 31.46% | 35.81% | ★★★★★★ |

| Bio-Thera Solutions | 26.85% | 117.16% | ★★★★★★ |

| Huayi Brothers Media | 40.13% | 103.97% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

China National Software & Service (SHSE:600536)

Simply Wall St Growth Rating: ★★★★☆☆

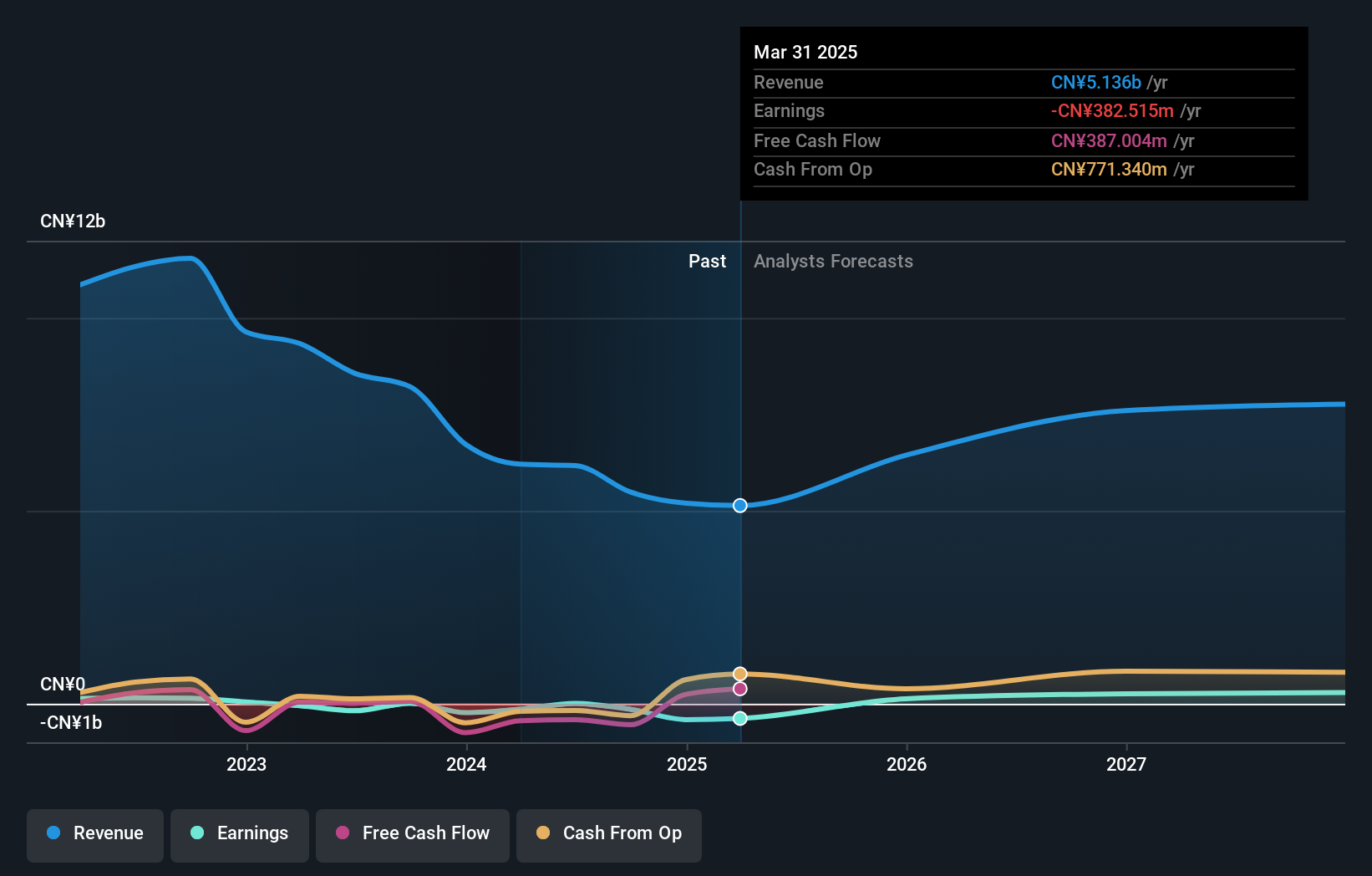

Overview: China National Software & Service Company Limited operates as a software company in China, with a market cap of CN¥35.63 billion.

Operations: The company generates revenue primarily from its Software Service Business, which amounted to CN¥6.17 billion.

Despite recent setbacks in revenue and a net loss reported in the first half of 2024, China National Software & Service is showing signs of a strong rebound. With an anticipated revenue growth rate of 16.8% per year, it outpaces the broader Chinese market forecast of 13.1%. Furthermore, earnings are expected to surge by a robust 67.8% annually, reflecting potential operational efficiencies and market gains. The firm's strategic R&D investments have been pivotal, positioning it well within China’s competitive tech landscape for potentially lucrative future prospects.

Sinocelltech Group (SHSE:688520)

Simply Wall St Growth Rating: ★★★★★☆

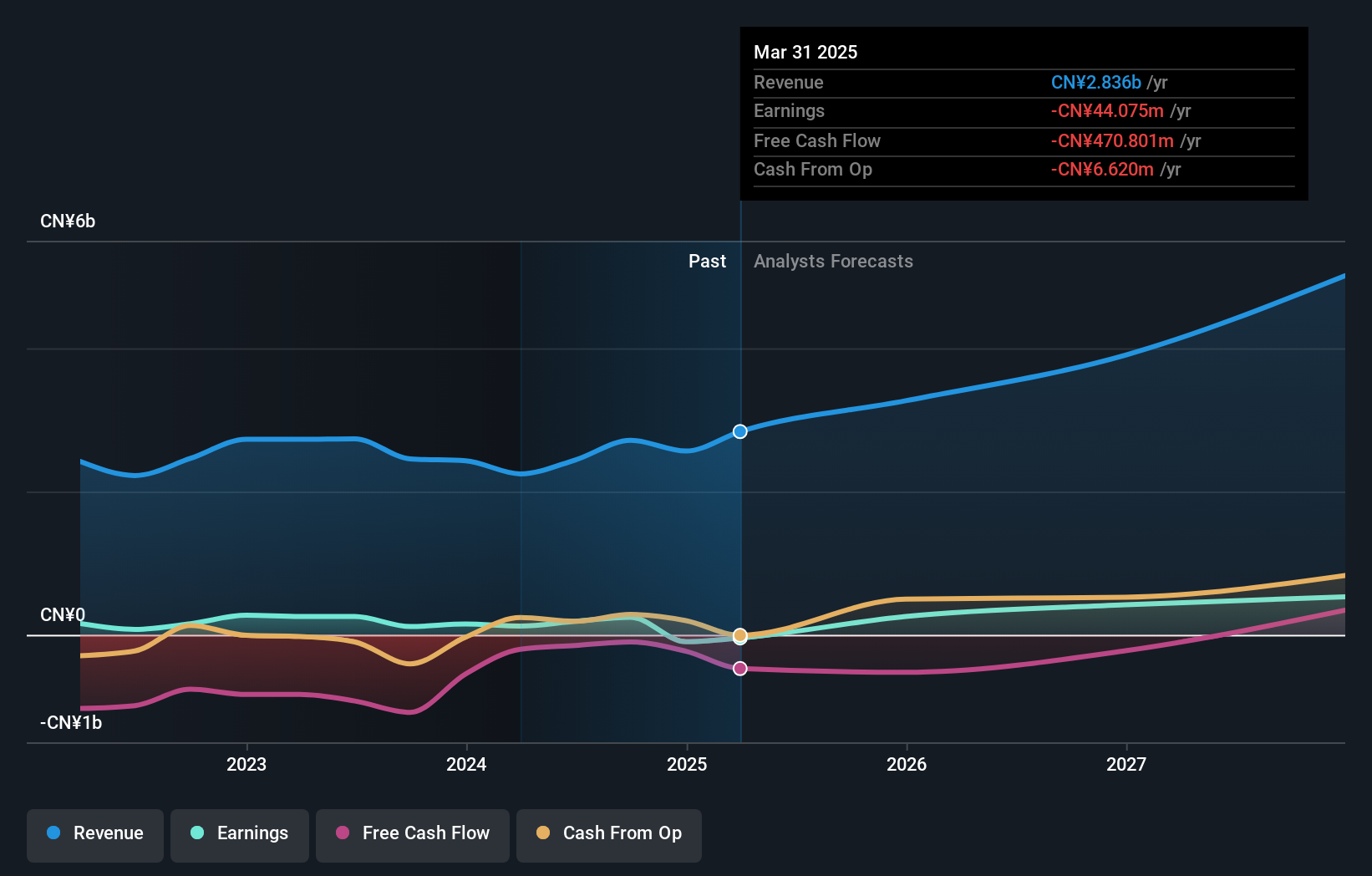

Overview: Sinocelltech Group Limited, a biotech company, engages in the research and development, and industrialization of recombinant proteins, monoclonal antibodies, and vaccines in China with a market cap of CN¥18.42 billion.

Operations: Sinocelltech Group generates revenue primarily from its biological drugs and vaccines segment, amounting to CN¥2.38 billion. The company's focus is on the development and industrialization of recombinant proteins, monoclonal antibodies, and vaccines in China.

Sinocelltech Group has demonstrated a notable turnaround, with its half-year earnings showing a swing from a net loss to a profit of CNY 125.71 million, up from last year's significant deficit. This growth is underscored by an impressive revenue increase to CNY 1.3 billion, marking a substantial rise of 61.4% compared to the previous period. The company's commitment to innovation is evident in its R&D spending which remains robust, supporting future growth in China’s dynamic tech sector where annual revenue and earnings are expected to grow by 25.6% and 131.4%, respectively. These figures not only highlight Sinocelltech’s recovery trajectory but also its potential role in shaping industry advancements through sustained investment in research and development initiatives.

Wuhan Jingce Electronic GroupLtd (SZSE:300567)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuhan Jingce Electronic Group Co., Ltd. researches, develops, produces, and sells display, semiconductor, and new energy detection systems with a market cap of CN¥17.59 billion.

Operations: Wuhan Jingce Electronic Group Ltd. generates revenue primarily from its Electron Product segment, which contributed CN¥2.44 billion. The company operates in the fields of display, semiconductor, and new energy detection systems.

Wuhan Jingce Electronic Group Ltd has shown resilience with its recent half-year earnings, reporting a net income surge to CNY 49.83 million from CNY 12.09 million year-over-year, reflecting a robust growth trajectory in the competitive tech landscape of China. This performance is bolstered by a modest increase in revenue to CNY 1,121.04 million, up from CNY 1,110.43 million previously. The firm's strategic focus on R&D is evident as it continues to allocate substantial resources towards innovation despite market challenges; this commitment is crucial for maintaining its competitive edge and responding to rapid technological advancements within the sector.

Make It Happen

- Take a closer look at our Chinese High Growth Tech and AI Stocks list of 259 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600536

China National Software & Service

Operates as a software company in China.