- China

- /

- Semiconductors

- /

- SZSE:301321

There's No Escaping Highbroad Advanced Material (Hefei) Co., Ltd.'s (SZSE:301321) Muted Revenues Despite A 35% Share Price Rise

Highbroad Advanced Material (Hefei) Co., Ltd. (SZSE:301321) shares have continued their recent momentum with a 35% gain in the last month alone. Taking a wider view, although not as strong as the last month, the full year gain of 11% is also fairly reasonable.

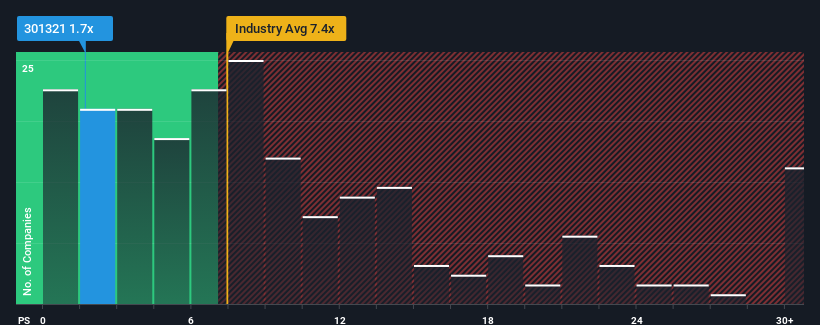

In spite of the firm bounce in price, Highbroad Advanced Material (Hefei)'s price-to-sales (or "P/S") ratio of 1.7x might still make it look like a strong buy right now compared to the wider Semiconductor industry in China, where around half of the companies have P/S ratios above 7.4x and even P/S above 13x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Highbroad Advanced Material (Hefei)

How Has Highbroad Advanced Material (Hefei) Performed Recently?

Revenue has risen firmly for Highbroad Advanced Material (Hefei) recently, which is pleasing to see. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Highbroad Advanced Material (Hefei) will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Highbroad Advanced Material (Hefei)?

The only time you'd be truly comfortable seeing a P/S as depressed as Highbroad Advanced Material (Hefei)'s is when the company's growth is on track to lag the industry decidedly.

If we review the last year of revenue growth, the company posted a worthy increase of 13%. Still, lamentably revenue has fallen 19% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 42% shows it's an unpleasant look.

With this in mind, we understand why Highbroad Advanced Material (Hefei)'s P/S is lower than most of its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Highbroad Advanced Material (Hefei)'s P/S

Highbroad Advanced Material (Hefei)'s recent share price jump still sees fails to bring its P/S alongside the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's no surprise that Highbroad Advanced Material (Hefei) maintains its low P/S off the back of its sliding revenue over the medium-term. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 3 warning signs for Highbroad Advanced Material (Hefei) that we have uncovered.

If these risks are making you reconsider your opinion on Highbroad Advanced Material (Hefei), explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Highbroad Advanced Material (Hefei) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301321

Highbroad Advanced Material (Hefei)

Highbroad Advanced Material (Hefei) Co., Ltd.

Low risk and slightly overvalued.

Market Insights

Community Narratives