- China

- /

- Semiconductors

- /

- SHSE:688521

VeriSilicon Microelectronics (Shanghai) Co., Ltd.'s (SHSE:688521) 29% Price Boost Is Out Of Tune With Revenues

VeriSilicon Microelectronics (Shanghai) Co., Ltd. (SHSE:688521) shareholders are no doubt pleased to see that the share price has bounced 29% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 37% in the last twelve months.

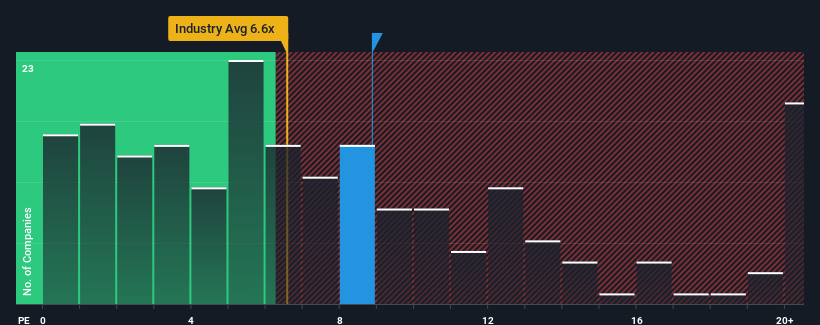

Following the firm bounce in price, VeriSilicon Microelectronics (Shanghai) may be sending bearish signals at the moment with its price-to-sales (or "P/S") ratio of 8.9x, since almost half of all companies in the Semiconductor in China have P/S ratios under 6.6x and even P/S lower than 3x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for VeriSilicon Microelectronics (Shanghai)

What Does VeriSilicon Microelectronics (Shanghai)'s Recent Performance Look Like?

While the industry has experienced revenue growth lately, VeriSilicon Microelectronics (Shanghai)'s revenue has gone into reverse gear, which is not great. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think VeriSilicon Microelectronics (Shanghai)'s future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like VeriSilicon Microelectronics (Shanghai)'s to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 13%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 55% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 32% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 31% per year, which is not materially different.

With this in consideration, we find it intriguing that VeriSilicon Microelectronics (Shanghai)'s P/S is higher than its industry peers. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

What Does VeriSilicon Microelectronics (Shanghai)'s P/S Mean For Investors?

The large bounce in VeriSilicon Microelectronics (Shanghai)'s shares has lifted the company's P/S handsomely. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Analysts are forecasting VeriSilicon Microelectronics (Shanghai)'s revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for VeriSilicon Microelectronics (Shanghai) with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on VeriSilicon Microelectronics (Shanghai), explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688521

VeriSilicon Microelectronics (Shanghai)

Provides platform-based custom silicon and semiconductor IP licensing services in China and internationally.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives