- China

- /

- Semiconductors

- /

- SHSE:688332

Discovering Undiscovered Gems In February 2025

Reviewed by Simply Wall St

As February 2025 unfolds, global markets are navigating a landscape marked by geopolitical tensions and consumer spending concerns, with major U.S. indices experiencing declines amid tariff uncertainties and economic data pointing to contraction in the services sector. Despite these challenges, investors remain on the lookout for promising opportunities within small-cap stocks, where undiscovered gems can often be found by focusing on companies that demonstrate resilience and adaptability in volatile environments.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 5.93% | 20.71% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tchaikapharma High Quality Medicines AD | 9.38% | 6.91% | 31.36% | ★★★★★★ |

| Taiyo KagakuLtd | 0.73% | 4.83% | -2.64% | ★★★★★☆ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Biggeorge Property Nyilvánosan Muködo Részvénytársaság | 17.83% | 35.24% | 34.64% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

Shenzhen Bluetrum Technology (SHSE:688332)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenzhen Bluetrum Technology Co., Ltd. specializes in the research, development, design, and sale of wireless audio SOC chips in China, with a market cap of CN¥14.43 billion.

Operations: Bluetrum Technology generates revenue primarily from the sale of wireless audio SOC chips. The company focuses on optimizing its cost structure to enhance profitability, with a notable emphasis on research and development expenses. Gross profit margin trends indicate fluctuations that reflect changes in production efficiency and market dynamics.

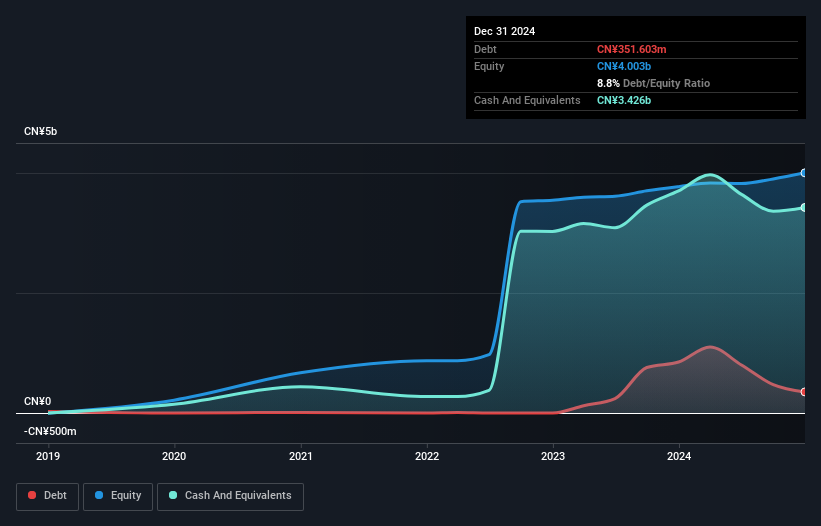

Bluetrum Technology, a small player in the semiconductor space, has shown impressive earnings growth of 18.7% over the past year, outpacing the industry average of 13.9%. Its price-to-earnings ratio stands at 57.7x, which is below the sector's average of 69.8x, suggesting potential value for investors. Despite a volatile share price recently, Bluetrum remains profitable with sufficient interest coverage and more cash than debt on its books. The company's debt to equity ratio has increased from 4.3% to 12.1% over five years but this doesn't seem to hinder its growth prospects significantly given its strong earnings trajectory and future forecasted growth rate of 25.76%.

Edifier Technology (SZSE:002351)

Simply Wall St Value Rating: ★★★★★★

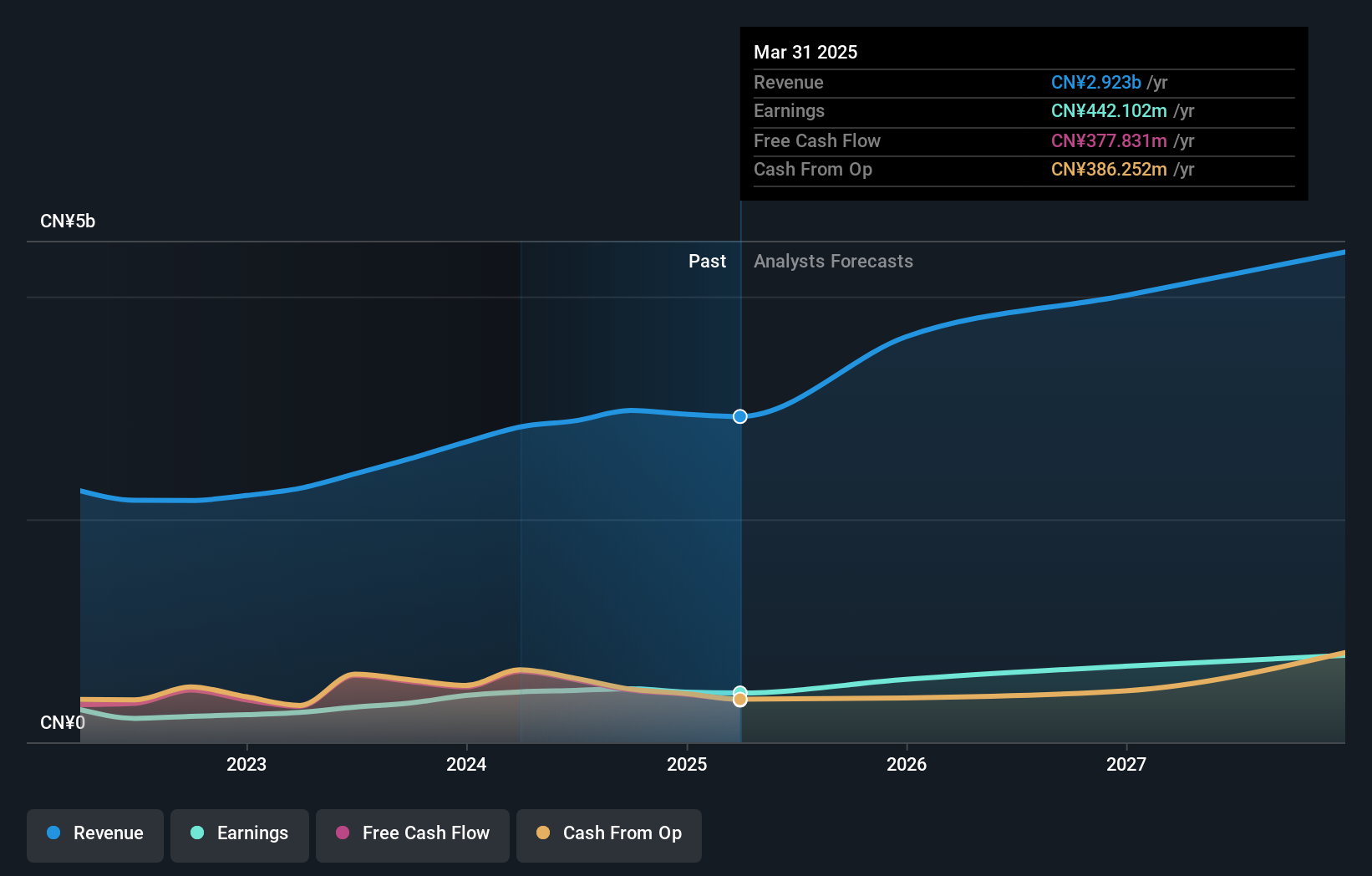

Overview: Edifier Technology Co., Ltd. designs, produces, and sells audio equipment in China with a market capitalization of CN¥14.40 billion.

Operations: Edifier Technology generates revenue primarily from its E-Pneumatic segment, which reported CN¥2.98 billion. The company's financial performance is reflected in its net profit margin, which stands at 7.5%.

Edifier Technology, a promising player in the consumer durables sector, has shown impressive earnings growth of 36% over the past year, outpacing the industry average of -1.9%. Its debt-to-equity ratio has improved from 0.7 to 0.4 over five years, indicating stronger financial health. With a price-to-earnings ratio at 30x, it appears attractively valued compared to the broader CN market at 38x. The company is free cash flow positive and holds more cash than total debt, suggesting robust liquidity and stability despite recent share price volatility. Earnings are expected to grow by approximately 21% annually moving forward.

- Dive into the specifics of Edifier Technology here with our thorough health report.

Examine Edifier Technology's past performance report to understand how it has performed in the past.

Shenzhen Farben Information TechnologyLtd (SZSE:300925)

Simply Wall St Value Rating: ★★★★★★

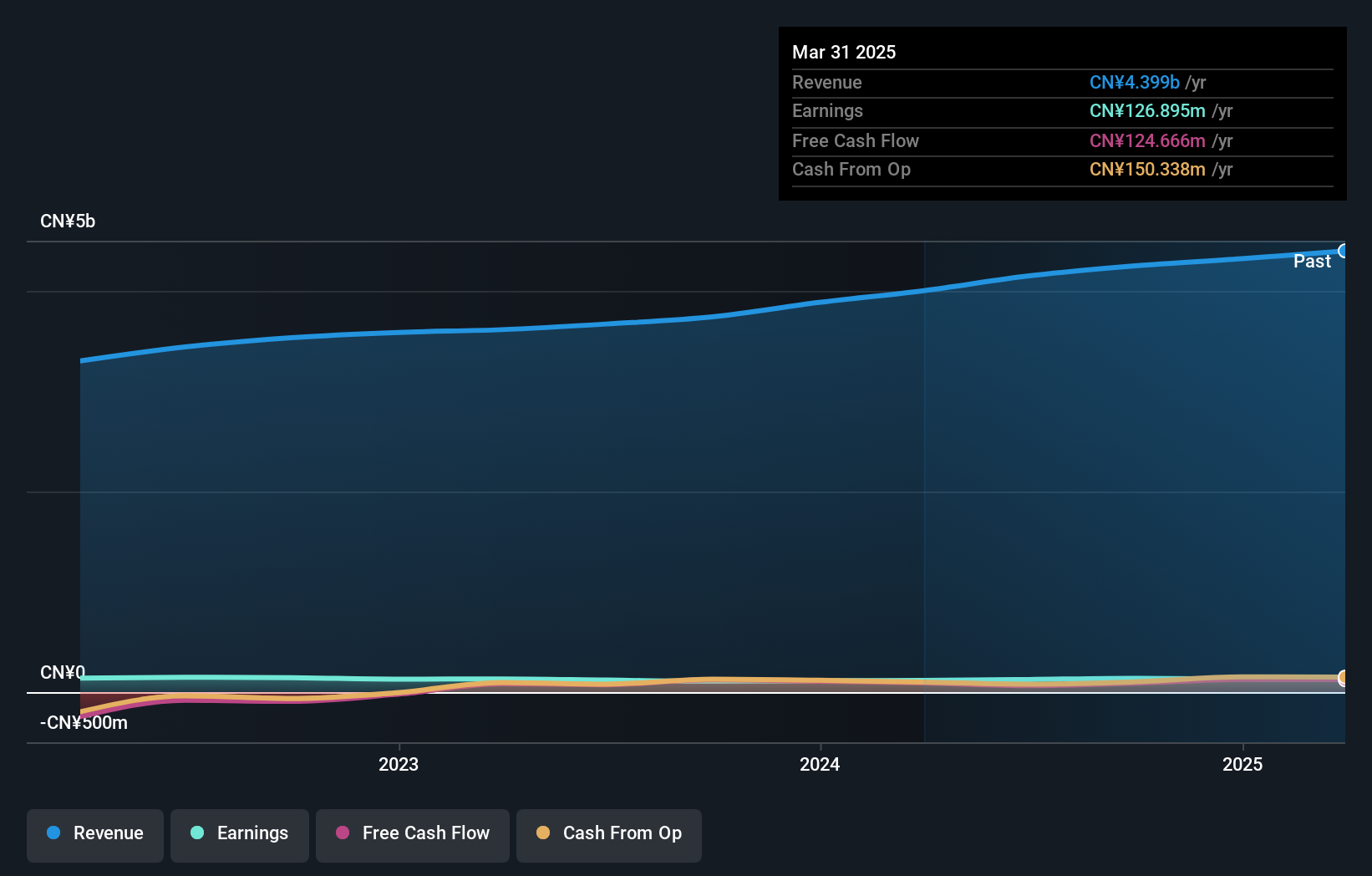

Overview: Shenzhen Farben Information Technology Co., Ltd. operates in the technology sector, focusing on providing information technology services, with a market cap of CN¥11.62 billion.

Operations: With a market cap of CN¥11.62 billion, Shenzhen Farben Information Technology Co., Ltd. generates its revenue primarily through its information technology services. The company's financial performance is marked by a focus on efficient cost management and strategic revenue channels, contributing to its overall profitability in the technology sector.

Shenzhen Farben, a dynamic player in the tech space, has seen its earnings grow by 28% over the past year, outpacing the industry average of -8%. Its price-to-earnings ratio of 86x is attractively below the IT sector's 105x average. Over five years, it reduced its debt-to-equity from 11% to 7%, indicating prudent financial management. Despite recent share price volatility, its high-quality earnings and positive free cash flow suggest robust fundamentals. With more cash than total debt and interest coverage not being a concern, Shenzhen Farben seems well-positioned for continued stability in a competitive market.

Summing It All Up

- Dive into all 4748 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688332

Shenzhen Bluetrum Technology

Engages in the research and development, design, and sale of wireless audio SOC chips in China.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives