Highlighting Three Growth Companies With Strong Insider Ownership

Reviewed by Simply Wall St

As global markets continue to navigate the complexities of rising inflation and potential tariff changes, U.S. stock indexes have climbed toward record highs, with growth stocks notably outperforming value shares. In this environment, companies with strong insider ownership can offer unique insights into potential growth opportunities, as insiders often have a vested interest in the long-term success of their businesses.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 50.1% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.7% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| Laopu Gold (SEHK:6181) | 36.4% | 39.1% |

| On Holding (NYSE:ONON) | 19.1% | 29.9% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

Let's dive into some prime choices out of the screener.

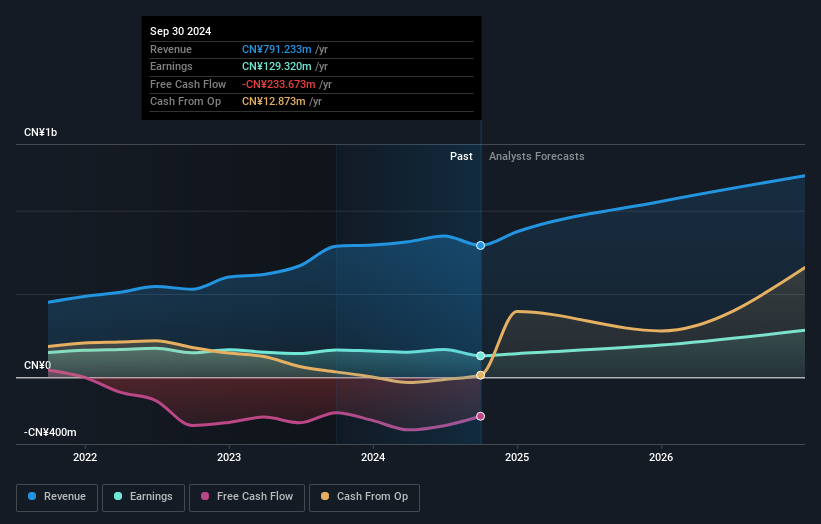

Zhuzhou Huarui Precision Cutting ToolsLtd (SHSE:688059)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zhuzhou Huarui Precision Cutting Tools Co., Ltd. operates in the manufacturing sector, specializing in precision cutting tools, with a market cap of CN¥3.18 billion.

Operations: The company generates revenue from its Machinery & Industrial Equipment segment, amounting to CN¥791.23 million.

Insider Ownership: 15.7%

Revenue Growth Forecast: 18.7% p.a.

Zhuzhou Huarui Precision Cutting Tools Ltd. demonstrates strong growth potential with forecasted earnings growth of 34.91% annually, outpacing the Chinese market's 25%. Despite being dropped from the S&P Global BMI Index, its revenue is expected to grow faster than the market at 18.7% per year, although slower than some high-growth peers. The price-to-earnings ratio of 29.5x suggests it is undervalued compared to the broader Chinese market average of 36.5x, despite low return on equity forecasts and unsustainable dividends due to insufficient free cash flow coverage.

- Click here and access our complete growth analysis report to understand the dynamics of Zhuzhou Huarui Precision Cutting ToolsLtd.

- Insights from our recent valuation report point to the potential overvaluation of Zhuzhou Huarui Precision Cutting ToolsLtd shares in the market.

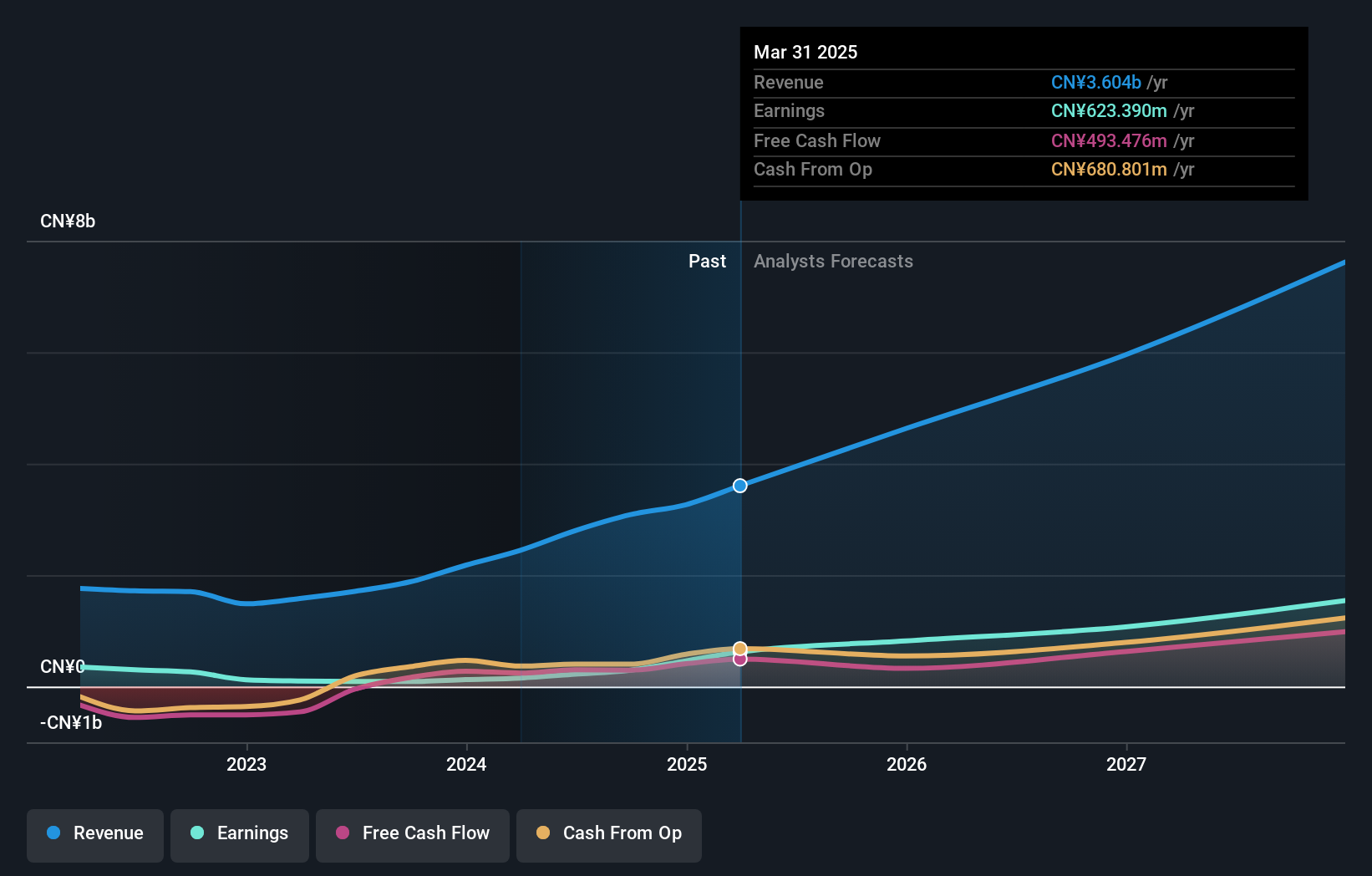

Bestechnic (Shanghai) (SHSE:688608)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bestechnic (Shanghai) Co., Ltd. specializes in the research, design, development, manufacture, and sale of smart audio and video SoC chips in China with a market cap of CN¥42.96 billion.

Operations: The company generates revenue primarily from its Integrated Circuit segment, amounting to CN¥3.09 billion.

Insider Ownership: 25.7%

Revenue Growth Forecast: 24.6% p.a.

Bestechnic (Shanghai) shows strong growth potential with forecasted earnings growth of 39.45% annually, surpassing the Chinese market's 25%. Revenue is also expected to grow at a robust 24.6% per year, outpacing the market's 13.3%. Despite these promising figures, its return on equity is projected to be low at 9.6% in three years, and its share price has been highly volatile recently.

- Get an in-depth perspective on Bestechnic (Shanghai)'s performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Bestechnic (Shanghai)'s share price might be too optimistic.

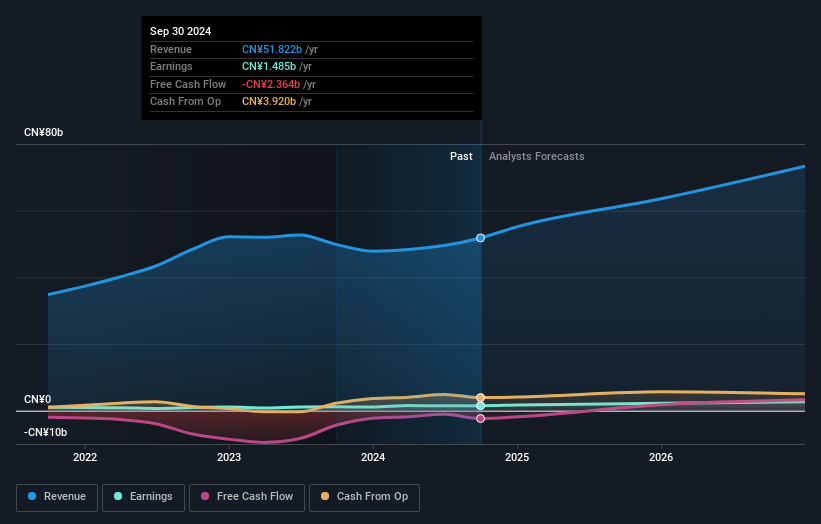

Sunwoda ElectronicLtd (SZSE:300207)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sunwoda Electronic Co., Ltd specializes in the research, development, design, production, and sale of lithium-ion battery modules and has a market cap of CN¥42.80 billion.

Operations: The company generates revenue through its activities in the research, development, design, production, and sale of lithium-ion battery modules.

Insider Ownership: 29.1%

Revenue Growth Forecast: 15.3% p.a.

Sunwoda Electronic Ltd. demonstrates promising growth prospects with earnings forecasted to grow at 25.7% annually, outpacing the Chinese market's 25%. Revenue is expected to increase by 15.3% per year, also above market rates. The stock trades at a substantial discount of 53.2% below its estimated fair value, offering good relative value compared to peers and industry standards. However, return on equity is projected to be low at 8.7% in three years' time.

- Take a closer look at Sunwoda ElectronicLtd's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Sunwoda ElectronicLtd is priced lower than what may be justified by its financials.

Where To Now?

- Explore the 1454 names from our Fast Growing Companies With High Insider Ownership screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Zhuzhou Huarui Precision Cutting ToolsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688059

Zhuzhou Huarui Precision Cutting ToolsLtd

Zhuzhou Huarui Precision Cutting Tools Co.,Ltd.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives