Getting In Cheap On Hunan Copote Science Technology Co.,Ltd. (SHSE:600476) Is Unlikely

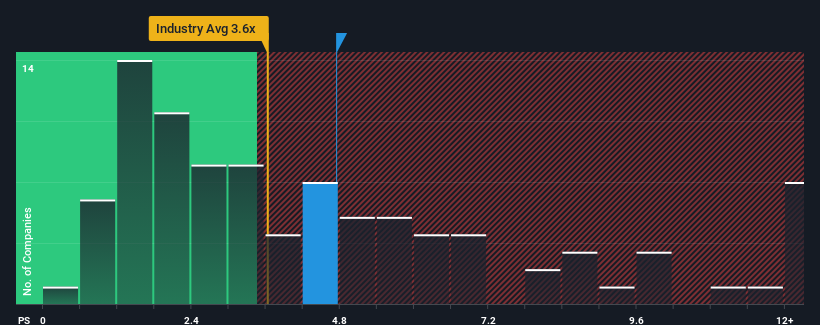

When you see that almost half of the companies in the IT industry in China have price-to-sales ratios (or "P/S") below 3.6x, Hunan Copote Science Technology Co.,Ltd. (SHSE:600476) looks to be giving off some sell signals with its 4.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Hunan Copote Science TechnologyLtd

How Has Hunan Copote Science TechnologyLtd Performed Recently?

For example, consider that Hunan Copote Science TechnologyLtd's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. If not, then existing shareholders may be quite nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Hunan Copote Science TechnologyLtd will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Hunan Copote Science TechnologyLtd?

In order to justify its P/S ratio, Hunan Copote Science TechnologyLtd would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a frustrating 20% decrease to the company's top line. Even so, admirably revenue has lifted 136% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

This is in contrast to the rest of the industry, which is expected to grow by 42% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it concerning that Hunan Copote Science TechnologyLtd is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Hunan Copote Science TechnologyLtd's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

The fact that Hunan Copote Science TechnologyLtd currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we observe slower-than-industry revenue growth alongside a high P/S ratio, we assume there to be a significant risk of the share price decreasing, which would result in a lower P/S ratio. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

Having said that, be aware Hunan Copote Science TechnologyLtd is showing 2 warning signs in our investment analysis, and 1 of those is significant.

If you're unsure about the strength of Hunan Copote Science TechnologyLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Hunan Copote Science TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600476

Hunan Copote Science TechnologyLtd

Provides software and information technology services in the postal industry in China.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives