- China

- /

- Semiconductors

- /

- SZSE:300223

Ingenic SemiconductorLtd's (SZSE:300223) five-year earnings growth trails the 8.4% YoY shareholder returns

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And the truth is, you can make significant gains if you buy good quality businesses at the right price. For example, long term Ingenic Semiconductor Co.,Ltd. (SZSE:300223) shareholders have enjoyed a 49% share price rise over the last half decade, well in excess of the market return of around 12% (not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 10% in the last year, including dividends.

Since it's been a strong week for Ingenic SemiconductorLtd shareholders, let's have a look at trend of the longer term fundamentals.

See our latest analysis for Ingenic SemiconductorLtd

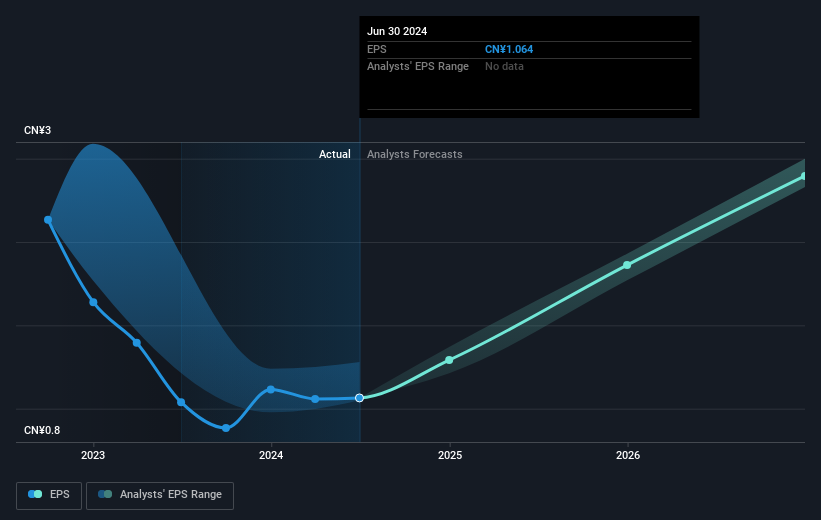

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Ingenic SemiconductorLtd achieved compound earnings per share (EPS) growth of 41% per year. This EPS growth is higher than the 8% average annual increase in the share price. So it seems the market isn't so enthusiastic about the stock these days. Of course, with a P/E ratio of 68.36, the market remains optimistic.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on Ingenic SemiconductorLtd's earnings, revenue and cash flow.

A Different Perspective

Ingenic SemiconductorLtd shareholders have received returns of 10% over twelve months (even including dividends), which isn't far from the general market return. That gain looks pretty satisfying, and it is even better than the five-year TSR of 8% per year. It is possible that management foresight will bring growth well into the future, even if the share price slows down. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Ingenic SemiconductorLtd has 1 warning sign we think you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300223

Ingenic SemiconductorLtd

Engages in the research and development, design, and sale of integrated circuit chip products in China and internationally.

Flawless balance sheet with high growth potential.