- China

- /

- Semiconductors

- /

- SZSE:300236

Shanghai Sinyang Semiconductor Materials Co., Ltd. (SZSE:300236) Stock Rockets 50% As Investors Are Less Pessimistic Than Expected

Shanghai Sinyang Semiconductor Materials Co., Ltd. (SZSE:300236) shares have had a really impressive month, gaining 50% after a shaky period beforehand. Looking further back, the 18% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

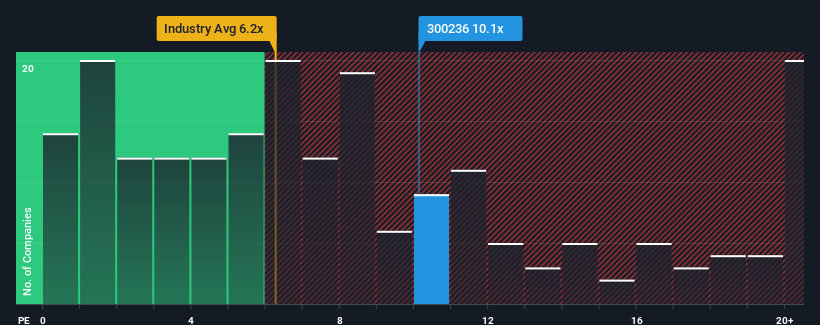

Since its price has surged higher, Shanghai Sinyang Semiconductor Materials may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 10.1x, since almost half of all companies in the Semiconductor industry in China have P/S ratios under 6.2x and even P/S lower than 3x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Shanghai Sinyang Semiconductor Materials

How Has Shanghai Sinyang Semiconductor Materials Performed Recently?

With revenue growth that's inferior to most other companies of late, Shanghai Sinyang Semiconductor Materials has been relatively sluggish. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Shanghai Sinyang Semiconductor Materials' future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Shanghai Sinyang Semiconductor Materials?

In order to justify its P/S ratio, Shanghai Sinyang Semiconductor Materials would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a decent 10% gain to the company's revenues. Pleasingly, revenue has also lifted 59% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 38% over the next year. With the industry predicted to deliver 36% growth , the company is positioned for a comparable revenue result.

In light of this, it's curious that Shanghai Sinyang Semiconductor Materials' P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Final Word

Shanghai Sinyang Semiconductor Materials' P/S has grown nicely over the last month thanks to a handy boost in the share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Analysts are forecasting Shanghai Sinyang Semiconductor Materials' revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Shanghai Sinyang Semiconductor Materials that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300236

Shanghai Sinyang Semiconductor Materials

Shanghai Sinyang Semiconductor Materials Co., Ltd.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives