- China

- /

- Semiconductors

- /

- SZSE:300751

Suzhou Maxwell Technologies Co., Ltd.'s (SZSE:300751) P/E Is Still On The Mark Following 28% Share Price Bounce

Suzhou Maxwell Technologies Co., Ltd. (SZSE:300751) shares have had a really impressive month, gaining 28% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 24% over that time.

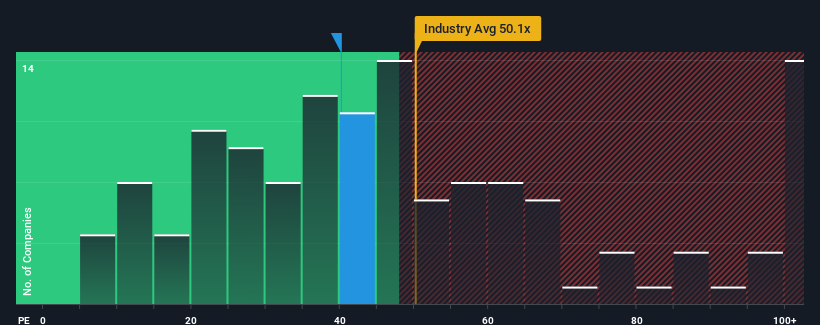

Since its price has surged higher, Suzhou Maxwell Technologies may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 40.1x, since almost half of all companies in China have P/E ratios under 32x and even P/E's lower than 20x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Recent times have been advantageous for Suzhou Maxwell Technologies as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Suzhou Maxwell Technologies

How Is Suzhou Maxwell Technologies' Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like Suzhou Maxwell Technologies' to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 5.6%. This was backed up an excellent period prior to see EPS up by 86% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 31% per year over the next three years. That's shaping up to be materially higher than the 26% per annum growth forecast for the broader market.

With this information, we can see why Suzhou Maxwell Technologies is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Suzhou Maxwell Technologies shares have received a push in the right direction, but its P/E is elevated too. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Suzhou Maxwell Technologies' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Suzhou Maxwell Technologies (1 shouldn't be ignored) you should be aware of.

You might be able to find a better investment than Suzhou Maxwell Technologies. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300751

Suzhou Maxwell Technologies

Engages in the design, research and development, production, and sale of solar cell production equipment in China.

Adequate balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success