- China

- /

- Semiconductors

- /

- SHSE:688368

Not Many Are Piling Into Shanghai Bright Power Semiconductor Co., Ltd. (SHSE:688368) Stock Yet As It Plummets 26%

To the annoyance of some shareholders, Shanghai Bright Power Semiconductor Co., Ltd. (SHSE:688368) shares are down a considerable 26% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 63% share price decline.

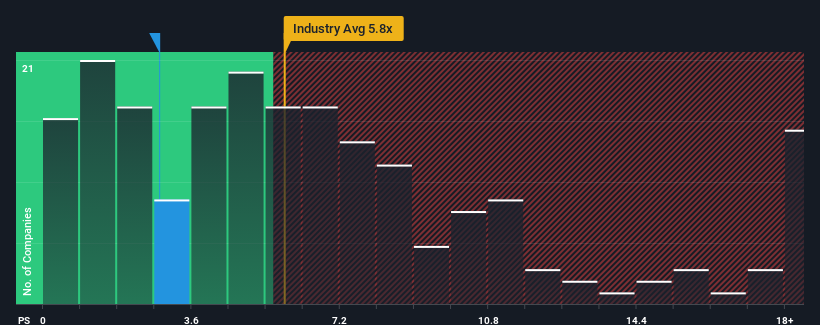

Following the heavy fall in price, Shanghai Bright Power Semiconductor's price-to-sales (or "P/S") ratio of 2.8x might make it look like a strong buy right now compared to the wider Semiconductor industry in China, where around half of the companies have P/S ratios above 5.8x and even P/S above 10x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Shanghai Bright Power Semiconductor

How Shanghai Bright Power Semiconductor Has Been Performing

Shanghai Bright Power Semiconductor certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shanghai Bright Power Semiconductor.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Shanghai Bright Power Semiconductor's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 21%. As a result, it also grew revenue by 18% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 35% over the next year. Meanwhile, the rest of the industry is forecast to expand by 34%, which is not materially different.

With this in consideration, we find it intriguing that Shanghai Bright Power Semiconductor's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Final Word

Shanghai Bright Power Semiconductor's P/S looks about as weak as its stock price lately. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It looks to us like the P/S figures for Shanghai Bright Power Semiconductor remain low despite growth that is expected to be in line with other companies in the industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Shanghai Bright Power Semiconductor with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on Shanghai Bright Power Semiconductor, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688368

Shanghai Bright Power Semiconductor

Engages in the research, development, and sale of power management and motor control chips in China and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives