Market Might Still Lack Some Conviction On Aisino Co.Ltd. (SHSE:600271) Even After 28% Share Price Boost

Aisino Co.Ltd. (SHSE:600271) shareholders have had their patience rewarded with a 28% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 18% in the last twelve months.

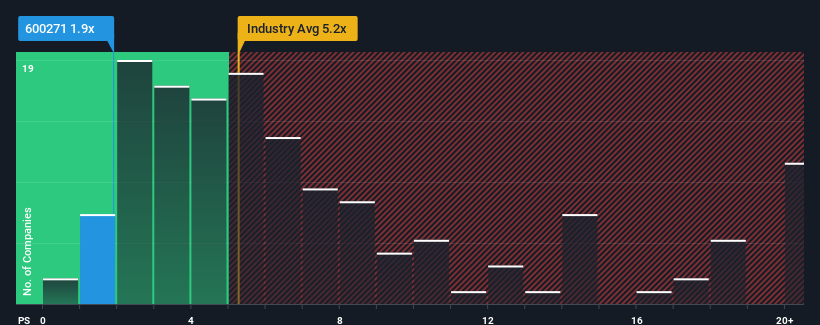

Although its price has surged higher, AisinoLtd's price-to-sales (or "P/S") ratio of 1.9x might still make it look like a strong buy right now compared to the wider Software industry in China, where around half of the companies have P/S ratios above 5.2x and even P/S above 9x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for AisinoLtd

How AisinoLtd Has Been Performing

AisinoLtd hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on AisinoLtd.How Is AisinoLtd's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as AisinoLtd's is when the company's growth is on track to lag the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 43%. The last three years don't look nice either as the company has shrunk revenue by 56% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 27% as estimated by the one analyst watching the company. With the industry predicted to deliver 26% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that AisinoLtd's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Even after such a strong price move, AisinoLtd's P/S still trails the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've seen that AisinoLtd currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for AisinoLtd with six simple checks will allow you to discover any risks that could be an issue.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600271

AisinoLtd

Provides information technology solutions in China and internationally.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives