- China

- /

- Semiconductors

- /

- SHSE:688699

Subdued Growth No Barrier To Shenzhen Sunmoon Microelectronics Co., Ltd's (SHSE:688699) Price

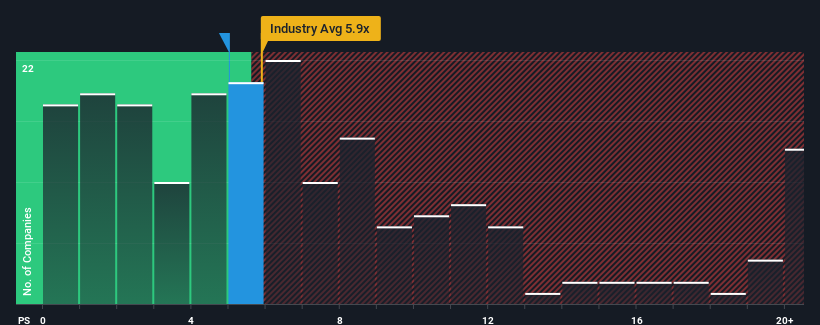

There wouldn't be many who think Shenzhen Sunmoon Microelectronics Co., Ltd's (SHSE:688699) price-to-sales (or "P/S") ratio of 5x is worth a mention when the median P/S for the Semiconductor industry in China is similar at about 5.9x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Shenzhen Sunmoon Microelectronics

What Does Shenzhen Sunmoon Microelectronics' P/S Mean For Shareholders?

For example, consider that Shenzhen Sunmoon Microelectronics' financial performance has been poor lately as its revenue has been in decline. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Shenzhen Sunmoon Microelectronics, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Shenzhen Sunmoon Microelectronics?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Shenzhen Sunmoon Microelectronics' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 5.7% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 23% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 34% shows it's noticeably less attractive.

In light of this, it's curious that Shenzhen Sunmoon Microelectronics' P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What We Can Learn From Shenzhen Sunmoon Microelectronics' P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Shenzhen Sunmoon Microelectronics revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. If recent medium-term revenue trends continue, the probability of a share price decline will become quite substantial, placing shareholders at risk.

You should always think about risks. Case in point, we've spotted 3 warning signs for Shenzhen Sunmoon Microelectronics you should be aware of, and 2 of them shouldn't be ignored.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688699

Shenzhen Sunmoon Microelectronics

Engages in the design, processing, and sale of integrated circuits in China.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives