- China

- /

- Semiconductors

- /

- SHSE:688766

Optimistic Investors Push Puya Semiconductor (Shanghai) Co., Ltd. (SHSE:688766) Shares Up 25% But Growth Is Lacking

Despite an already strong run, Puya Semiconductor (Shanghai) Co., Ltd. (SHSE:688766) shares have been powering on, with a gain of 25% in the last thirty days. The last 30 days bring the annual gain to a very sharp 25%.

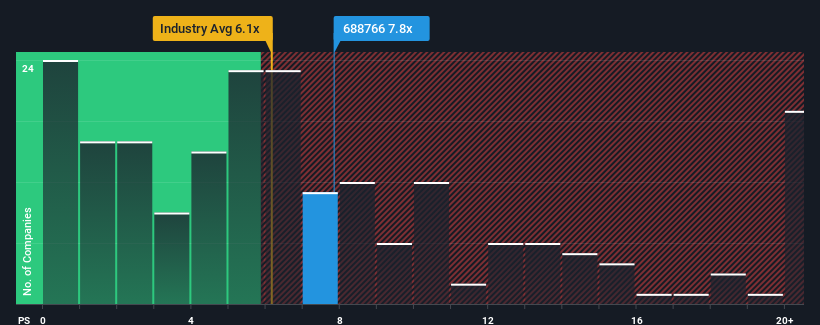

After such a large jump in price, Puya Semiconductor (Shanghai) may be sending sell signals at present with a price-to-sales (or "P/S") ratio of 7.8x, when you consider almost half of the companies in the Semiconductor industry in China have P/S ratios under 6.1x and even P/S lower than 2x aren't out of the ordinary. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Puya Semiconductor (Shanghai)

How Puya Semiconductor (Shanghai) Has Been Performing

Recent times have been advantageous for Puya Semiconductor (Shanghai) as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Puya Semiconductor (Shanghai)'s future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

Puya Semiconductor (Shanghai)'s P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 47%. The strong recent performance means it was also able to grow revenue by 64% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 36% over the next year. With the industry predicted to deliver 36% growth , the company is positioned for a comparable revenue result.

With this information, we find it interesting that Puya Semiconductor (Shanghai) is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Puya Semiconductor (Shanghai)'s P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Given Puya Semiconductor (Shanghai)'s future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. A positive change is needed in order to justify the current price-to-sales ratio.

Before you settle on your opinion, we've discovered 1 warning sign for Puya Semiconductor (Shanghai) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688766

Puya Semiconductor (Shanghai)

Engages in research, development, design, and sale of non-volatile memory chips and memory based derivative chips in China and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives