- China

- /

- Semiconductors

- /

- SHSE:688048

After Leaping 42% Suzhou Everbright Photonics Co., Ltd. (SHSE:688048) Shares Are Not Flying Under The Radar

Suzhou Everbright Photonics Co., Ltd. (SHSE:688048) shareholders are no doubt pleased to see that the share price has bounced 42% in the last month, although it is still struggling to make up recently lost ground. But the last month did very little to improve the 53% share price decline over the last year.

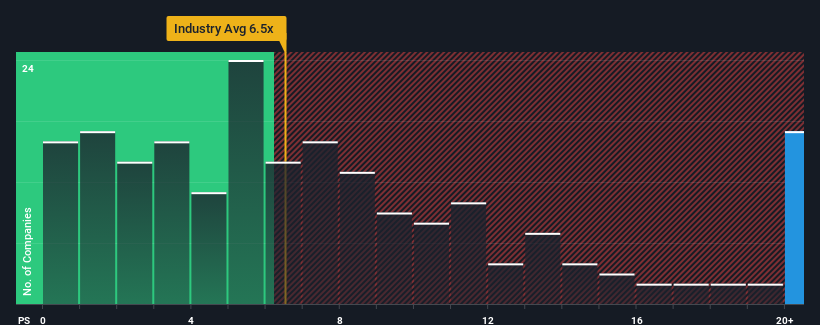

Following the firm bounce in price, Suzhou Everbright Photonics may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 27x, since almost half of all companies in the Semiconductor industry in China have P/S ratios under 6.5x and even P/S lower than 3x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Suzhou Everbright Photonics

What Does Suzhou Everbright Photonics' Recent Performance Look Like?

Suzhou Everbright Photonics could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Suzhou Everbright Photonics' future stacks up against the industry? In that case, our free report is a great place to start.How Is Suzhou Everbright Photonics' Revenue Growth Trending?

Suzhou Everbright Photonics' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 24%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 18% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 66% over the next year. With the industry only predicted to deliver 37%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Suzhou Everbright Photonics' P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Suzhou Everbright Photonics' P/S?

Shares in Suzhou Everbright Photonics have seen a strong upwards swing lately, which has really helped boost its P/S figure. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into Suzhou Everbright Photonics shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Suzhou Everbright Photonics, and understanding should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688048

Suzhou Everbright Photonics

Researches and develops, designs, produces, and sells semiconductor laser chips in China and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives