- China

- /

- Semiconductors

- /

- SHSE:688173

Halo Microelectronics Co., Ltd.'s (SHSE:688173) 47% Price Boost Is Out Of Tune With Revenues

Those holding Halo Microelectronics Co., Ltd. (SHSE:688173) shares would be relieved that the share price has rebounded 47% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 35% in the last twelve months.

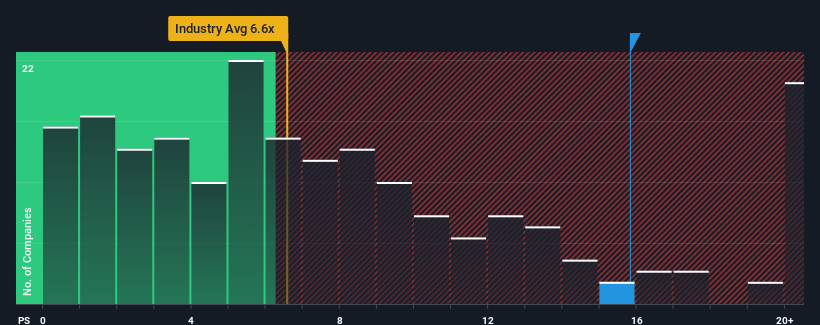

Since its price has surged higher, Halo Microelectronics may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 15.8x, when you consider almost half of the companies in the Semiconductor industry in China have P/S ratios under 6.6x and even P/S lower than 3x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Halo Microelectronics

What Does Halo Microelectronics' Recent Performance Look Like?

Halo Microelectronics could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Halo Microelectronics.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Halo Microelectronics would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 29% decrease to the company's top line. Even so, admirably revenue has lifted 74% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 137% during the coming year according to the sole analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 20,706%, which is noticeably more attractive.

With this information, we find it concerning that Halo Microelectronics is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Halo Microelectronics' P/S?

The strong share price surge has lead to Halo Microelectronics' P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've concluded that Halo Microelectronics currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Halo Microelectronics that you need to be mindful of.

If you're unsure about the strength of Halo Microelectronics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Halo Microelectronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688173

Halo Microelectronics

Engages in the design, development, and sale of analog and power management integrated circuit products worldwide.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives