- China

- /

- Semiconductors

- /

- SHSE:688082

There Are Reasons To Feel Uneasy About ACM Research (Shanghai)'s (SHSE:688082) Returns On Capital

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. In light of that, when we looked at ACM Research (Shanghai) (SHSE:688082) and its ROCE trend, we weren't exactly thrilled.

Understanding Return On Capital Employed (ROCE)

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on ACM Research (Shanghai) is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.11 = CN¥767m ÷ (CN¥10b - CN¥3.1b) (Based on the trailing twelve months to March 2024).

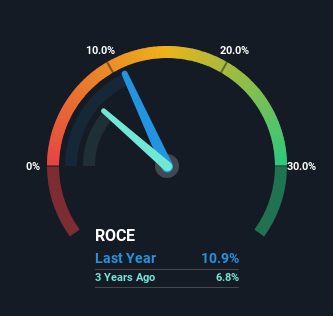

Therefore, ACM Research (Shanghai) has an ROCE of 11%. On its own, that's a standard return, however it's much better than the 3.9% generated by the Semiconductor industry.

View our latest analysis for ACM Research (Shanghai)

In the above chart we have measured ACM Research (Shanghai)'s prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free analyst report for ACM Research (Shanghai) .

So How Is ACM Research (Shanghai)'s ROCE Trending?

Unfortunately, the trend isn't great with ROCE falling from 24% five years ago, while capital employed has grown 1,755%. Usually this isn't ideal, but given ACM Research (Shanghai) conducted a capital raising before their most recent earnings announcement, that would've likely contributed, at least partially, to the increased capital employed figure. It's unlikely that all of the funds raised have been put to work yet, so as a consequence ACM Research (Shanghai) might not have received a full period of earnings contribution from it. Additionally, we found that ACM Research (Shanghai)'s most recent EBIT figure is around the same as the prior year, so we'd attribute the drop in ROCE mostly to the capital raise.

On a related note, ACM Research (Shanghai) has decreased its current liabilities to 30% of total assets. That could partly explain why the ROCE has dropped. Effectively this means their suppliers or short-term creditors are funding less of the business, which reduces some elements of risk. Some would claim this reduces the business' efficiency at generating ROCE since it is now funding more of the operations with its own money.

Our Take On ACM Research (Shanghai)'s ROCE

Even though returns on capital have fallen in the short term, we find it promising that revenue and capital employed have both increased for ACM Research (Shanghai). These growth trends haven't led to growth returns though, since the stock has fallen 14% over the last year. So we think it'd be worthwhile to look further into this stock given the trends look encouraging.

ACM Research (Shanghai) does come with some risks though, we found 2 warning signs in our investment analysis, and 1 of those is potentially serious...

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688082

ACM Research (Shanghai)

Engages in the research, development, production, and sale of semiconductor equipment in China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion