- South Korea

- /

- Hospitality

- /

- KOSE:A032350

Asian Growth Stocks Backed By Insider Confidence

Reviewed by Simply Wall St

In the current global market landscape, Asian economies are navigating a complex environment marked by fluctuating investor sentiment and economic challenges. Despite these headwinds, growth companies in Asia with high insider ownership stand out as potentially resilient investments, as insider confidence often suggests strong belief in a company's long-term prospects.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 30% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 79.1% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 31.1% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 30.3% |

Let's take a closer look at a couple of our picks from the screened companies.

Lotte Tour Development (KOSE:A032350)

Simply Wall St Growth Rating: ★★★★☆☆

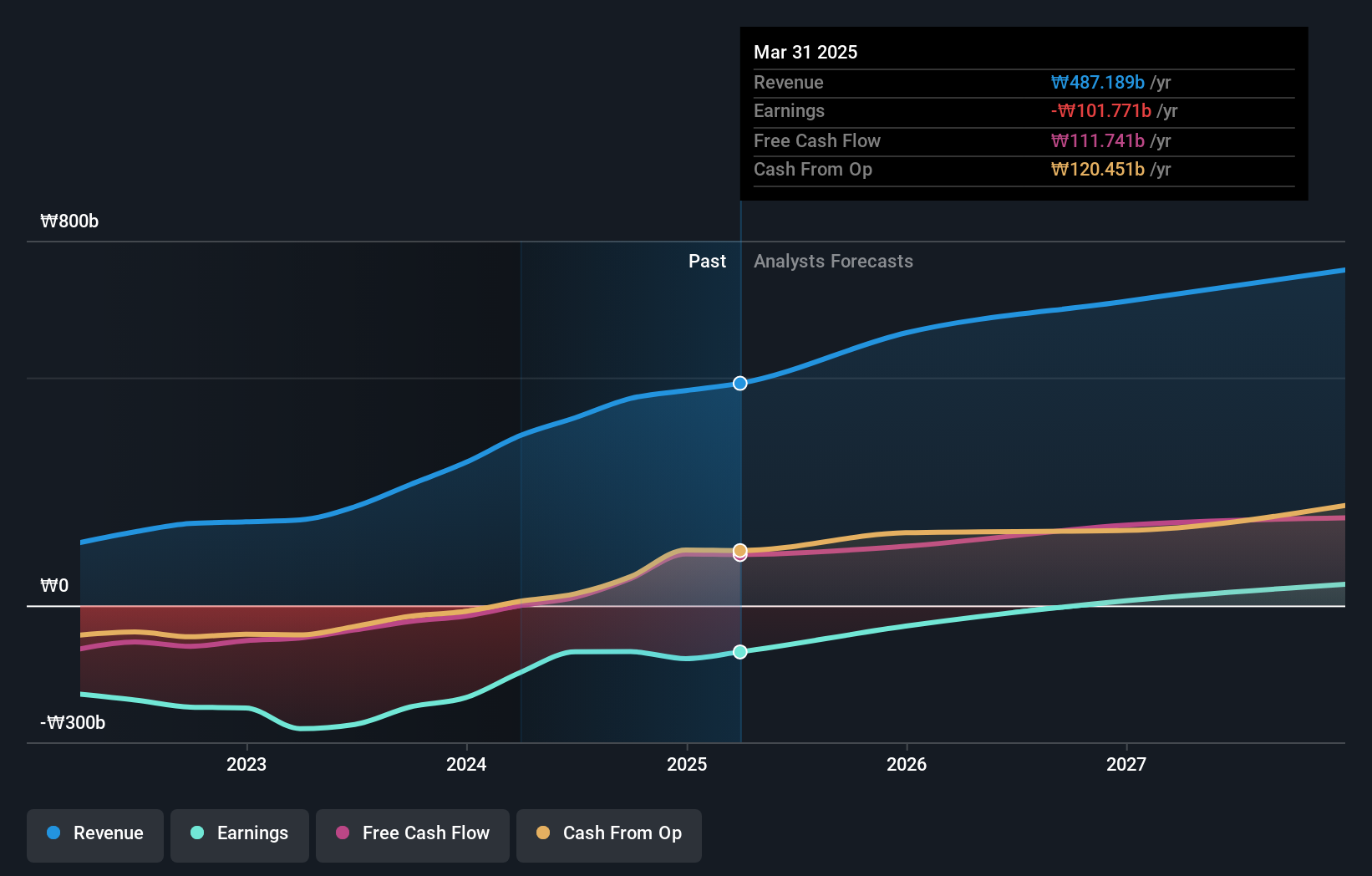

Overview: Lotte Tour Development Co., Ltd., along with its subsidiaries, provides travel and tourism services in South Korea and has a market capitalization of ₩1.78 trillion.

Operations: The company's revenue segments include the Dream Tower Integrated Resort Division at ₩490.71 billion, the Travel Related Service Sector (excluding Internet Journalism) at ₩82.51 billion, and the Internet Media Sector at ₩3.09 billion.

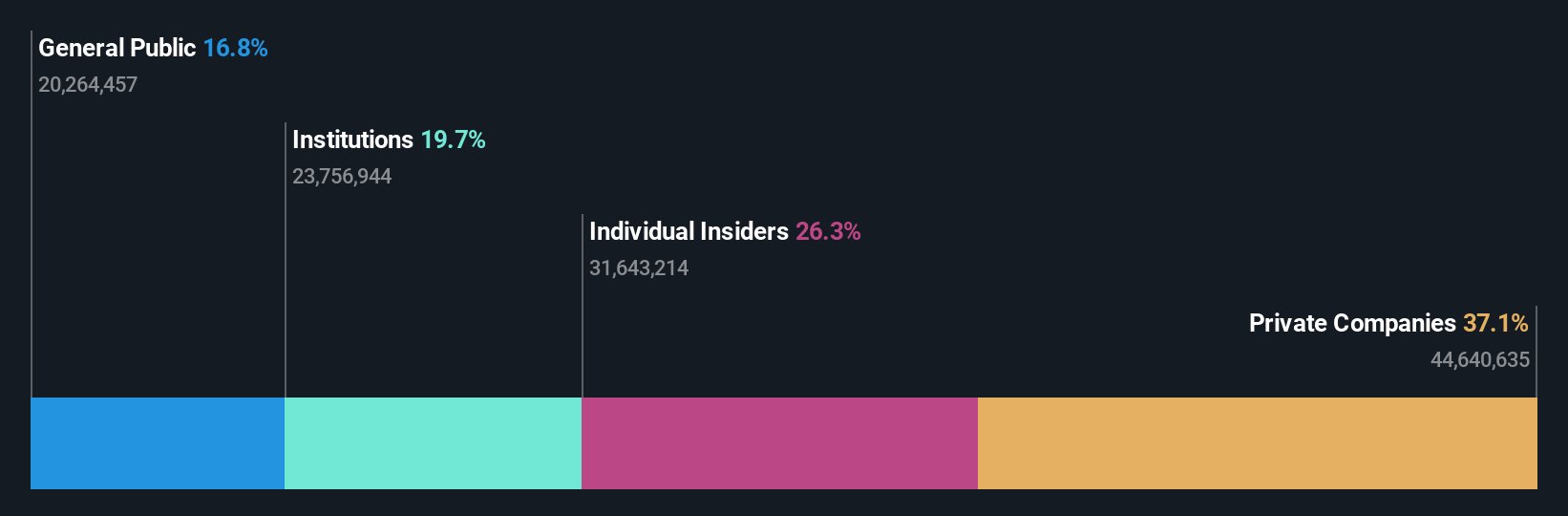

Insider Ownership: 28.4%

Revenue Growth Forecast: 13.8% p.a.

Lotte Tour Development has demonstrated strong revenue growth, with third-quarter sales rising to KRW 186.67 billion from KRW 139.15 billion a year ago. The company turned a net income of KRW 6.50 million compared to a significant loss last year, reflecting improving financial health. Despite recent share price volatility and low expected return on equity, its revenue is forecasted to grow faster than the market at 13.8% annually, with profitability anticipated within three years.

- Delve into the full analysis future growth report here for a deeper understanding of Lotte Tour Development.

- Insights from our recent valuation report point to the potential undervaluation of Lotte Tour Development shares in the market.

Shenzhen Bluetrum Technology (SHSE:688332)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Bluetrum Technology Co., Ltd. focuses on the research, development, design, and sale of wireless audio SOC chips in China with a market cap of approximately CN¥17.69 billion.

Operations: The company generates revenue primarily from the research, development, design, and sale of wireless audio SOC chips in China.

Insider Ownership: 26.2%

Revenue Growth Forecast: 24.8% p.a.

Shenzhen Bluetrum Technology's earnings are forecast to grow significantly at 27.05% annually, though slightly below the market average. Its revenue is expected to outpace the market with a 24.8% growth rate per year. Despite a volatile share price and an unstable dividend track record, its P/E ratio of 58.1x remains attractive compared to the industry average of 76.9x, reflecting potential value for investors seeking growth opportunities in Asia's semiconductor sector.

- Get an in-depth perspective on Shenzhen Bluetrum Technology's performance by reading our analyst estimates report here.

- The analysis detailed in our Shenzhen Bluetrum Technology valuation report hints at an inflated share price compared to its estimated value.

WinWay Technology (TWSE:6515)

Simply Wall St Growth Rating: ★★★★★★

Overview: WinWay Technology Co., Ltd. designs, processes, and sells optoelectronic product test fixtures and integrated circuit test interfaces globally, with a market cap of NT$84.25 billion.

Operations: The company generates revenue from the manufacture and sales of photoelectric product testing tools, amounting to NT$7.29 billion.

Insider Ownership: 21.9%

Revenue Growth Forecast: 21.8% p.a.

WinWay Technology is poised for robust growth, with revenue forecasted to increase by 21.8% annually, surpassing the Taiwan market's 13.3%. Earnings are expected to grow significantly at 24.5% per year, outpacing the market's 20.3%. Despite its highly volatile share price recently, the company's return on equity is projected to reach a high of 39.4% in three years. No substantial insider trading activity has been reported over the past three months.

- Take a closer look at WinWay Technology's potential here in our earnings growth report.

- Our expertly prepared valuation report WinWay Technology implies its share price may be too high.

Taking Advantage

- Discover the full array of 625 Fast Growing Asian Companies With High Insider Ownership right here.

- Seeking Other Investments? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A032350

Lotte Tour Development

Engages in the provision of travel and tourism services in South Korea.

Good value with reasonable growth potential.

Market Insights

Community Narratives