- China

- /

- Semiconductors

- /

- SZSE:300053

Zhuhai Aerospace Microchips Science & Technology Co., Ltd.'s (SZSE:300053) 27% Price Boost Is Out Of Tune With Revenues

Zhuhai Aerospace Microchips Science & Technology Co., Ltd. (SZSE:300053) shares have continued their recent momentum with a 27% gain in the last month alone. Notwithstanding the latest gain, the annual share price return of 4.3% isn't as impressive.

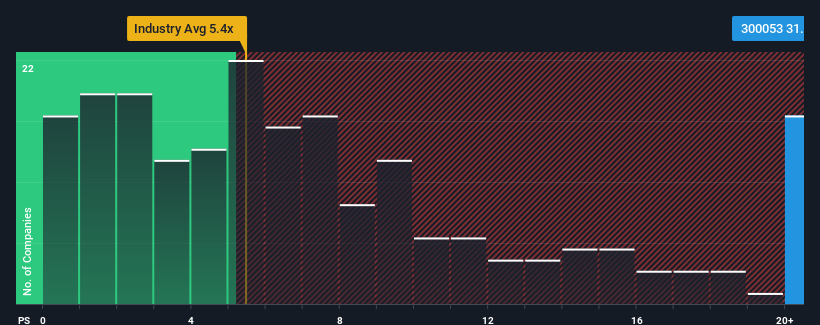

Following the firm bounce in price, Zhuhai Aerospace Microchips Science & Technology may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 31.2x, since almost half of all companies in the Semiconductor industry in China have P/S ratios under 5.4x and even P/S lower than 2x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Zhuhai Aerospace Microchips Science & Technology

What Does Zhuhai Aerospace Microchips Science & Technology's Recent Performance Look Like?

For example, consider that Zhuhai Aerospace Microchips Science & Technology's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Zhuhai Aerospace Microchips Science & Technology, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Zhuhai Aerospace Microchips Science & Technology would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 28% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 68% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 36% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

In light of this, it's alarming that Zhuhai Aerospace Microchips Science & Technology's P/S sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What We Can Learn From Zhuhai Aerospace Microchips Science & Technology's P/S?

The strong share price surge has lead to Zhuhai Aerospace Microchips Science & Technology's P/S soaring as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Zhuhai Aerospace Microchips Science & Technology currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

Plus, you should also learn about these 2 warning signs we've spotted with Zhuhai Aerospace Microchips Science & Technology.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Zhuhai Aerospace Microchips Science & Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300053

Zhuhai Aerospace Microchips Science & Technology

Zhuhai Aerospace Microchips Science & Technology Co., Ltd.

Excellent balance sheet with minimal risk.

Market Insights

Community Narratives