- China

- /

- Semiconductors

- /

- SHSE:688508

Wuxi Chipown Micro-electronics limited's (SHSE:688508) Shares Leap 32% Yet They're Still Not Telling The Full Story

Those holding Wuxi Chipown Micro-electronics limited (SHSE:688508) shares would be relieved that the share price has rebounded 32% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 48% in the last twelve months.

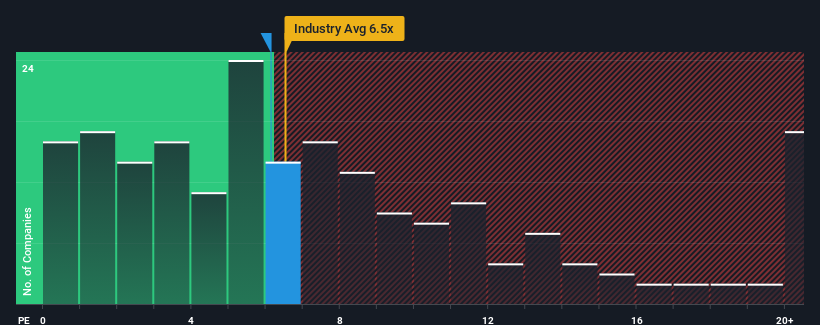

In spite of the firm bounce in price, there still wouldn't be many who think Wuxi Chipown Micro-electronics' price-to-sales (or "P/S") ratio of 6.1x is worth a mention when the median P/S in China's Semiconductor industry is similar at about 6.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Wuxi Chipown Micro-electronics

What Does Wuxi Chipown Micro-electronics' P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Wuxi Chipown Micro-electronics has been relatively sluggish. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Wuxi Chipown Micro-electronics will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Wuxi Chipown Micro-electronics would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 8.4% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 82% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next year should generate growth of 47% as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 37% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Wuxi Chipown Micro-electronics' P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Its shares have lifted substantially and now Wuxi Chipown Micro-electronics' P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Looking at Wuxi Chipown Micro-electronics' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Wuxi Chipown Micro-electronics that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Chipown Micro-electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688508

Wuxi Chipown Micro-electronics

Engages in the research and development, and sale of semiconductor products in China.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives