- China

- /

- Electronic Equipment and Components

- /

- SHSE:688551

Global Market's Hidden Gems: 3 Companies That May Be Trading Below Their Estimated Worth

Reviewed by Simply Wall St

As global markets navigate a landscape marked by steady inflation and geopolitical uncertainties, investors are closely watching indices that have seen mixed performances across regions. In such an environment, identifying undervalued stocks—those trading below their estimated worth—can offer potential opportunities for investors seeking to capitalize on market inefficiencies and overlooked value.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Takara Bio (TSE:4974) | ¥919.00 | ¥1829.46 | 49.8% |

| SBO (WBAG:SBO) | €27.30 | €54.56 | 50% |

| Robit Oyj (HLSE:ROBIT) | €1.155 | €2.26 | 49% |

| Norconsult (OB:NORCO) | NOK46.15 | NOK90.70 | 49.1% |

| Guangdong Lyric Robot AutomationLtd (SHSE:688499) | CN¥61.70 | CN¥122.88 | 49.8% |

| E-Globe (BIT:EGB) | €0.67 | €1.31 | 49% |

| Cosmax (KOSE:A192820) | ₩211500.00 | ₩420128.18 | 49.7% |

| Camurus (OM:CAMX) | SEK720.00 | SEK1416.78 | 49.2% |

| Aker BioMarine (OB:AKBM) | NOK84.90 | NOK169.50 | 49.9% |

| AIMECHATEC (TSE:6227) | ¥3970.00 | ¥7896.47 | 49.7% |

We're going to check out a few of the best picks from our screener tool.

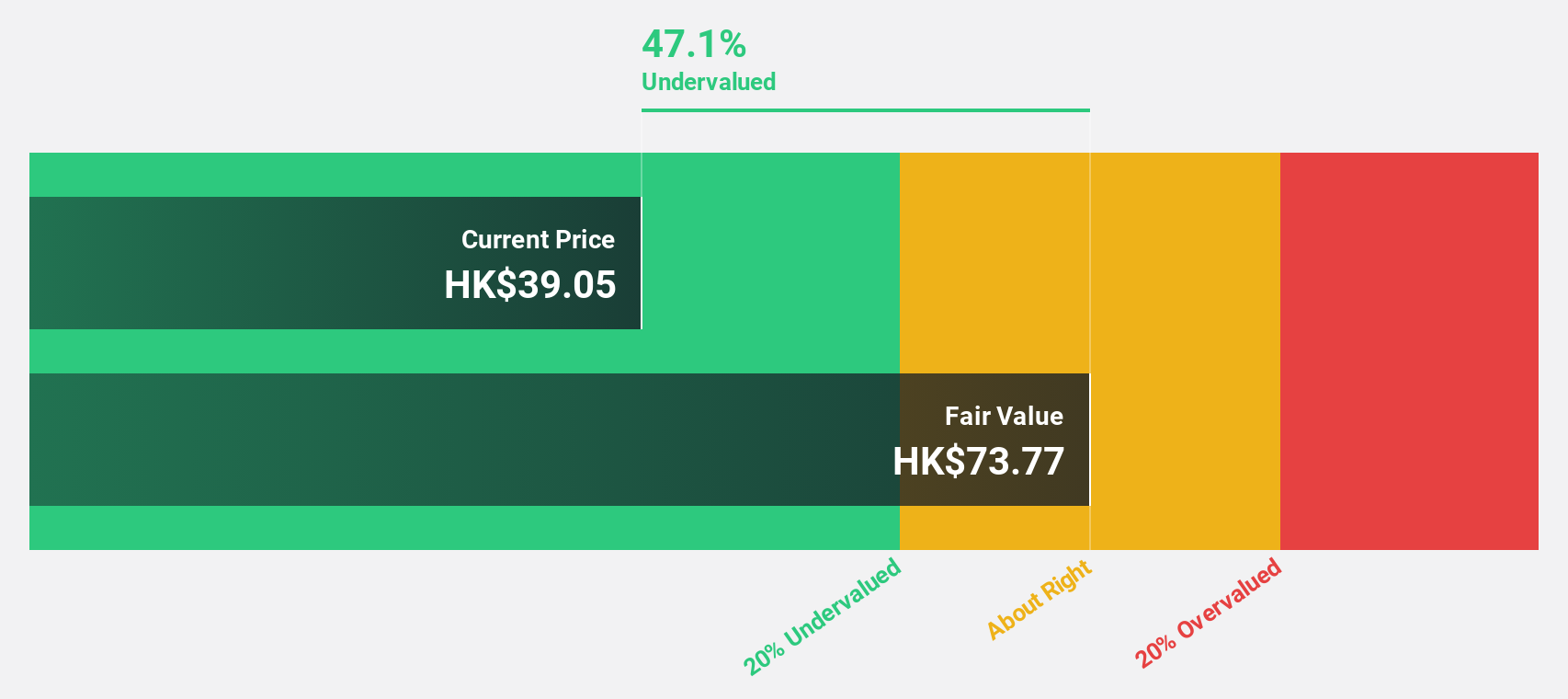

Shanghai Conant Optical (SEHK:2276)

Overview: Shanghai Conant Optical Co., Ltd. manufactures and sells resin spectacle lenses across Mainland China and international markets, including the Americas, Asia, Europe, Oceania, and Africa, with a market cap of HK$23.15 billion.

Operations: The company's revenue primarily comes from the manufacturing and sales of resin spectacle lenses, amounting to CN¥2.17 billion.

Estimated Discount To Fair Value: 35.1%

Shanghai Conant Optical is currently trading at a significant discount to its estimated fair value, with a price of HK$48.24 compared to a fair value estimate of HK$74.28. Recent earnings results show strong growth, with net income rising to CNY 272.87 million for the half-year ending June 2025, driven by increased sales volume and favorable product mix. However, the company has announced a decrease in interim dividends, reflecting ongoing capital management adjustments amidst changes in shareholding structure and registered capital.

- Upon reviewing our latest growth report, Shanghai Conant Optical's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Shanghai Conant Optical.

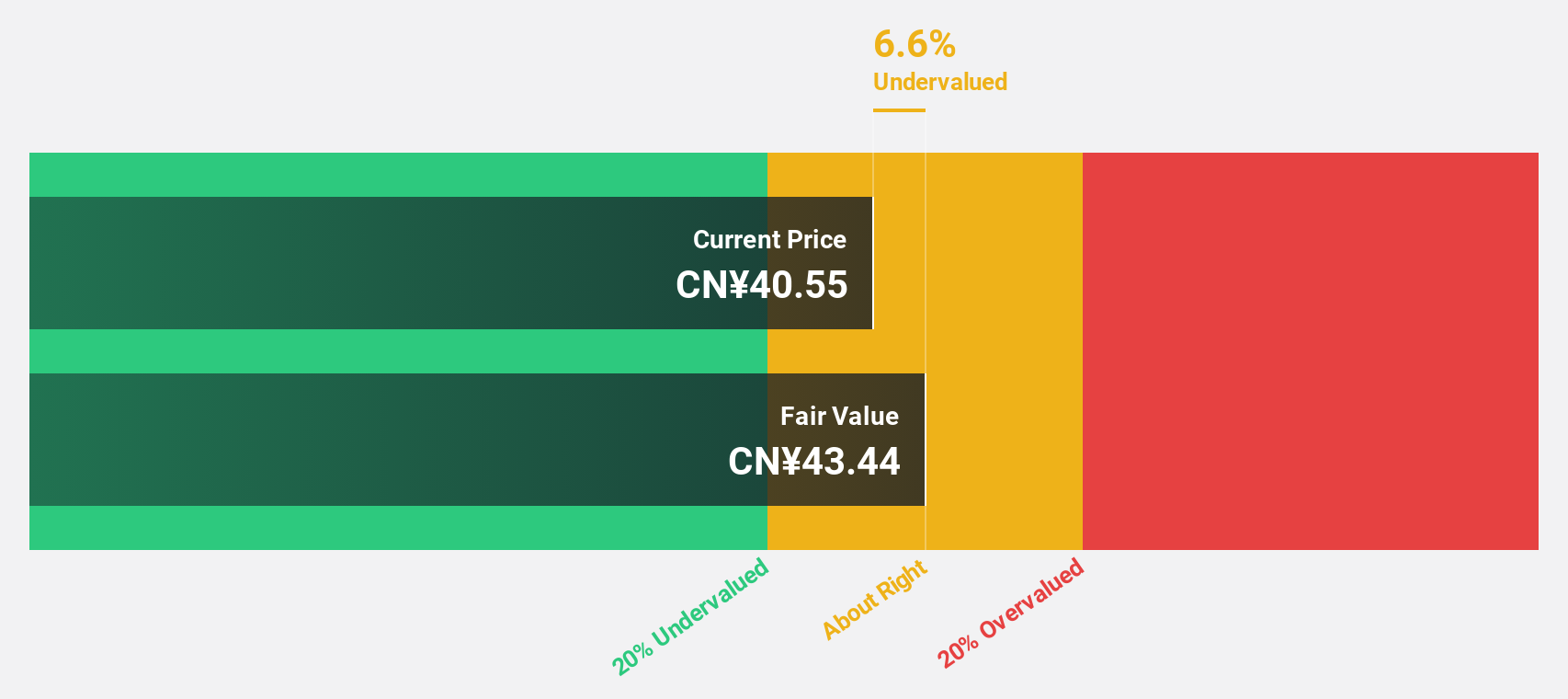

Hefei Kewell Power SystemLtd (SHSE:688551)

Overview: Hefei Kewell Power System Co., Ltd. specializes in providing testing equipment for test systems and intelligent manufacturing equipment in China, with a market cap of CN¥3.59 billion.

Operations: Hefei Kewell Power System Ltd. generates revenue through its offerings in testing equipment for test systems and intelligent manufacturing equipment within the Chinese market.

Estimated Discount To Fair Value: 40.9%

Hefei Kewell Power System Ltd. is trading at CN¥45.19, significantly below its estimated fair value of CN¥76.49, indicating potential undervaluation based on cash flows. Despite a volatile share price and recent declines in sales and net income for H1 2025 compared to the previous year, earnings are expected to grow substantially at 85.8% annually over the next three years, outpacing the broader Chinese market's growth rate of 25.9%.

- Our comprehensive growth report raises the possibility that Hefei Kewell Power SystemLtd is poised for substantial financial growth.

- Dive into the specifics of Hefei Kewell Power SystemLtd here with our thorough financial health report.

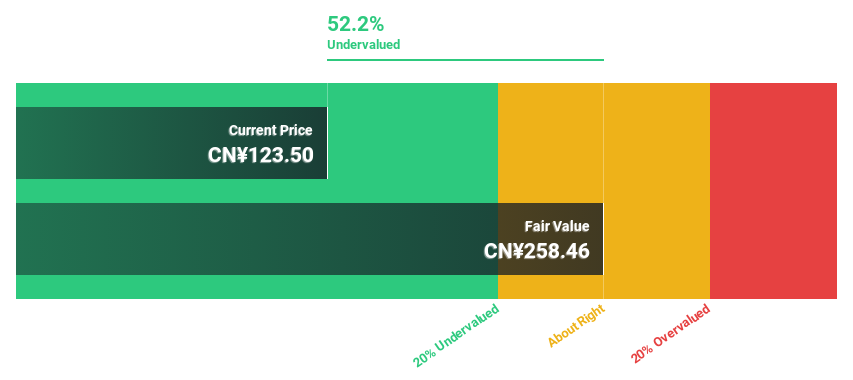

Shenzhen Techwinsemi Technology (SZSE:001309)

Overview: Shenzhen Techwinsemi Technology Co., Ltd. develops, manufactures, and sells storage control chips and modules both in China and internationally, with a market cap of CN¥21.40 billion.

Operations: The company's revenue primarily comes from the storage industry, amounting to CN¥6.71 billion.

Estimated Discount To Fair Value: 34.3%

Shenzhen Techwinsemi Technology is trading at CN¥101.97, well below its estimated fair value of CN¥155.31, suggesting undervaluation based on cash flows. Despite reporting a net loss of CNY 117.95 million for H1 2025, the company is forecast to grow earnings by 84.31% annually and become profitable within three years, surpassing market growth rates. However, debt coverage by operating cash flow remains a concern amidst strong revenue growth projections of 32% per year.

- According our earnings growth report, there's an indication that Shenzhen Techwinsemi Technology might be ready to expand.

- Unlock comprehensive insights into our analysis of Shenzhen Techwinsemi Technology stock in this financial health report.

Taking Advantage

- Gain an insight into the universe of 532 Undervalued Global Stocks Based On Cash Flows by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hefei Kewell Power SystemLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688551

Hefei Kewell Power SystemLtd

Provides test systems and intelligent manufacturing equipment in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion