- China

- /

- Semiconductors

- /

- SHSE:688512

Smarter Microelectronics (Guangzhou) Co., Ltd. (SHSE:688512) May Have Run Too Fast Too Soon With Recent 29% Price Plummet

The Smarter Microelectronics (Guangzhou) Co., Ltd. (SHSE:688512) share price has softened a substantial 29% over the previous 30 days, handing back much of the gains the stock has made lately. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 49% in that time.

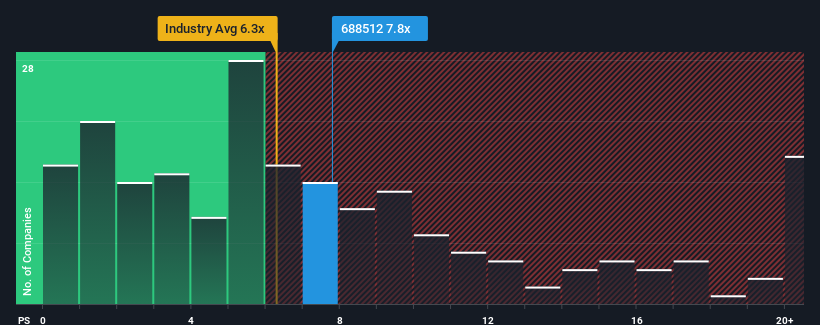

Although its price has dipped substantially, Smarter Microelectronics (Guangzhou) may still be sending sell signals at present with a price-to-sales (or "P/S") ratio of 7.8x, when you consider almost half of the companies in the Semiconductor industry in China have P/S ratios under 6.3x and even P/S lower than 3x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Smarter Microelectronics (Guangzhou)

What Does Smarter Microelectronics (Guangzhou)'s P/S Mean For Shareholders?

Recent times haven't been great for Smarter Microelectronics (Guangzhou) as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Smarter Microelectronics (Guangzhou).Is There Enough Revenue Growth Forecasted For Smarter Microelectronics (Guangzhou)?

The only time you'd be truly comfortable seeing a P/S as high as Smarter Microelectronics (Guangzhou)'s is when the company's growth is on track to outshine the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 8.3%. Still, revenue has barely risen at all in aggregate from three years ago, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next year should generate growth of 26% as estimated by the lone analyst watching the company. Meanwhile, the rest of the industry is forecast to expand by 51%, which is noticeably more attractive.

With this information, we find it concerning that Smarter Microelectronics (Guangzhou) is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Smarter Microelectronics (Guangzhou)'s P/S?

Smarter Microelectronics (Guangzhou)'s P/S remain high even after its stock plunged. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Smarter Microelectronics (Guangzhou), this doesn't appear to be impacting the P/S in the slightest. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

Plus, you should also learn about these 2 warning signs we've spotted with Smarter Microelectronics (Guangzhou) (including 1 which is concerning).

If you're unsure about the strength of Smarter Microelectronics (Guangzhou)'s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688512

Smarter Microelectronics (Guangzhou)

A chip design company, researches and develops, designs, and sells radio frequency (RF) front-end chips and modules in China.

Excellent balance sheet with limited growth.

Market Insights

Community Narratives