- China

- /

- Electrical

- /

- SZSE:002028

3 Asian Growth Companies With High Insider Ownership And Up To 23% Revenue Growth

Reviewed by Simply Wall St

As Asian markets continue to navigate through a landscape marked by political shifts and economic recalibrations, regions like Japan and China have seen notable stock market gains, driven by policy changes and sector-specific strengths. In such an environment, growth companies with high insider ownership can be particularly appealing as they often signal confidence in the company's potential for expansion.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 14.6% | 53.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Sineng ElectricLtd (SZSE:300827) | 36.1% | 26.6% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 34.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

Here's a peek at a few of the choices from the screener.

Smartsens Technology (Shanghai) (SHSE:688213)

Simply Wall St Growth Rating: ★★★★★★

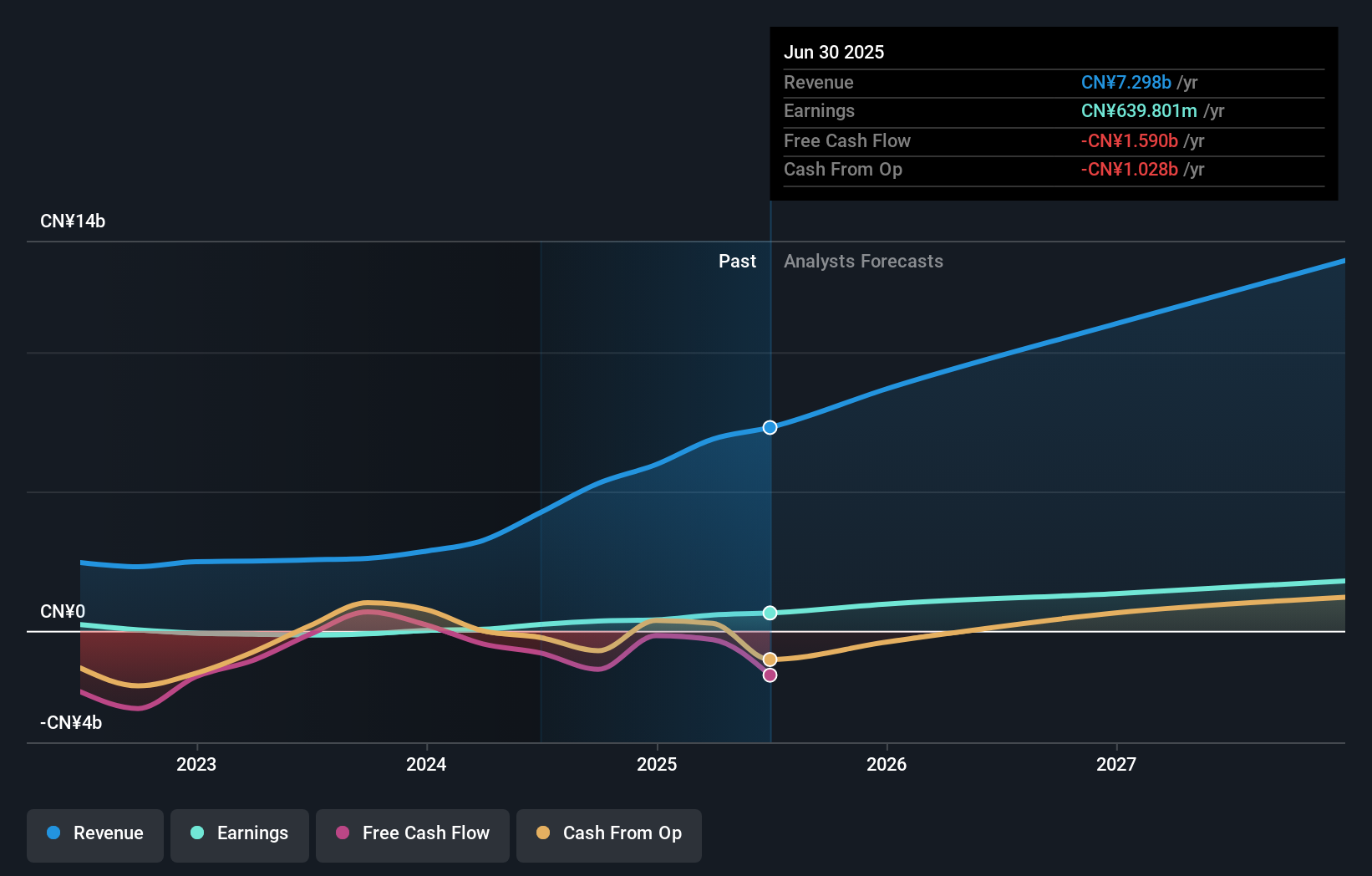

Overview: Smartsens Technology (Shanghai) Co., Ltd. focuses on the design and development of CMOS image sensors, with a market cap of CN¥43.92 billion.

Operations: The company's revenue primarily comes from its Semiconductor Integrated Circuit Chips segment, which generated CN¥7.30 billion.

Insider Ownership: 23.4%

Revenue Growth Forecast: 23.6% p.a.

Smartsens Technology (Shanghai) demonstrates strong growth potential with revenue and earnings projected to grow significantly above the Chinese market averages. Recently added to major indices, the company reported substantial revenue and net income increases for H1 2025. Despite a high P/E ratio of 68.7x, it remains below the industry average, suggesting relative value. However, its debt coverage by operating cash flow is weak. No recent insider trading activity has been observed over the past three months.

- Delve into the full analysis future growth report here for a deeper understanding of Smartsens Technology (Shanghai).

- The valuation report we've compiled suggests that Smartsens Technology (Shanghai)'s current price could be quite moderate.

Sieyuan Electric (SZSE:002028)

Simply Wall St Growth Rating: ★★★★★☆

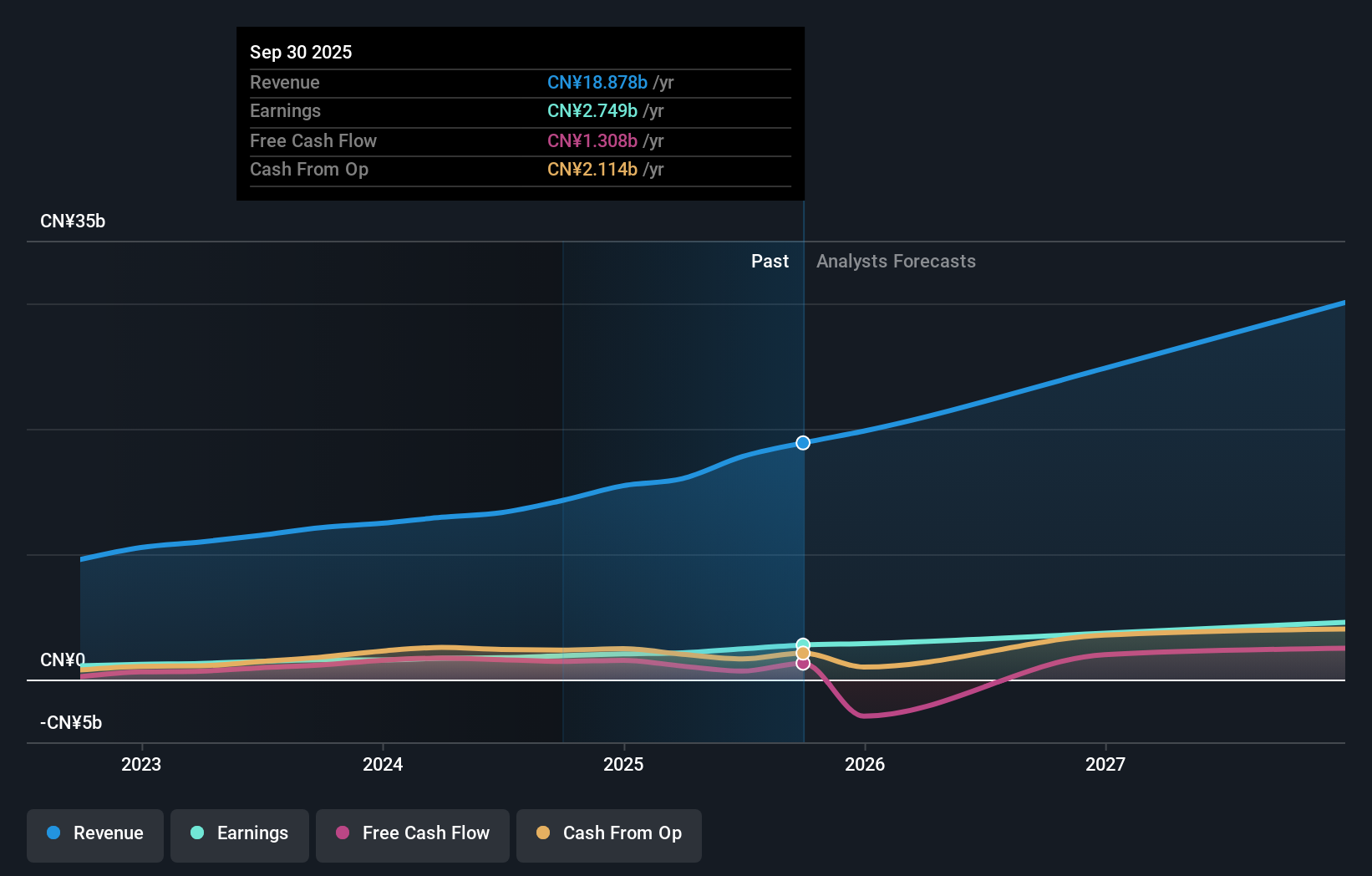

Overview: Sieyuan Electric Co., Ltd. focuses on the research, development, production, sale, and service of power transmission and distribution equipment both in China and internationally, with a market cap of CN¥95.71 billion.

Operations: The company's revenue primarily comes from its Distribution and Controls Equipment/Furniture segment, generating CN¥18.88 billion.

Insider Ownership: 35.1%

Revenue Growth Forecast: 20.8% p.a.

Sieyuan Electric showcases promising growth prospects with revenue expected to grow significantly faster than the Chinese market, driven by a recent 44.5% earnings increase. Despite being dropped from the S&P Global BMI Index, its P/E ratio of 34.8x suggests good value compared to market averages. Insider ownership remains stable with no recent trading activity reported. The company's high return on equity forecast and strategic focus underscore its potential in the Asian growth landscape.

- Unlock comprehensive insights into our analysis of Sieyuan Electric stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Sieyuan Electric shares in the market.

Hangzhou Changchuan TechnologyLtd (SZSE:300604)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hangzhou Changchuan Technology Co., Ltd engages in the research, development, production, and sale of integrated circuit equipment and high-frequency communication materials, with a market cap of CN¥55.73 billion.

Operations: The company generates revenue through its activities in integrated circuit equipment and high-frequency communication materials.

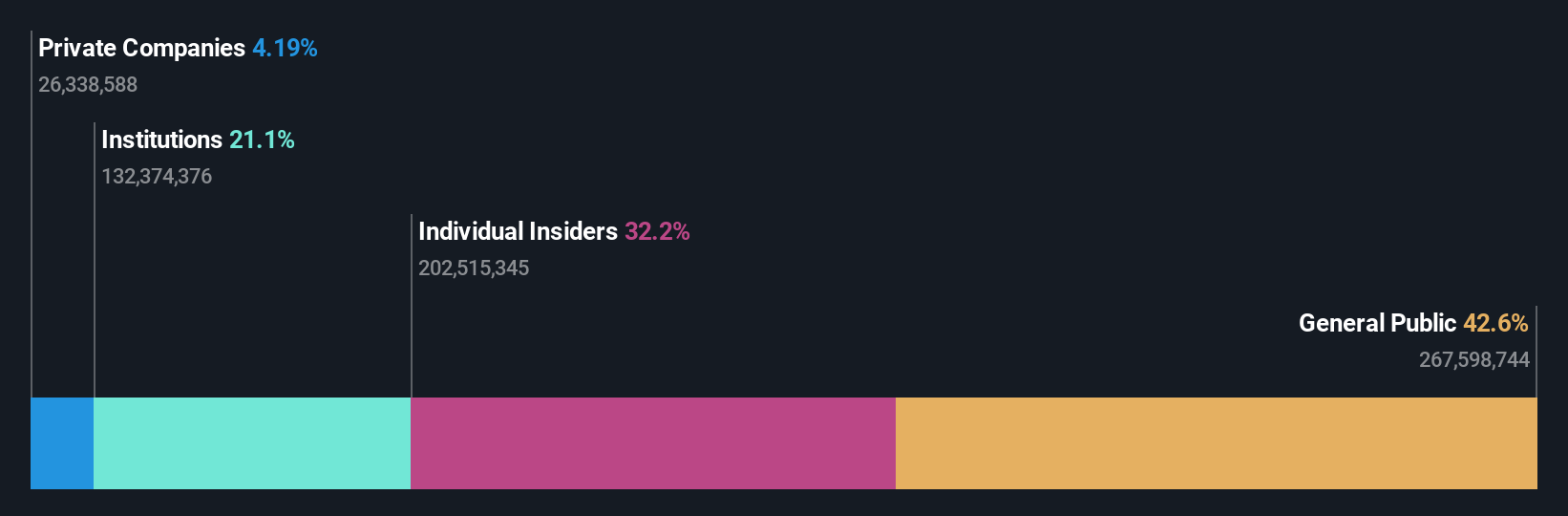

Insider Ownership: 32.2%

Revenue Growth Forecast: 17.1% p.a.

Hangzhou Changchuan Technology's earnings are projected to grow significantly, outpacing the Chinese market with 27.5% annual growth. Revenue is also expected to rise faster than the market average at 17.1% per year, though below the high-growth threshold of 20%. The company's share price has been highly volatile recently, but insider ownership remains stable with no substantial trading activity in three months. A recent meeting focused on board and committee changes reflects ongoing strategic adjustments.

- Click here to discover the nuances of Hangzhou Changchuan TechnologyLtd with our detailed analytical future growth report.

- Our valuation report here indicates Hangzhou Changchuan TechnologyLtd may be overvalued.

Seize The Opportunity

- Discover the full array of 620 Fast Growing Asian Companies With High Insider Ownership right here.

- Interested In Other Possibilities? The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002028

Sieyuan Electric

Engages in research and development, production, sale, and service of power transmission and distribution equipment in China and internationally.

High growth potential with solid track record.

Market Insights

Community Narratives