- China

- /

- Semiconductors

- /

- SHSE:688123

Exploring Three Undiscovered Gems in Asia with Strong Potential

Reviewed by Simply Wall St

Amid escalating geopolitical tensions and fluctuating economic indicators, global markets have experienced a turbulent period, with smaller-cap indices like the S&P MidCap 400 and Russell 2000 facing notable declines. Despite these challenges, sentiment among small business owners has shown signs of improvement, offering a glimmer of optimism for investors seeking opportunities in under-the-radar stocks. In such an environment, identifying promising stocks often involves looking for companies with strong fundamentals that can weather market volatility while capitalizing on unique growth opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| MSC | 30.39% | 6.56% | 14.62% | ★★★★★★ |

| New Asia Construction & Development | 50.47% | 7.81% | 34.50% | ★★★★★★ |

| Shenzhen Coship Electronics | NA | 8.20% | 44.45% | ★★★★★★ |

| Kung Sing Engineering | 13.45% | 2.65% | -51.67% | ★★★★★★ |

| JHT DesignLtd | 2.19% | 33.65% | -8.51% | ★★★★★★ |

| Tibet Development | 48.40% | -0.31% | 52.09% | ★★★★★★ |

| Guangdong Goworld | 27.20% | 1.38% | -9.57% | ★★★★★☆ |

| Tait Marketing & Distribution | 0.71% | 8.00% | 12.85% | ★★★★★☆ |

| Dong Fang Offshore | 29.10% | 42.34% | 42.27% | ★★★★★☆ |

| ASRock Rack Incorporation | 26.93% | 225.32% | 6287.64% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

UTS Marketing Solutions Holdings (SEHK:6113)

Simply Wall St Value Rating: ★★★★★★

Overview: UTS Marketing Solutions Holdings Limited is an investment holding company that provides outbound telemarketing services and contact center facilities for promoting financial products in Malaysia, with a market cap of HK$2.87 billion.

Operations: The company's revenue primarily stems from the provision of telemarketing services, amounting to MYR 93.06 million.

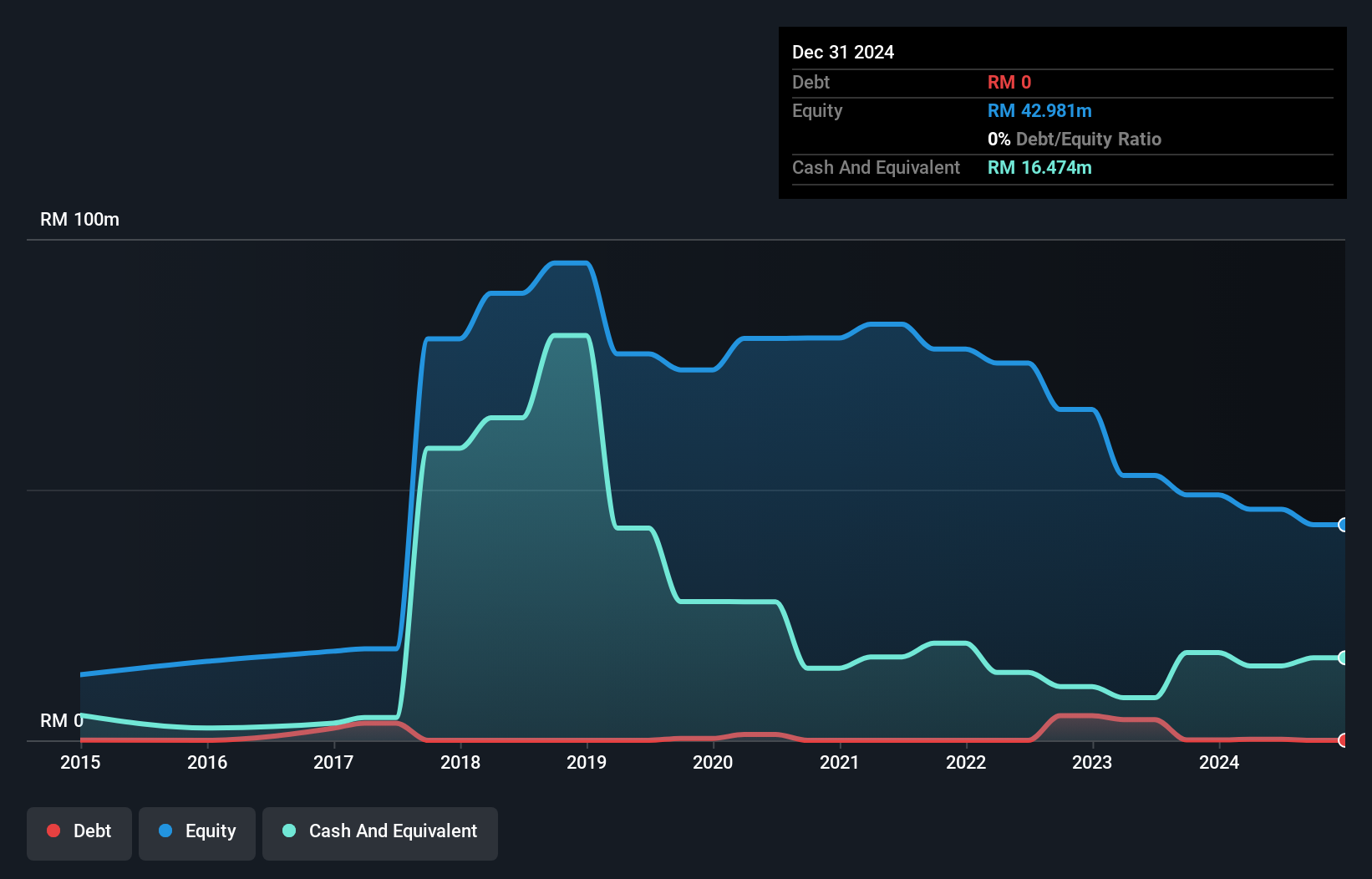

UTS Marketing Solutions Holdings, a small player in the Asian market, has caught attention with recent strategic shifts. Despite earnings declining by 8.5% annually over five years, its net income rose to MYR 13.29 million last year from MYR 10.31 million previously, with basic earnings per share improving to MYR 0.0332 from MYR 0.0258. The company is debt-free now compared to a debt-to-equity ratio of 0.5% five years ago, reflecting financial prudence amidst volatility and significant insider selling recently observed in its stock movements. Microhash International's acquisition of an additional stake suggests confidence in UTS's potential transformation into BitStrat Holdings Limited.

Giantec Semiconductor (SHSE:688123)

Simply Wall St Value Rating: ★★★★★★

Overview: Giantec Semiconductor Corporation is engaged in the manufacturing and sale of integrated circuits both domestically in China and internationally, with a market capitalization of approximately CN¥12.65 billion.

Operations: Giantec Semiconductor's revenue primarily stems from its integrated circuit design industry, generating approximately CN¥1.04 billion.

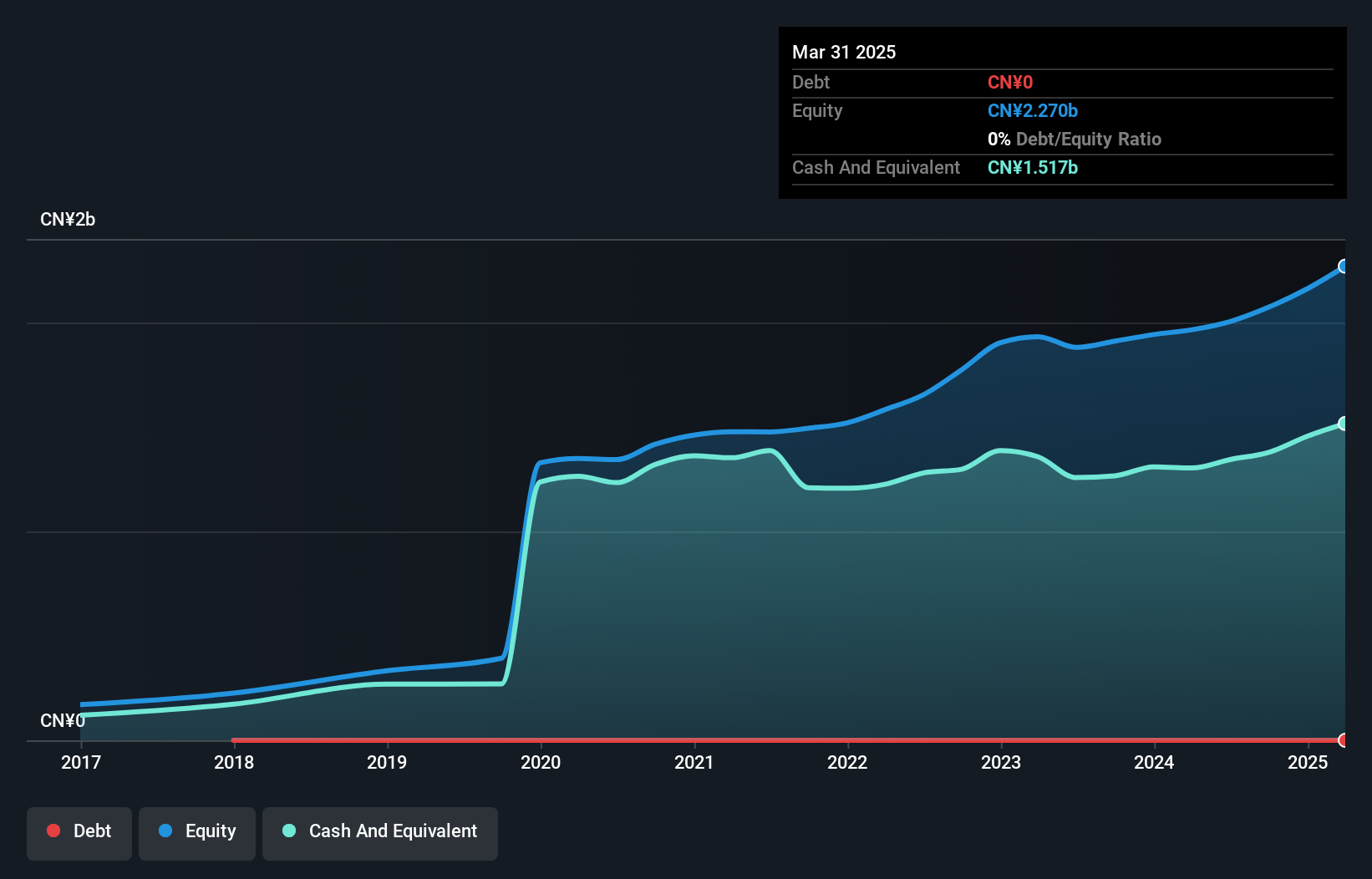

Giantec Semiconductor, a nimble player in the semiconductor space, showcases impressive growth with earnings surging 160.5% last year, outpacing the industry average of 8%. The company is debt-free for five years, eliminating concerns over interest payments. Trading at a price-to-earnings ratio of 37.4x compared to the CN market's 38.3x suggests good value among peers. Recent transactions saw a consortium acquire a 2.40% stake for CNY 240 million at CNY 63 per share, reflecting investor confidence despite recent share price volatility over three months. Net income jumped to CNY 99 million from CNY 51 million year-on-year for Q1-2025.

Shin-Etsu PolymerLtd (TSE:7970)

Simply Wall St Value Rating: ★★★★★★

Overview: Shin-Etsu Polymer Co., Ltd. is a global manufacturer and seller of polyvinyl chloride (PVC) products, with a market capitalization of ¥146.41 billion.

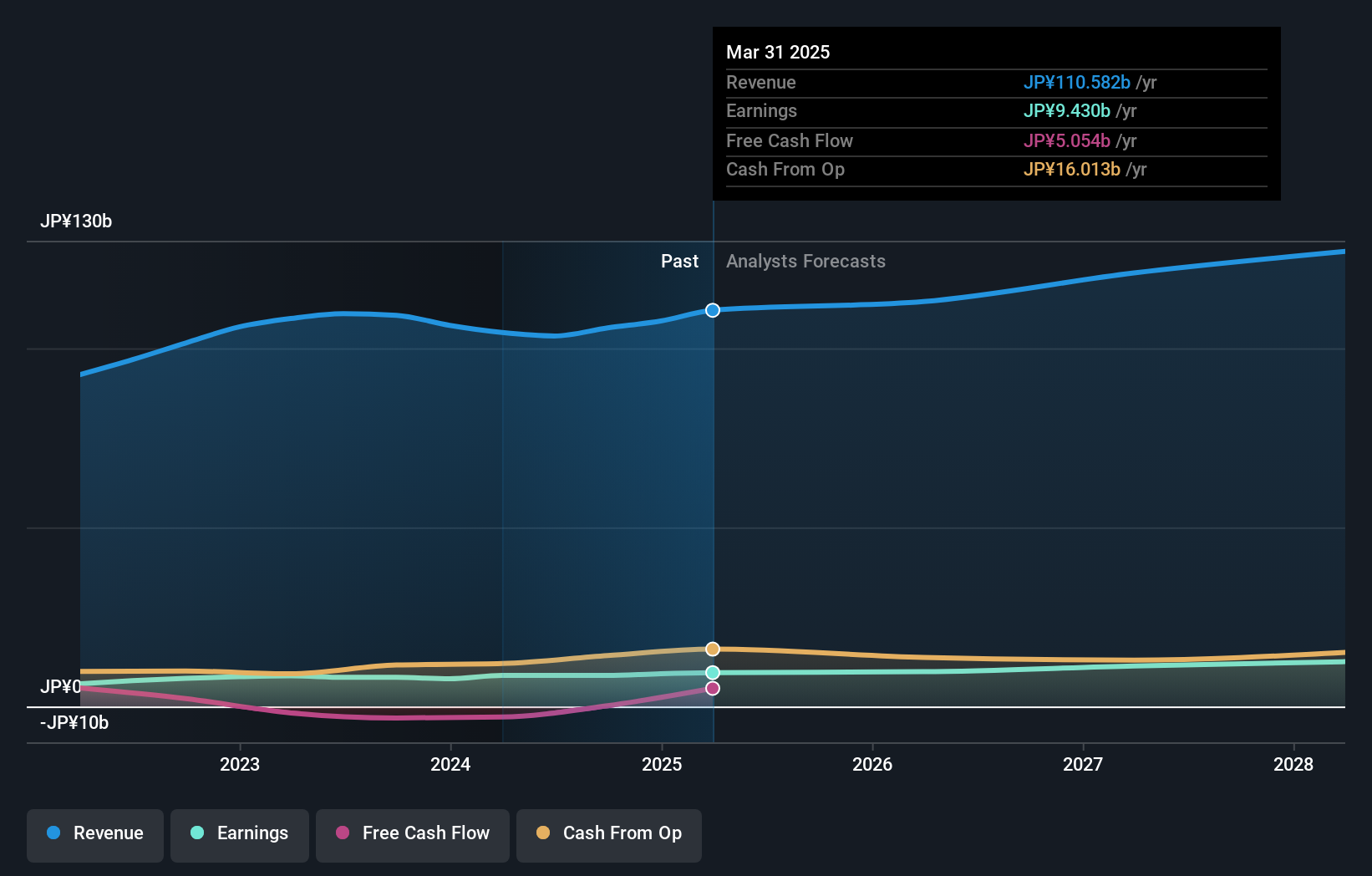

Operations: The company generates revenue primarily through its Precision Molding Products segment, which accounts for ¥56.02 billion, and the Electronic Device segment contributing ¥24.85 billion. The Living Environment/Living Materials segment adds another ¥22.08 billion to the revenue stream.

Shin-Etsu Polymer, a nimble player in the chemicals arena, has shown resilience with earnings growing at 11.9% annually over five years. It operates debt-free, enhancing its financial stability and allowing it to focus on growth opportunities. Despite an 8.7% earnings growth last year not matching the industry’s 13.2%, Shin-Etsu remains a value pick trading at 82.9% below estimated fair value. The company recently upped its annual dividend to JPY 27 per share from JPY 24, reflecting confidence in cash flow strength and future prospects amidst ongoing strategic adjustments in leadership roles discussed at recent board meetings.

- Delve into the full analysis health report here for a deeper understanding of Shin-Etsu PolymerLtd.

Gain insights into Shin-Etsu PolymerLtd's past trends and performance with our Past report.

Make It Happen

- Delve into our full catalog of 2621 Asian Undiscovered Gems With Strong Fundamentals here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688123

Giantec Semiconductor

Manufactures and sells integrated circuits in China and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives