- China

- /

- Electronic Equipment and Components

- /

- SZSE:002913

Three Undiscovered Gems With Promising Potential

Reviewed by Simply Wall St

In the midst of a bustling earnings season and fluctuating economic indicators, small-cap stocks have shown resilience, holding up better than their large-cap counterparts despite a generally downward trend in major indices. As investors navigate these uncertain waters, identifying stocks with strong fundamentals and growth potential becomes crucial for uncovering hidden opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Macnica Galaxy | 47.16% | 10.05% | 20.58% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Pro-Hawk | 30.16% | -5.27% | -2.93% | ★★★★★☆ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Wuxi ETEK MicroelectronicsLtd (SHSE:688601)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wuxi ETEK Micro-Electronics Co., Ltd. specializes in the manufacturing of analog integrated circuits (IC) and has a market capitalization of CN¥6.17 billion.

Operations: Wuxi ETEK Micro-Electronics generates revenue primarily from the production of analog integrated circuits. The company's financial performance is highlighted by its gross profit margin, which reflects its cost management efficiency in manufacturing operations.

Wuxi ETEK Microelectronics, a notable player in the semiconductor industry, has shown impressive earnings growth of 66% over the past year, outpacing the industry's 14%. Despite recent volatility in its share price, it offers good relative value with a price-to-earnings ratio of 34x compared to the CN market's 36x. The company repurchased shares worth CNY 11.85 million recently, indicating confidence in its valuation. However, sales for nine months ending September fell slightly to CNY 605 million from last year's CNY 635 million. Net income also decreased to CNY 100 million from CNY 119 million previously.

Aoshikang Technology (SZSE:002913)

Simply Wall St Value Rating: ★★★★★☆

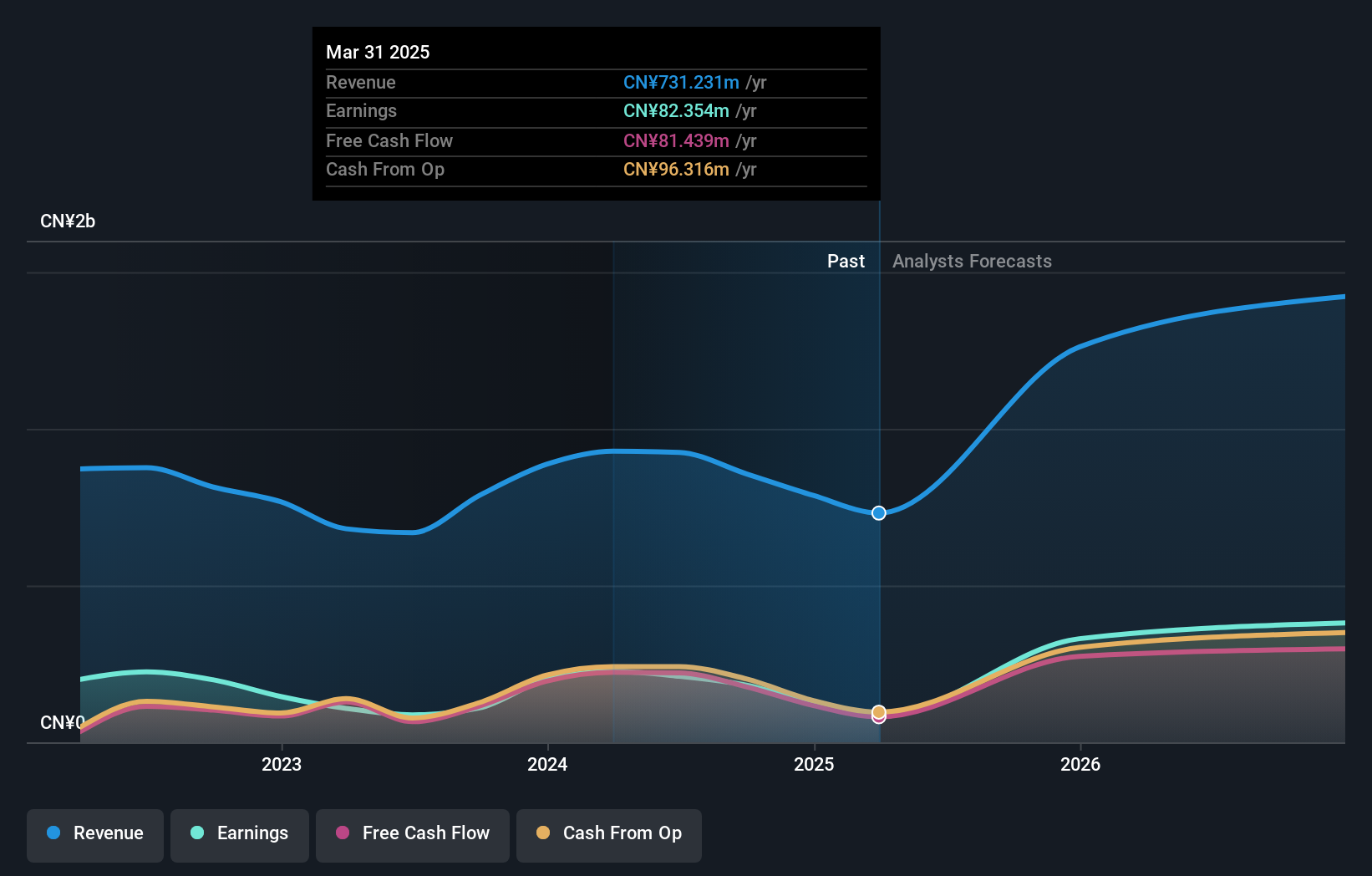

Overview: Aoshikang Technology Co., Ltd. focuses on the research, development, production, and sale of printed circuit boards with a market capitalization of CN¥8.18 billion.

Operations: The company generates revenue primarily from the sale of printed circuit boards.

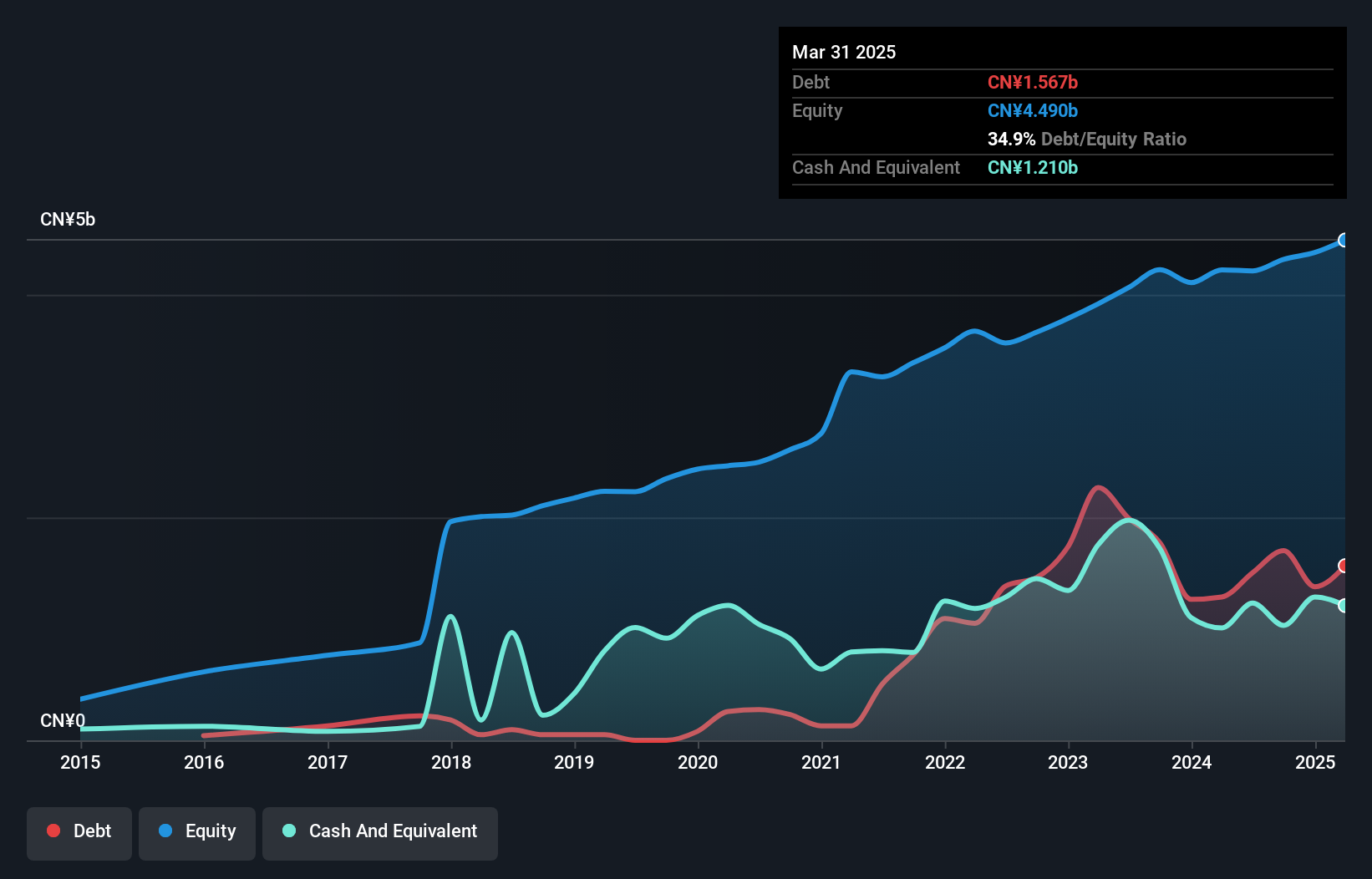

Aoshikang Technology, a small player in the electronics industry, has shown some intriguing financial dynamics. Over the past year, earnings grew by 7.3%, outpacing the industry's 1.7% growth rate, yet net income for the nine months ending September 2024 was CNY 278.81 million compared to CNY 440.52 million previously. The company trades at nearly 60% below its estimated fair value and holds a satisfactory net debt to equity ratio of around 20%. Despite not being free cash flow positive recently, Aoshikang's high-quality earnings and forecasted annual growth of over 30% suggest potential for future value realization.

Beijing Jiaxun Feihong Electrical (SZSE:300213)

Simply Wall St Value Rating: ★★★★★☆

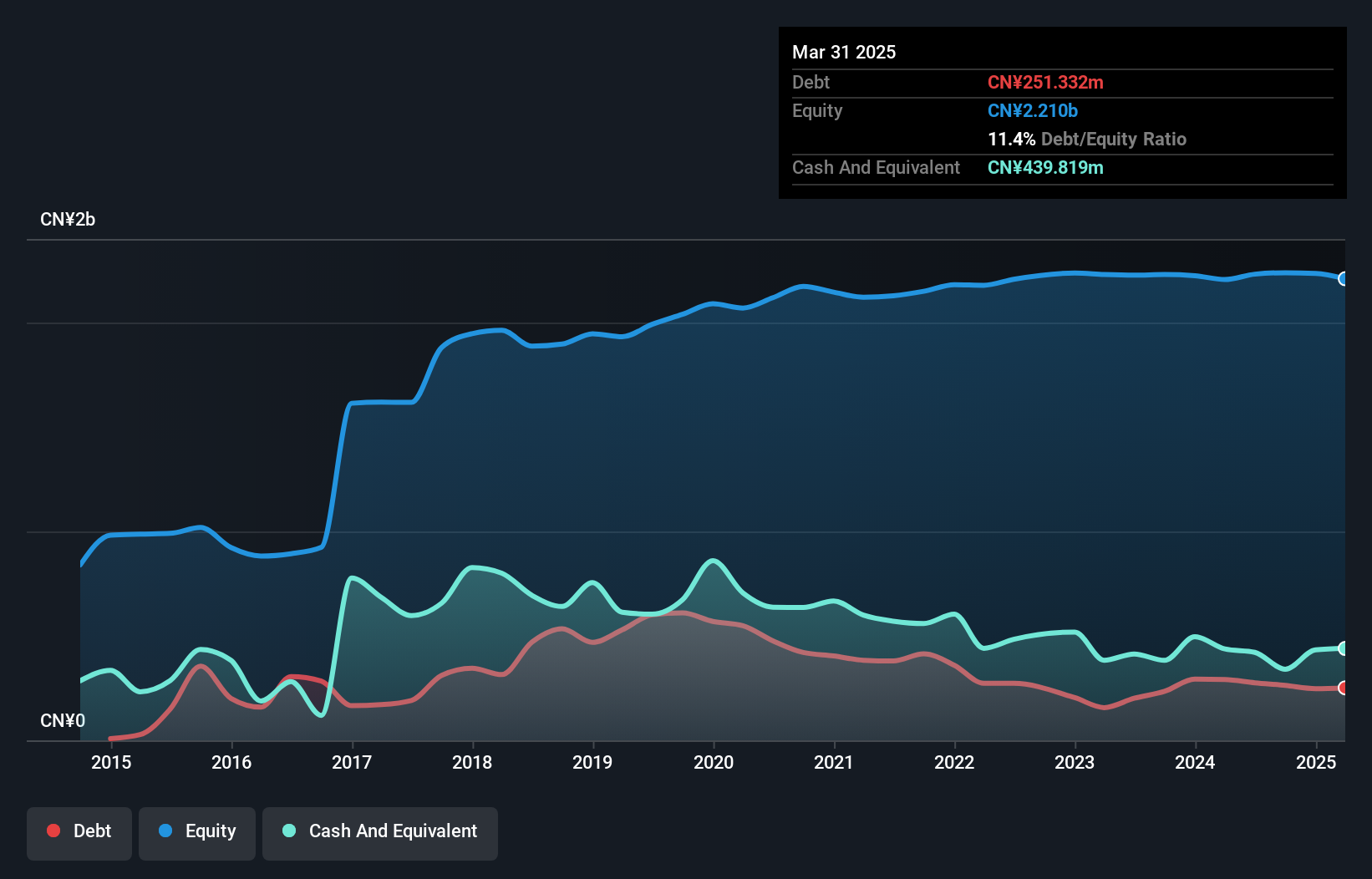

Overview: Beijing Jiaxun Feihong Electrical Co., Ltd. operates in the electrical industry and has a market capitalization of CN¥5.06 billion.

Operations: Beijing Jiaxun Feihong Electrical generates revenue from its operations in the electrical industry, contributing to its market capitalization of CN¥5.06 billion.

Beijing Jiaxun Feihong Electrical, a smaller player in the communications sector, showcases some promising aspects. Over the past five years, its debt to equity ratio has impressively decreased from 29.9% to 11.8%, indicating a more stable financial footing. Despite earnings declining by an annual average of 19.6% over this period, recent results show a slight uptick with earnings growing by 0.6% last year, outpacing the industry's -5.4%. The company also completed a share buyback program repurchasing over seven million shares for CNY 43.17 million, reflecting confidence in its future prospects amidst challenges and opportunities alike.

Taking Advantage

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4703 more companies for you to explore.Click here to unveil our expertly curated list of 4706 Undiscovered Gems With Strong Fundamentals.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002913

Aoshikang Technology

Engages in the research, development, production, and sale of printed circuit boards.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives