- China

- /

- Semiconductors

- /

- SHSE:688381

Why Investors Shouldn't Be Surprised By Dioo Microcircuits Co., Ltd. Jiangsu's (SHSE:688381) 39% Share Price Surge

Dioo Microcircuits Co., Ltd. Jiangsu (SHSE:688381) shareholders are no doubt pleased to see that the share price has bounced 39% in the last month, although it is still struggling to make up recently lost ground. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 51% share price drop in the last twelve months.

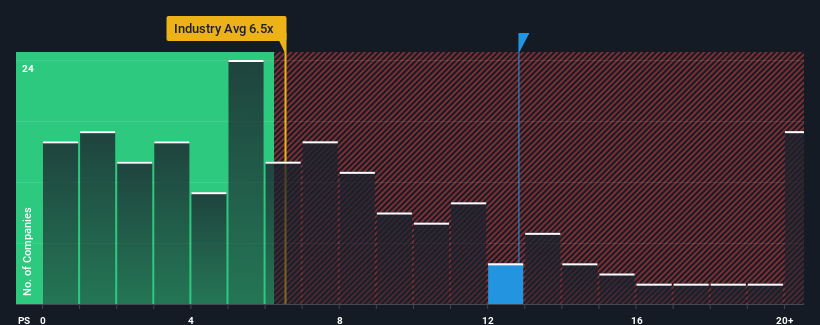

After such a large jump in price, Dioo Microcircuits Jiangsu may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 12.8x, since almost half of all companies in the Semiconductor industry in China have P/S ratios under 6.5x and even P/S lower than 3x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Dioo Microcircuits Jiangsu

What Does Dioo Microcircuits Jiangsu's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Dioo Microcircuits Jiangsu's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Dioo Microcircuits Jiangsu will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Dioo Microcircuits Jiangsu would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 24%. Even so, admirably revenue has lifted 54% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 54% over the next year. With the industry only predicted to deliver 37%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Dioo Microcircuits Jiangsu's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

The strong share price surge has lead to Dioo Microcircuits Jiangsu's P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into Dioo Microcircuits Jiangsu shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

You should always think about risks. Case in point, we've spotted 2 warning signs for Dioo Microcircuits Jiangsu you should be aware of, and 1 of them shouldn't be ignored.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688381

Dioo Microcircuits Jiangsu

Engages in the research, development, design, and manufacture of high-performance analog chips in China.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives