- China

- /

- Semiconductors

- /

- SHSE:688711

Macmic Science&Technology Co.,Ltd.'s (SHSE:688711) Shares Leap 28% Yet They're Still Not Telling The Full Story

Despite an already strong run, Macmic Science&Technology Co.,Ltd. (SHSE:688711) shares have been powering on, with a gain of 28% in the last thirty days. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 40% in the last twelve months.

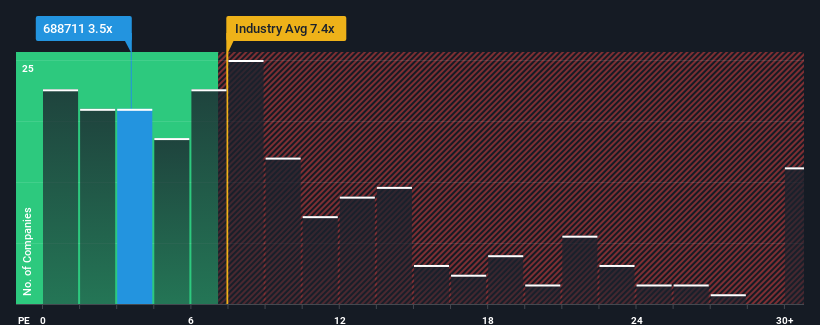

Even after such a large jump in price, Macmic Science&TechnologyLtd may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 3.5x, considering almost half of all companies in the Semiconductor industry in China have P/S ratios greater than 7.4x and even P/S higher than 13x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Macmic Science&TechnologyLtd

How Has Macmic Science&TechnologyLtd Performed Recently?

Macmic Science&TechnologyLtd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Macmic Science&TechnologyLtd.How Is Macmic Science&TechnologyLtd's Revenue Growth Trending?

Macmic Science&TechnologyLtd's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 6.8%. Even so, admirably revenue has lifted 190% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 74% over the next year. That's shaping up to be materially higher than the 42% growth forecast for the broader industry.

With this information, we find it odd that Macmic Science&TechnologyLtd is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Shares in Macmic Science&TechnologyLtd have risen appreciably however, its P/S is still subdued. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Macmic Science&TechnologyLtd's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Before you settle on your opinion, we've discovered 4 warning signs for Macmic Science&TechnologyLtd (2 are a bit unpleasant!) that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688711

Macmic Science&TechnologyLtd

Engages in the design, development, production, and sale of power semiconductor chips, single tubes, and modules in Taiwan and internationally.

Low risk and slightly overvalued.

Market Insights

Community Narratives