- China

- /

- Semiconductors

- /

- SHSE:688256

Asian Growth Stocks With High Insider Ownership In November 2025

Reviewed by Simply Wall St

As global markets navigate through a period of heightened scrutiny on AI spending and valuation concerns, the Asian market has shown resilience, with Chinese stocks edging higher amid easing trade tensions. In this environment, growth companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those closest to the business, potentially aligning well with investors seeking stability and commitment in uncertain times.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 14.9% | 54.8% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 56.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

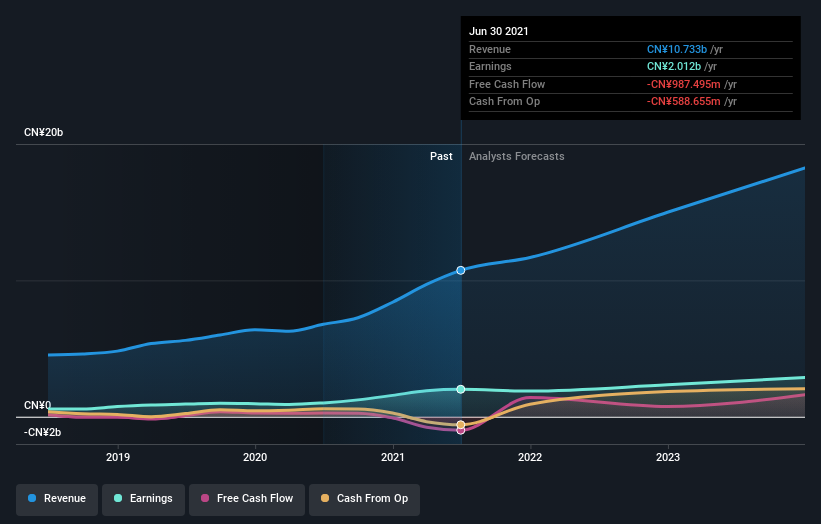

Hangzhou First Applied Material (SHSE:603806)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hangzhou First Applied Material Co., Ltd. designs, develops, manufactures, and sells solar battery encapsulation materials both in China and internationally, with a market cap of CN¥42.61 billion.

Operations: The company generates revenue from the design, development, manufacturing, and sale of solar battery encapsulation materials across domestic and international markets.

Insider Ownership: 13.5%

Revenue Growth Forecast: 20.2% p.a.

Hangzhou First Applied Material is positioned for significant growth, with earnings expected to increase 46.6% annually, outpacing the Chinese market. Despite a decline in recent financial performance, including net income dropping to CNY 687.6 million for nine months ending September 2025, its revenue is forecast to grow over 20% annually. The company trades at a favorable valuation compared to industry peers and maintains high insider ownership, although recent insider trading activity has been minimal.

- Get an in-depth perspective on Hangzhou First Applied Material's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Hangzhou First Applied Material implies its share price may be lower than expected.

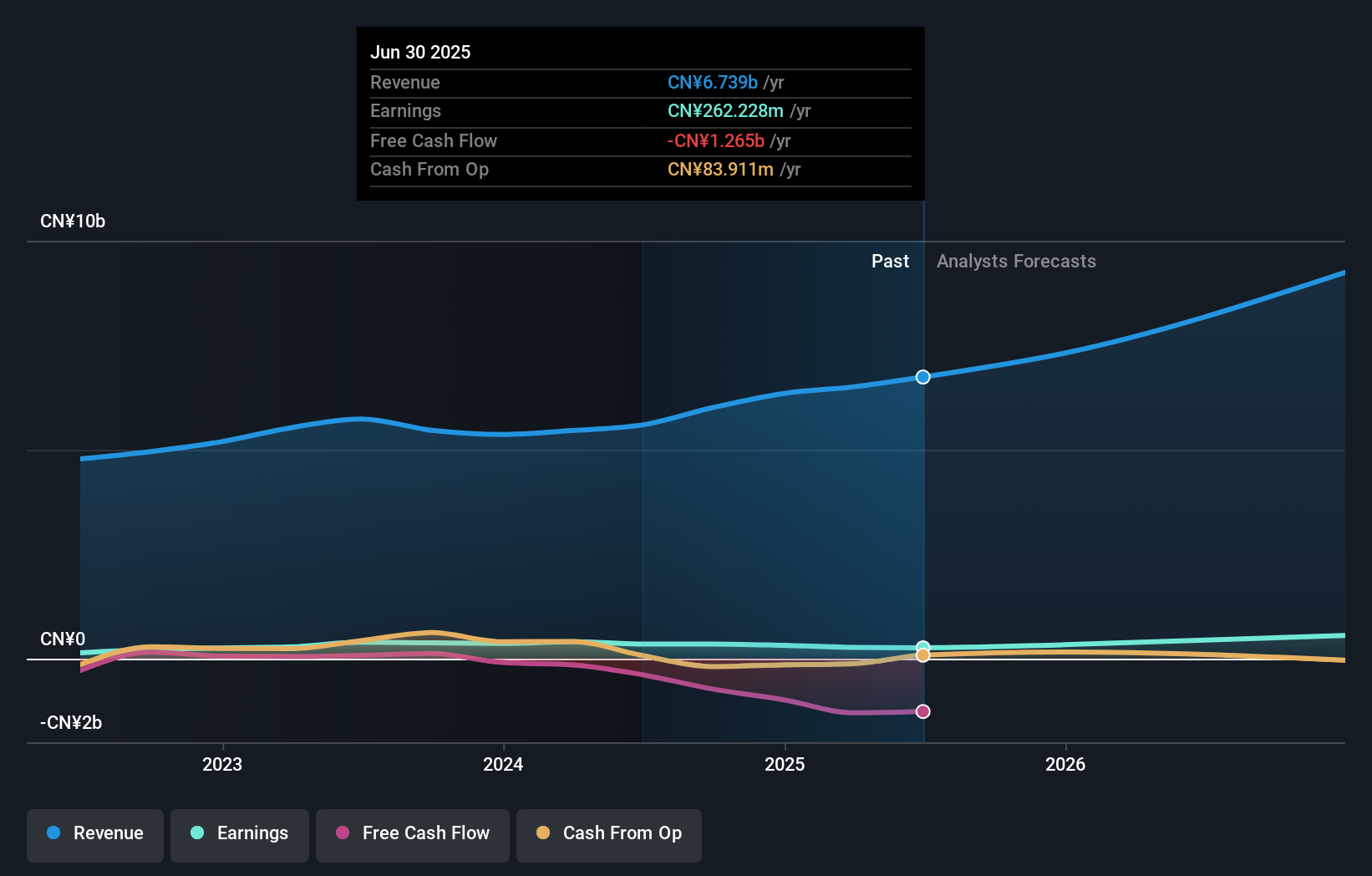

Hebei Huatong Wires and Cables Group (SHSE:605196)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hebei Huatong Wires and Cables Group Co., Ltd. operates in the manufacturing sector, focusing on the production of wires and cables, with a market capitalization of approximately CN¥17.63 billion.

Operations: Hebei Huatong Wires and Cables Group Co., Ltd. generates its revenue primarily from the manufacturing of wires and cables.

Insider Ownership: 37.3%

Revenue Growth Forecast: 23.6% p.a.

Hebei Huatong Wires and Cables Group is poised for substantial growth, with earnings forecast to rise 53% annually, surpassing the Chinese market's average. Despite a dip in net income to CNY 257.33 million for the nine months ending September 2025, revenue grew to CNY 5.34 billion from the previous year. The company's shares are highly volatile and its debt coverage by operating cash flow is inadequate. It was recently added to the S&P Global BMI Index.

- Delve into the full analysis future growth report here for a deeper understanding of Hebei Huatong Wires and Cables Group.

- Our expertly prepared valuation report Hebei Huatong Wires and Cables Group implies its share price may be too high.

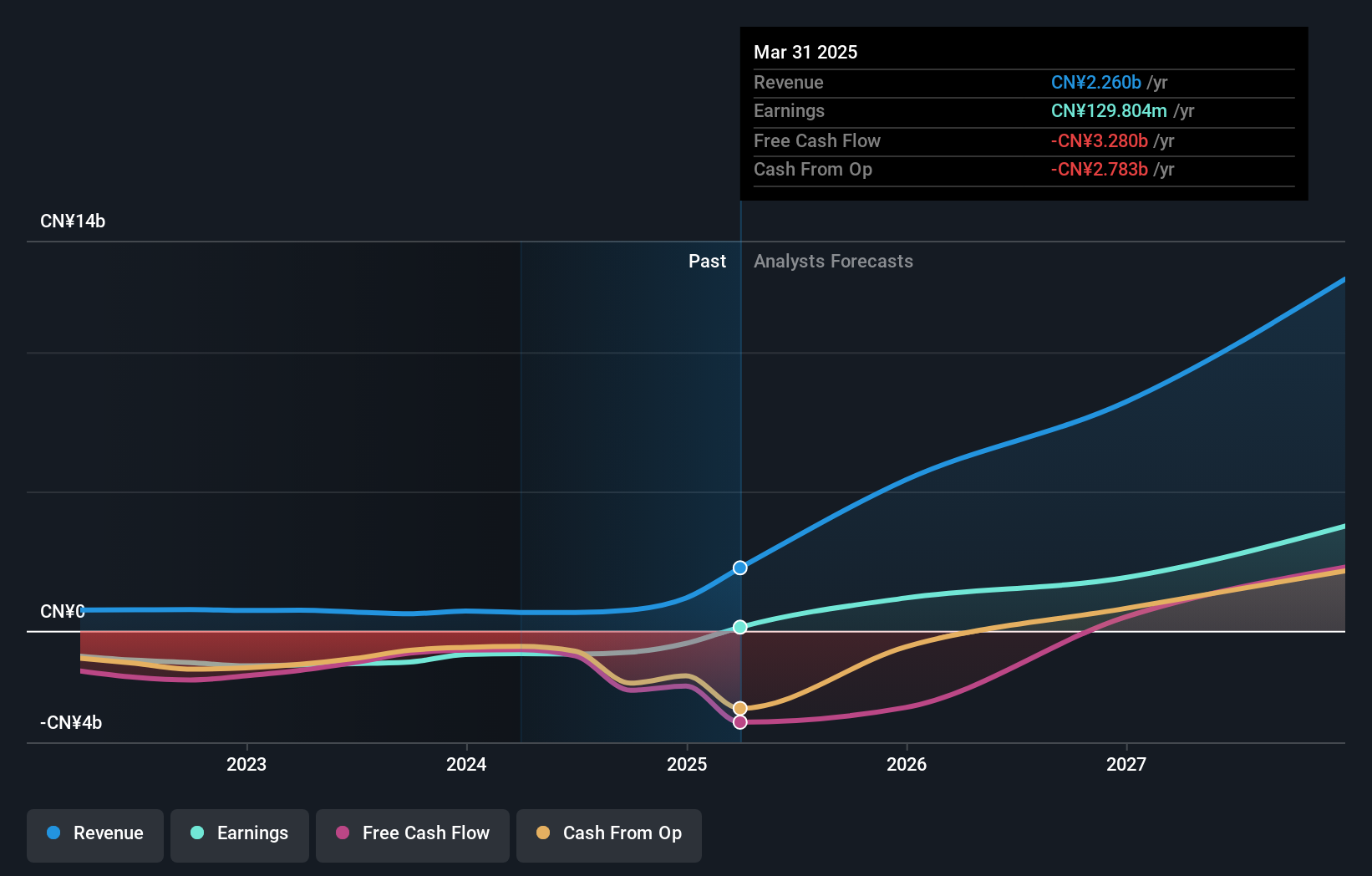

Cambricon Technologies (SHSE:688256)

Simply Wall St Growth Rating: ★★★★★★

Overview: Cambricon Technologies Corporation Limited focuses on researching, developing, designing, and selling core chips for cloud servers, edge computing, and terminal equipment in China, with a market cap of approximately CN¥604.06 billion.

Operations: Cambricon Technologies generates revenue from its core chip offerings for cloud servers, edge computing, and terminal equipment in China.

Insider Ownership: 28.3%

Revenue Growth Forecast: 58.8% p.a.

Cambricon Technologies demonstrates strong growth potential, with earnings expected to grow 62% annually, outpacing the Chinese market. The company recently turned profitable, reporting a net income of CNY 1.60 billion for the nine months ending September 2025, compared to a loss previously. Revenue surged to CNY 4.61 billion from CNY 185.31 million last year. Despite high earnings quality and robust revenue forecasts, its share price remains highly volatile without recent insider trading activity noted.

- Unlock comprehensive insights into our analysis of Cambricon Technologies stock in this growth report.

- Our valuation report here indicates Cambricon Technologies may be overvalued.

Next Steps

- Discover the full array of 624 Fast Growing Asian Companies With High Insider Ownership right here.

- Searching for a Fresh Perspective? AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688256

Cambricon Technologies

Research, develops, design, and sells core chips in cloud server, edge computing, and terminal equipment in China.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives