- China

- /

- Semiconductors

- /

- SHSE:688391

Hi-Trend Technology (Shanghai)'s (SHSE:688391) Shareholders Have More To Worry About Than Only Soft Earnings

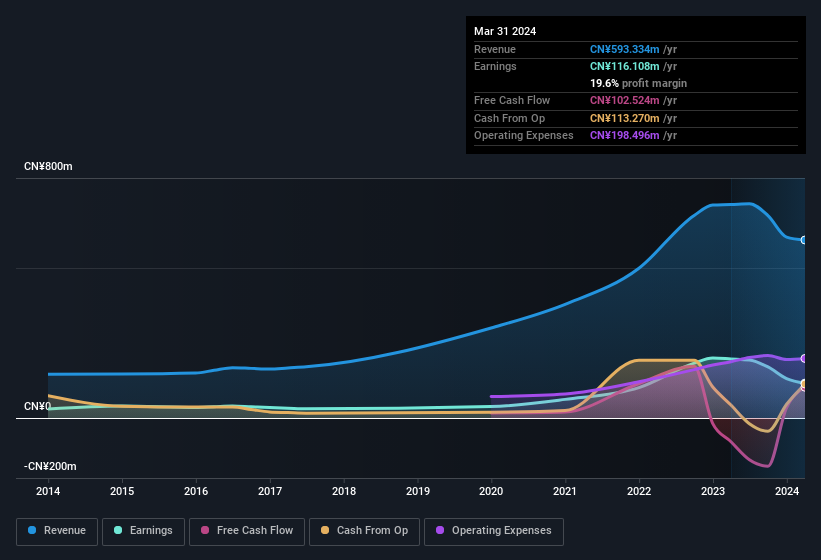

A lackluster earnings announcement from Hi-Trend Technology (Shanghai) Co., Ltd. (SHSE:688391) last week didn't sink the stock price. We think that investors are worried about some weaknesses underlying the earnings.

Check out our latest analysis for Hi-Trend Technology (Shanghai)

How Do Unusual Items Influence Profit?

For anyone who wants to understand Hi-Trend Technology (Shanghai)'s profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit gained from CN¥8.6m worth of unusual items. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And that's as you'd expect, given these boosts are described as 'unusual'. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Hi-Trend Technology (Shanghai).

An Unusual Tax Situation

Just as we noted the unusual items, we must inform you that Hi-Trend Technology (Shanghai) received a tax benefit which contributed CN¥14m to the bottom line. This is of course a bit out of the ordinary, given it is more common for companies to be paying tax than receiving tax benefits! We're sure the company was pleased with its tax benefit. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth. While we think it's good that the company has booked a tax benefit, it does mean that there's every chance the statutory profit will come in a lot higher than it would be if the income was adjusted for one-off factors.

Our Take On Hi-Trend Technology (Shanghai)'s Profit Performance

In its last report Hi-Trend Technology (Shanghai) received a tax benefit which might make its profit look better than it really is on a underlying level. Furthermore, it also benefitted from a positive unusual item, which boosted the profit result even higher. For the reasons mentioned above, we think that a perfunctory glance at Hi-Trend Technology (Shanghai)'s statutory profits might make it look better than it really is on an underlying level. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. Every company has risks, and we've spotted 1 warning sign for Hi-Trend Technology (Shanghai) you should know about.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

Valuation is complex, but we're here to simplify it.

Discover if Hi-Trend Technology (Shanghai) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688391

Hi-Trend Technology (Shanghai)

Designs, develops, and sells integrated circuit (IC) products in China.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026