Stock Analysis

- China

- /

- Entertainment

- /

- SZSE:300027

Exploring Growth Potential: Three High Insider Ownership Stocks On The Chinese Exchange

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating global markets, China's economy shows signs of resilience and potential growth areas, notably in its property sector despite broader market retreats. In this context, high insider ownership stocks on the Chinese exchange offer intriguing prospects for investors looking to tap into companies with potentially aligned interests between shareholders and management. Understanding the intrinsic value and growth potential of such stocks becomes particularly relevant in current market conditions where discerning stability and commitment can lead to informed investment choices.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

| Suzhou Shijing Environmental TechnologyLtd (SZSE:301030) | 22% | 54.9% |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 24.8% |

| Ningbo Deye Technology Group (SHSE:605117) | 24.8% | 28.4% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

| Eoptolink Technology (SZSE:300502) | 26.7% | 39.4% |

| Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

| Fujian Wanchen Biotechnology Group (SZSE:300972) | 15.3% | 75.9% |

| UTour Group (SZSE:002707) | 24% | 33.1% |

| Offcn Education Technology (SZSE:002607) | 26.1% | 65.3% |

We're going to check out a few of the best picks from our screener tool.

Zbit Semiconductor (SHSE:688416)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zbit Semiconductor Inc., based in China, specializes in the design and development of memory chips and MCU chips, with a market capitalization of approximately CN¥3.23 billion.

Operations: The company generates CN¥314.61 million from its semiconductor segment, focusing on memory and MCU chips.

Insider Ownership: 28.8%

Zbit Semiconductor, a growth-focused company in China, is expected to become profitable within the next three years, with earnings forecasted to grow significantly at 163.03% annually. Despite its highly volatile share price recently, Zbit's revenue growth of 35.7% per year outpaces the broader Chinese market's 13.8%. However, recent financials show increased losses with a net loss expanding from CNY 18.67 million to CNY 33.05 million in Q1 2024 compared to the previous year, indicating some short-term challenges despite strong growth prospects and high insider ownership.

- Click here to discover the nuances of Zbit Semiconductor with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Zbit Semiconductor's share price might be too optimistic.

Jiangsu Yawei Machine Tool (SZSE:002559)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Yawei Machine Tool Co., Ltd. specializes in manufacturing and selling metal forming machine tools, serving both domestic and international markets, with a market capitalization of CN¥4.34 billion.

Operations: The company generates CN¥1.98 billion from its general equipment manufacturing segment.

Insider Ownership: 15.2%

Jiangsu Yawei Machine Tool Co., Ltd. is poised for robust growth with earnings and revenue forecasted to increase by 43.67% and 25.1% per year, respectively, outperforming the broader Chinese market. Despite substantial earnings growth last year, recent adjustments in dividends and a lack of insider buying may raise concerns about its short-term financial health. Additionally, one-off items have significantly impacted its financial results, suggesting potential volatility in its earnings quality.

- Get an in-depth perspective on Jiangsu Yawei Machine Tool's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Jiangsu Yawei Machine Tool's shares may be trading at a premium.

Huayi Brothers Media (SZSE:300027)

Simply Wall St Growth Rating: ★★★★★★

Overview: Huayi Brothers Media Corporation is an entertainment media company based in China, engaging in both domestic and international operations, with a market capitalization of approximately CN¥4.97 billion.

Operations: The entertainment media firm generates its revenue from various segments, although specific financial details for each segment are not provided in the text.

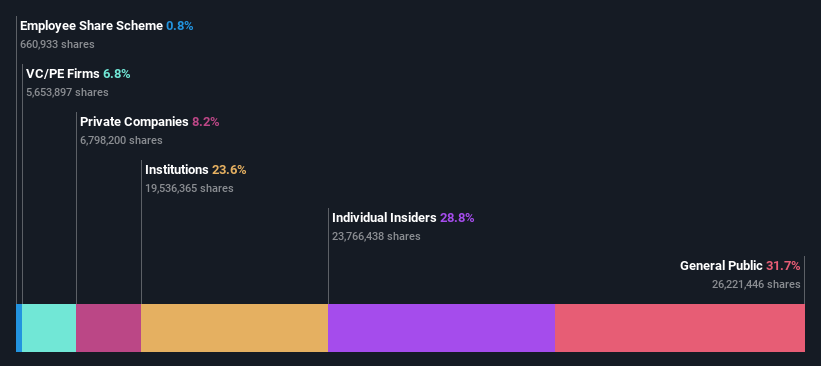

Insider Ownership: 17.5%

Huayi Brothers Media, despite a challenging financial year with a significant net loss reduction from CNY 981.14 million to CNY 538.83 million, shows promising signs of recovery. The company's revenue growth is expected to outpace the Chinese market significantly, with forecasts suggesting a high annual increase in earnings and revenue over the next three years. However, recent quarterly results indicate ongoing losses and reduced sales, highlighting potential risks amidst its growth trajectory.

- Click to explore a detailed breakdown of our findings in Huayi Brothers Media's earnings growth report.

- Upon reviewing our latest valuation report, Huayi Brothers Media's share price might be too pessimistic.

Where To Now?

- Take a closer look at our Fast Growing Chinese Companies With High Insider Ownership list of 389 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Huayi Brothers Media is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300027

Huayi Brothers Media

Operates as an entertainment media company in China and internationally.

Exceptional growth potential and good value.