- China

- /

- Semiconductors

- /

- SHSE:688608

3 Asian Growth Stocks With Insider Ownership Expecting Up To 69% Earnings Growth

Reviewed by Simply Wall St

As global markets navigate the potential for rate cuts and shifting economic dynamics, Asian equities have captured investor attention with their robust performance, particularly in China where stock indices have reached significant highs. In this context, growth companies with high insider ownership stand out as compelling opportunities due to their alignment of interests between management and shareholders, which can be especially advantageous during periods of economic uncertainty.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Techwing (KOSDAQ:A089030) | 19.1% | 68% |

| Synspective (TSE:290A) | 12.8% | 48.9% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 25.8% |

| Samyang Foods (KOSE:A003230) | 14.9% | 28.0% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 98.7% |

| Novoray (SHSE:688300) | 23.6% | 28.2% |

| Laopu Gold (SEHK:6181) | 35.5% | 34.3% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.8% | 43.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.7% | 87.4% |

Let's explore several standout options from the results in the screener.

TUHU Car (SEHK:9690)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TUHU Car Inc. operates as an integrated online and offline platform for automotive services in China, with a market cap of HK$18.40 billion.

Operations: The company's revenue segments include automotive services provided through both digital and physical channels across China.

Insider Ownership: 13.3%

Earnings Growth Forecast: 23.1% p.a.

TUHU Car's earnings are forecast to grow significantly at 23.1% annually, outpacing the Hong Kong market. Despite a decline in profit margins from 48.8% to 3.3%, its revenue growth of 9.2% per year surpasses the market average of 8.2%. Recent earnings show increased sales and net income, with no substantial insider trading activity noted over three months. The stock trades well below estimated fair value, suggesting potential undervaluation amidst leadership changes and strategic board appointments.

- Click here to discover the nuances of TUHU Car with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, TUHU Car's share price might be too optimistic.

Bestechnic (Shanghai) (SHSE:688608)

Simply Wall St Growth Rating: ★★★★★☆

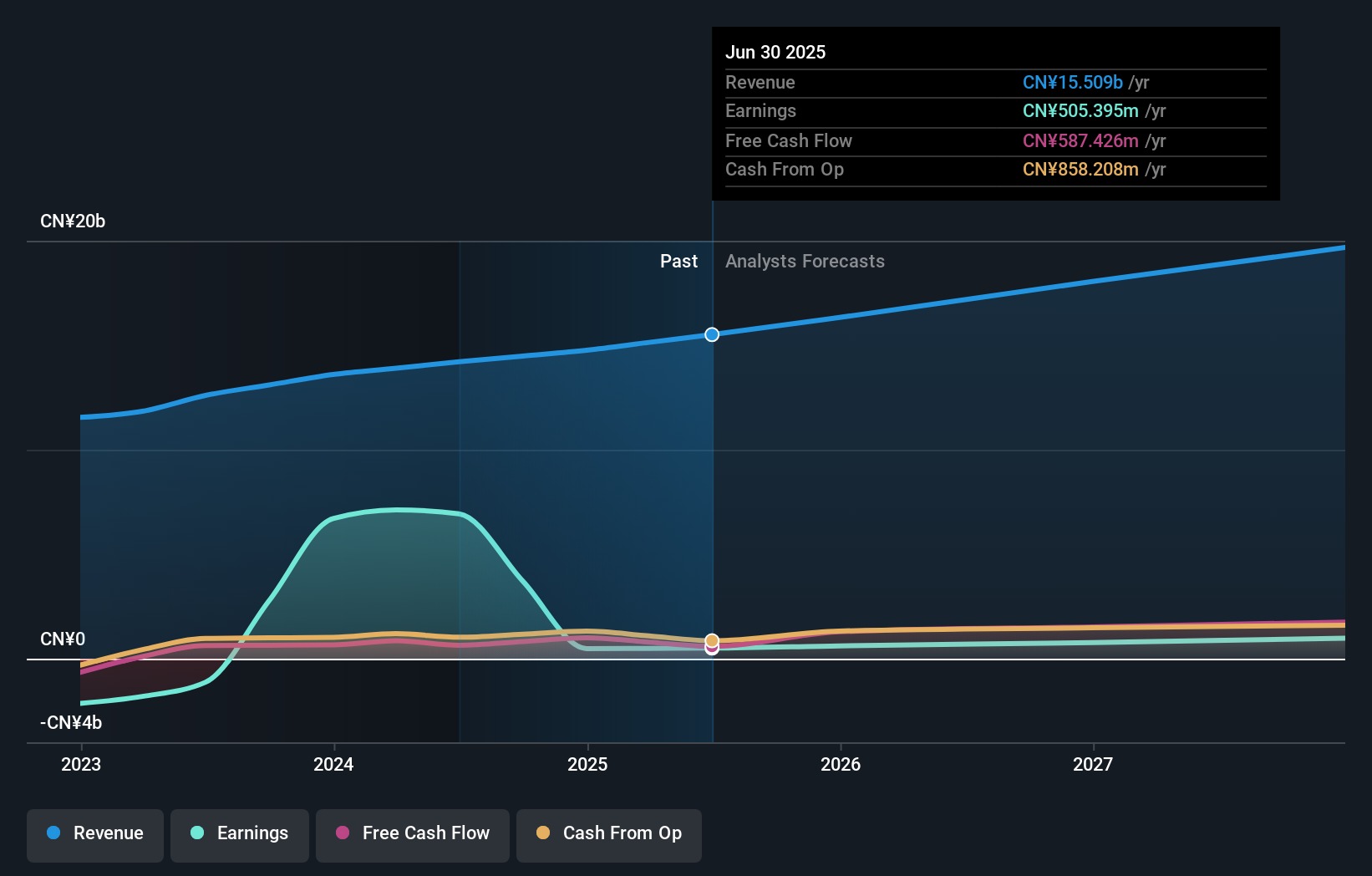

Overview: Bestechnic (Shanghai) Co., Ltd. focuses on the research, design, development, manufacture, and sale of smart audio and video SoC chips in China with a market cap of CN¥46.15 billion.

Operations: The company's revenue is primarily derived from its Integrated Circuit segment, totaling CN¥3.60 billion.

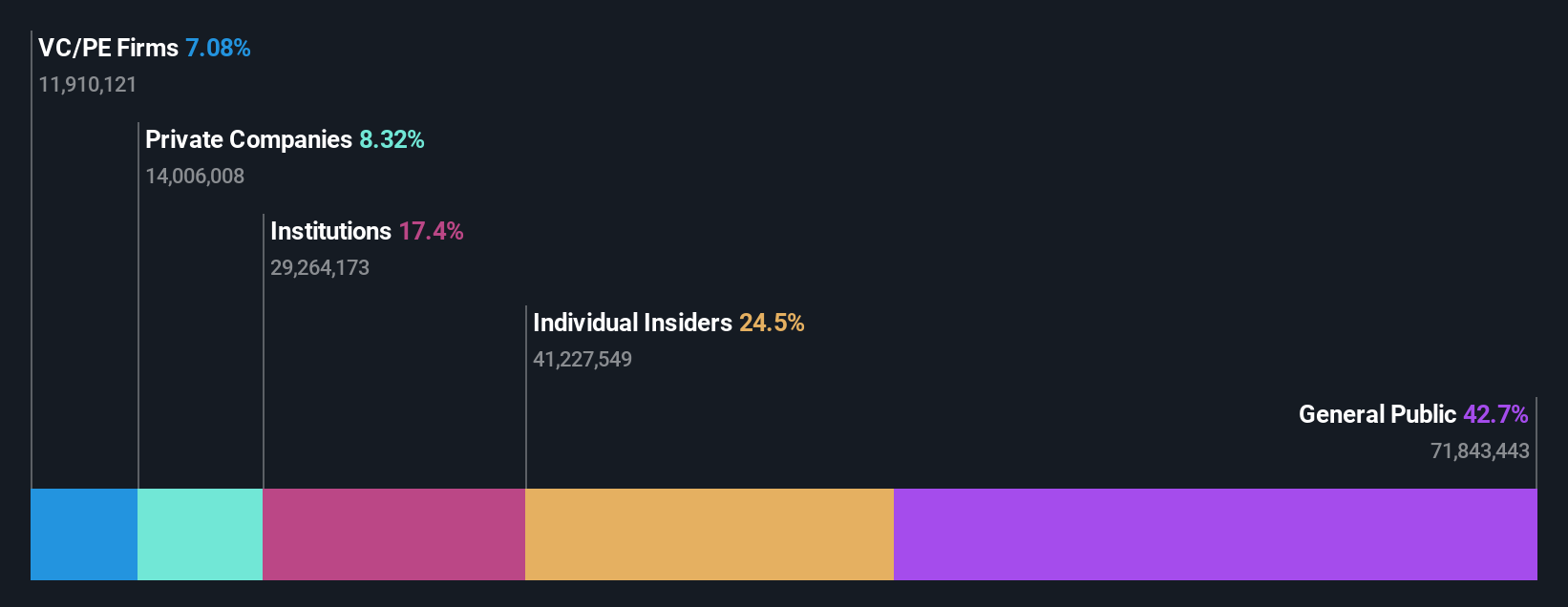

Insider Ownership: 25.6%

Earnings Growth Forecast: 31.7% p.a.

Bestechnic (Shanghai) is poised for substantial growth with earnings expected to rise 31.73% annually, surpassing the Chinese market average. Revenue is also forecast to grow at 27.2% per year, well above the market's 13.2%. Despite a low future Return on Equity of 14.9%, its Price-To-Earnings ratio of 74x suggests fair valuation compared to industry peers. The company has no significant insider trading activity over the past three months and maintains an unstable dividend track record.

- Navigate through the intricacies of Bestechnic (Shanghai) with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Bestechnic (Shanghai) shares in the market.

Ninestar (SZSE:002180)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ninestar Corporation is involved in the R&D, production, processing, and sales of printers and related consumables and accessories, with a market cap of CN¥37.60 billion.

Operations: The company's revenue segments include CN¥6.25 billion from self-produced printers and CN¥10.50 billion from printer consumables and accessories.

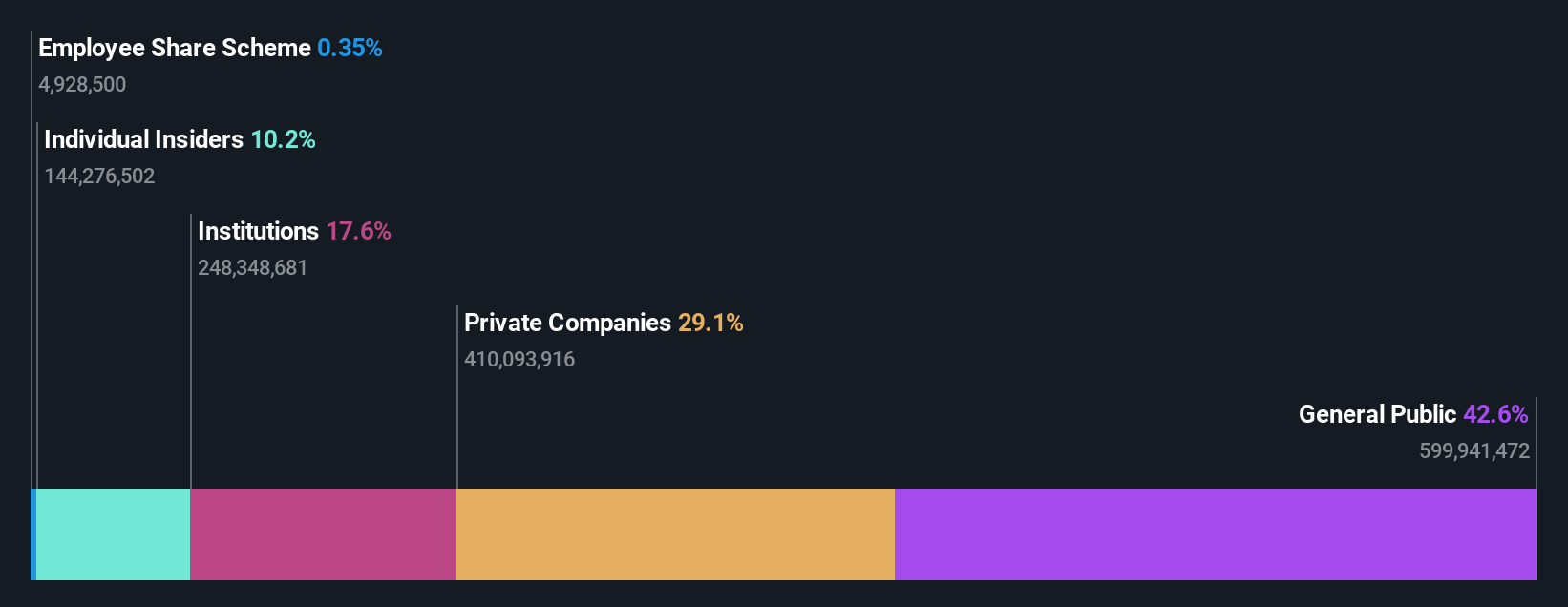

Insider Ownership: 10.2%

Earnings Growth Forecast: 69.3% p.a.

Ninestar is expected to achieve profitability within three years, with earnings growth forecast at 69.34% annually, outpacing market averages. Despite a recent net loss of CNY 311.77 million for the first half of 2025, revenue is projected to grow at 14% per year, slightly above the Chinese market's rate. The company has completed a share buyback program worth CNY 200.84 million but faces challenges with low future Return on Equity and declining sales figures.

- Click to explore a detailed breakdown of our findings in Ninestar's earnings growth report.

- In light of our recent valuation report, it seems possible that Ninestar is trading behind its estimated value.

Summing It All Up

- Get an in-depth perspective on all 595 Fast Growing Asian Companies With High Insider Ownership by using our screener here.

- Seeking Other Investments? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bestechnic (Shanghai) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688608

Bestechnic (Shanghai)

Engages in the research, design, development, manufacture, and sale of smart audio and video SoC chips in China.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion