As global markets navigate through a period of volatility marked by trade tensions, monetary policy shifts, and mixed economic signals, investors are increasingly focused on identifying resilient opportunities. In this context, growth companies with high insider ownership can offer unique insights into potential market leaders as insiders' vested interests often align with long-term value creation.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Pharma Mar (BME:PHM) | 11.9% | 44.2% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 34.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 50.7% |

| CD Projekt (WSE:CDR) | 29.7% | 39.6% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

Here's a peek at a few of the choices from the screener.

Beijing HyperStrong Technology (SHSE:688411)

Simply Wall St Growth Rating: ★★★★★★

Overview: Beijing HyperStrong Technology Co., Ltd. specializes in the design, development, integration, and operation of energy storage power stations in China with a market cap of CN¥53.19 billion.

Operations: Beijing HyperStrong Technology Co., Ltd. generates its revenue through the design, development, integration, and operation of energy storage power stations within China.

Insider Ownership: 22.6%

Beijing HyperStrong Technology is poised for significant growth, with earnings forecasted to increase by 33.52% annually, outpacing the broader CN market. The company's revenue is also expected to grow rapidly at 31.6% per year. Despite recent share price volatility and a lack of substantial insider trading activity, the formation of a joint venture in AI technology services for electricity trading could enhance its technological capabilities and market position in energy storage solutions.

- Click to explore a detailed breakdown of our findings in Beijing HyperStrong Technology's earnings growth report.

- Our valuation report unveils the possibility Beijing HyperStrong Technology's shares may be trading at a premium.

Bestechnic (Shanghai) (SHSE:688608)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bestechnic (Shanghai) Co., Ltd. focuses on the research, design, development, manufacture, and sale of smart audio and video SoC chips in China with a market cap of CN¥43.95 billion.

Operations: The company generates revenue of CN¥3.67 billion from its Integrated Circuit segment.

Insider Ownership: 24.8%

Bestechnic (Shanghai) is experiencing strong growth, with earnings and revenue forecasted to rise significantly at 35.48% and 28.5% annually, respectively, surpassing the broader CN market. Recent earnings showed a substantial increase in net income to CNY 304.8 million from CNY 147.64 million year-on-year. Despite high share price volatility and no recent insider trading activity, its price-to-earnings ratio of 76.3x remains competitive within the semiconductor industry average.

- Delve into the full analysis future growth report here for a deeper understanding of Bestechnic (Shanghai).

- According our valuation report, there's an indication that Bestechnic (Shanghai)'s share price might be on the cheaper side.

Shenzhen Envicool Technology (SZSE:002837)

Simply Wall St Growth Rating: ★★★★★★

Overview: Shenzhen Envicool Technology Co., Ltd. specializes in producing and selling temperature control and energy-saving solutions in China, with a market cap of CN¥68.97 billion.

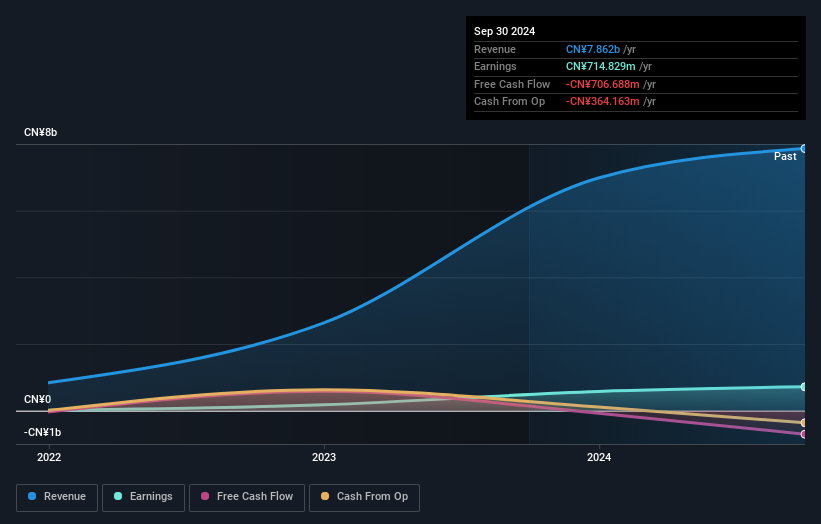

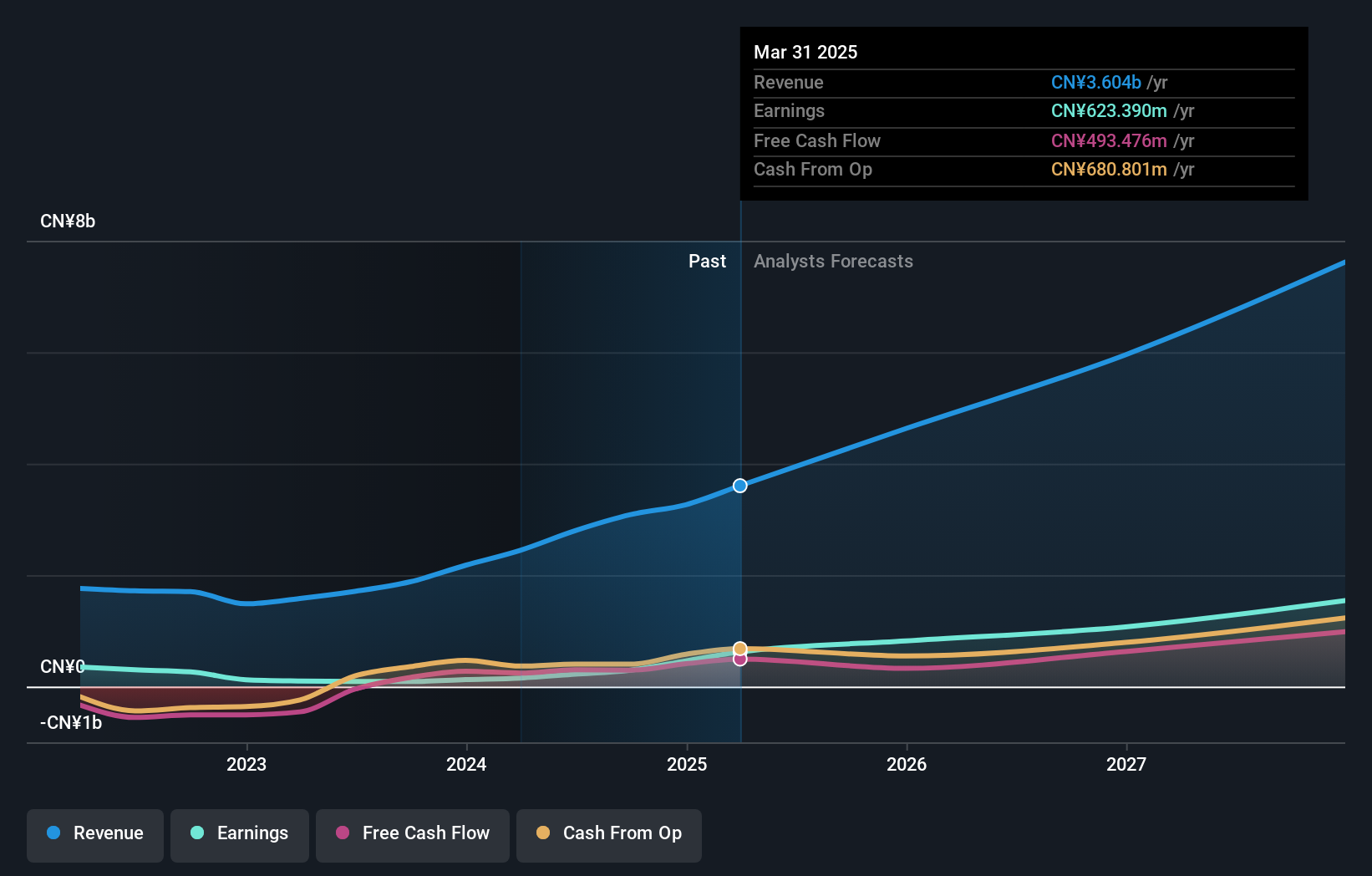

Operations: The company generates revenue of CN¥5.74 billion from its precision temperature control energy-saving equipment segment.

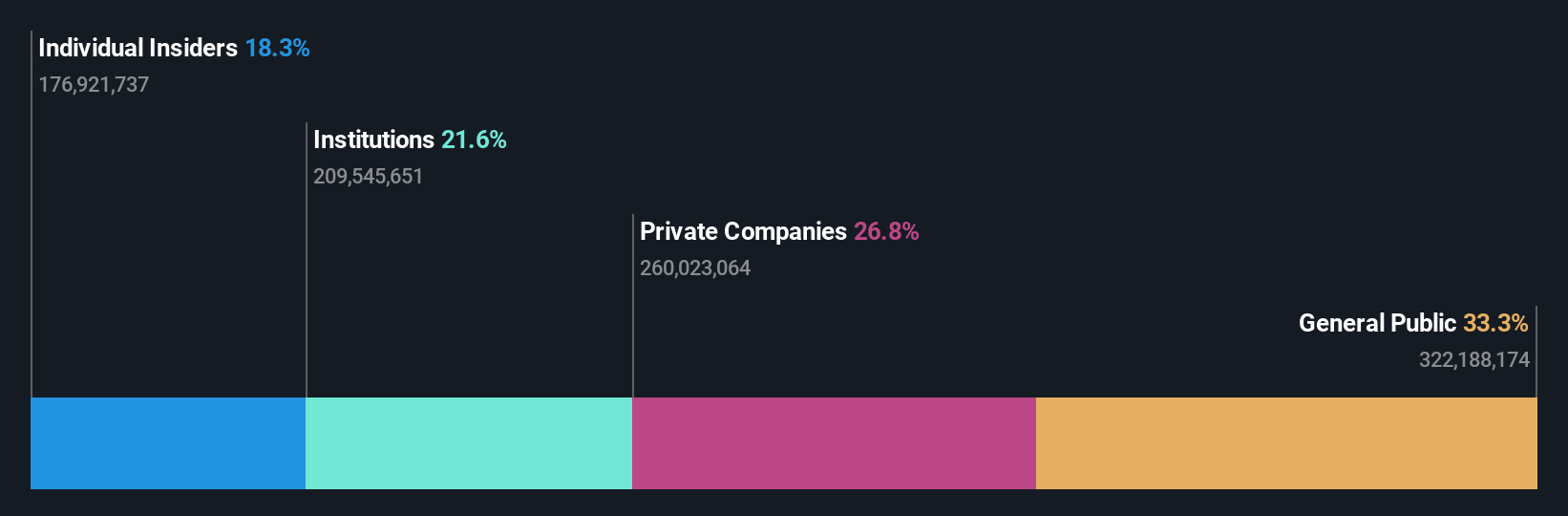

Insider Ownership: 18.1%

Shenzhen Envicool Technology's recent earnings report highlights a robust increase in revenue to CNY 4.03 billion from CNY 2.87 billion year-on-year, with net income rising to CNY 399.07 million. Forecasts suggest its revenue and earnings will grow significantly above the CN market average by over 25% annually, despite high share price volatility and no recent insider trading activity. The company's return on equity is projected to remain strong at 25.9% in three years, indicating sustained profitability potential.

- Get an in-depth perspective on Shenzhen Envicool Technology's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Shenzhen Envicool Technology's share price might be on the expensive side.

Summing It All Up

- Navigate through the entire inventory of 818 Fast Growing Global Companies With High Insider Ownership here.

- Ready For A Different Approach? AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002837

Shenzhen Envicool Technology

Produces and sells temperature control and energy savings solutions and products in China.

Exceptional growth potential with adequate balance sheet.

Market Insights

Community Narratives