3 Asian Growth Companies With High Insider Ownership Expecting Up To 109% Earnings Growth

Reviewed by Simply Wall St

In the current landscape, Asian markets are navigating a complex environment marked by trade tensions and economic policy shifts, with mainland Chinese stock markets showing resilience amid expectations of increased stimulus to counteract tariff impacts. Amidst these fluctuations, growth companies with high insider ownership can be particularly appealing as they often signal strong confidence from those closest to the business, potentially offering stability and alignment of interests in uncertain times.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.3% | 26% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.7% | 23.7% |

| Sineng ElectricLtd (SZSE:300827) | 35.9% | 42.8% |

| AcrelLtd (SZSE:300286) | 40% | 33.1% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 40.2% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Oscotec (KOSDAQ:A039200) | 21.3% | 85.9% |

| Fulin Precision (SZSE:300432) | 13.6% | 74.7% |

| Suzhou Gyz Electronic TechnologyLtd (SHSE:688260) | 16.4% | 121.7% |

Let's review some notable picks from our screened stocks.

Bestechnic (Shanghai) (SHSE:688608)

Simply Wall St Growth Rating: ★★★★★☆

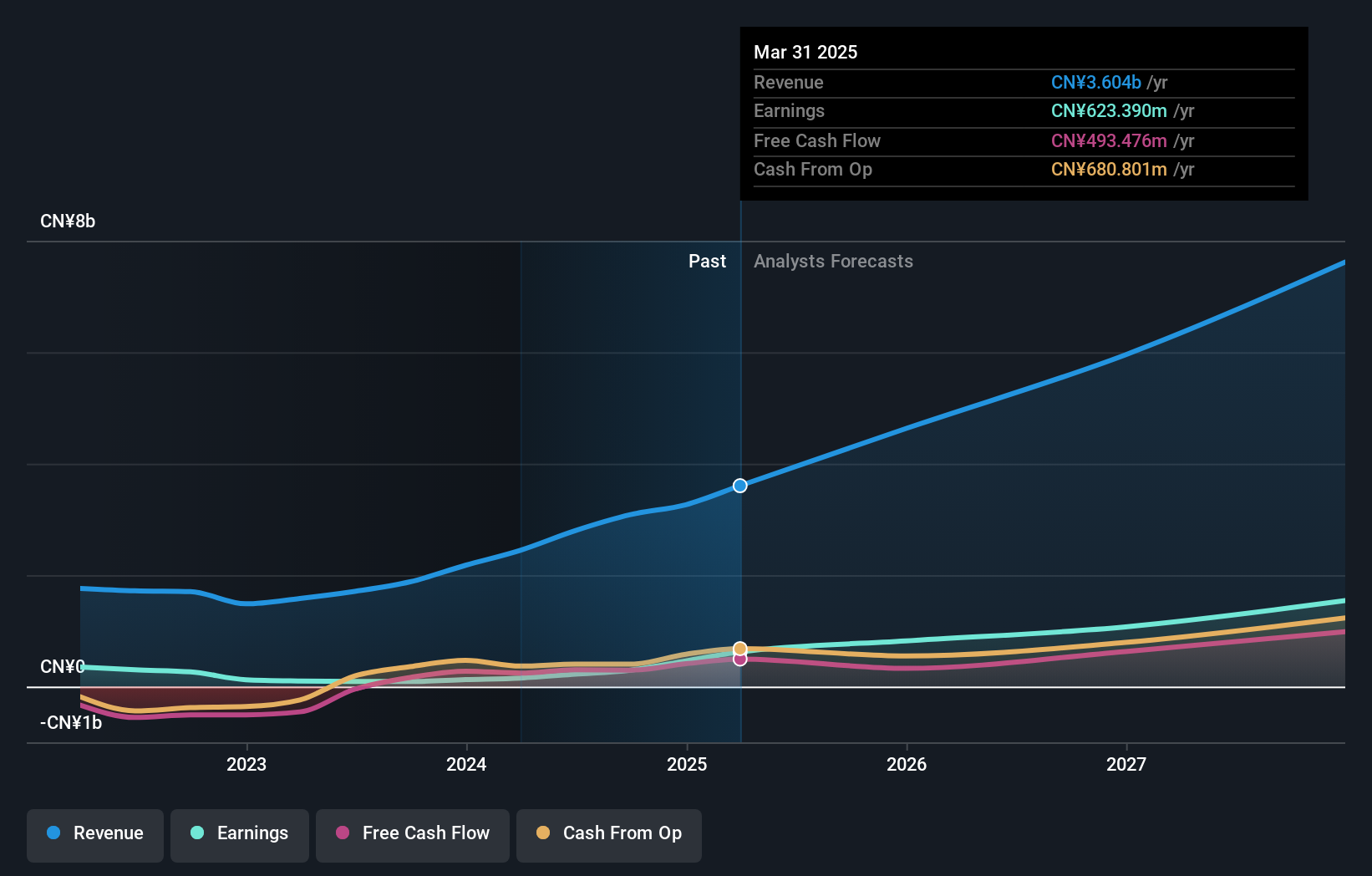

Overview: Bestechnic (Shanghai) Co., Ltd. focuses on the research, design, development, manufacture, and sale of smart audio and video SoC chips in China with a market cap of CN¥46.03 billion.

Operations: The company's revenue primarily comes from its Integrated Circuit segment, which generated CN¥3.26 billion.

Insider Ownership: 25.7%

Earnings Growth Forecast: 27.4% p.a.

Bestechnic (Shanghai) shows strong growth potential, with earnings and revenue forecasted to grow significantly at 27.38% and 24.9% per year, respectively, outpacing the Chinese market averages. The company reported impressive financial results for 2024, with sales reaching CNY 3.26 billion and net income rising to CNY 459.52 million—both substantial increases from the previous year. However, its share price has been highly volatile recently, which may concern some investors focused on stability.

- Get an in-depth perspective on Bestechnic (Shanghai)'s performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Bestechnic (Shanghai)'s share price might be too optimistic.

Shenzhen H&T Intelligent ControlLtd (SZSE:002402)

Simply Wall St Growth Rating: ★★★★★☆

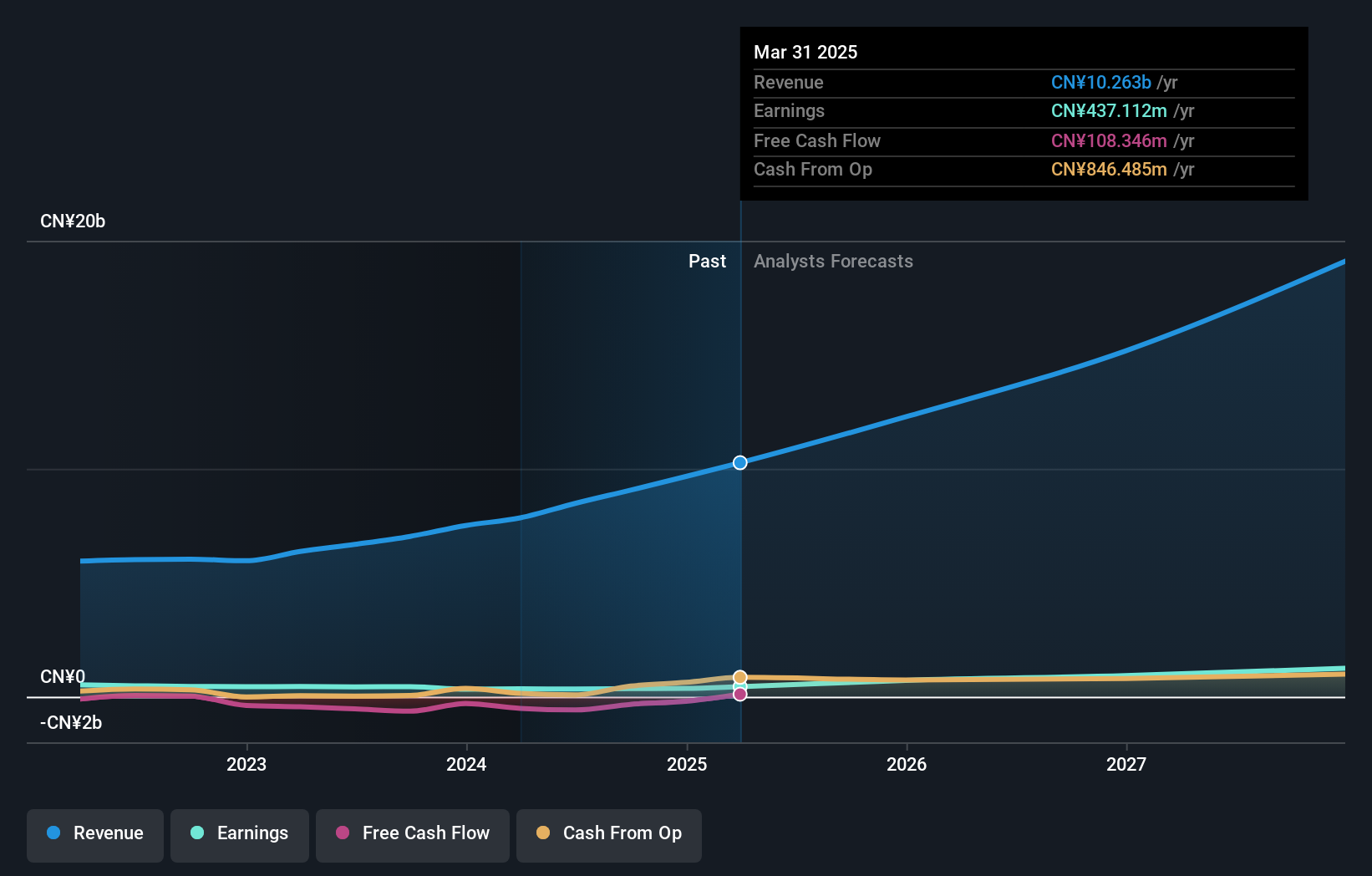

Overview: Shenzhen H&T Intelligent Control Co.Ltd, along with its subsidiaries, engages in the research, development, manufacture, sale, and marketing of intelligent controller products both in China and internationally with a market cap of CN¥17.50 billion.

Operations: The company's revenue is derived from the research, development, manufacture, sale, and marketing of intelligent controller products in both domestic and international markets.

Insider Ownership: 16.2%

Earnings Growth Forecast: 41.9% p.a.

Shenzhen H&T Intelligent Control Ltd. is poised for significant growth, with earnings projected to rise 41.91% annually over the next three years, surpassing the Chinese market's average growth rate. The company reported CNY 9.66 billion in sales for 2024, a substantial increase from the previous year, and a net income of CNY 364.3 million. Despite its promising growth outlook, investors should note the high share price volatility and low forecasted return on equity of 14.1%.

- Click here to discover the nuances of Shenzhen H&T Intelligent ControlLtd with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Shenzhen H&T Intelligent ControlLtd is priced higher than what may be justified by its financials.

Caliway Biopharmaceuticals (TWSE:6919)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Caliway Biopharmaceuticals Co. Ltd focuses on developing small molecule drugs for medical aesthetics and inflammatory diseases, with a market cap of NT$98.30 billion.

Operations: The company generates its revenue from the pharmaceuticals segment, amounting to NT$44.43 million.

Insider Ownership: 24.4%

Earnings Growth Forecast: 109.9% p.a.

Caliway Biopharmaceuticals is experiencing rapid growth, with revenue expected to increase significantly faster than the Taiwanese market average. Despite a net loss of NT$588.83 million in 2024, its innovative CBL-514 drug for non-surgical fat reduction shows promising clinical results and favorable safety profiles. While the company's share price has been highly volatile recently, it trades well below estimated fair value and is forecasted to become profitable within three years.

- Dive into the specifics of Caliway Biopharmaceuticals here with our thorough growth forecast report.

- Our valuation report here indicates Caliway Biopharmaceuticals may be overvalued.

Summing It All Up

- Navigate through the entire inventory of 646 Fast Growing Asian Companies With High Insider Ownership here.

- Ready To Venture Into Other Investment Styles? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6919

Caliway Biopharmaceuticals

Engages in the development of drugs for aesthetic medicine and chronic inflammation.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives