Hangzhou Lion ElectronicsLtd And Two More High Insider Ownership Growth Companies On The Chinese Exchange

Reviewed by Simply Wall St

As global markets navigate through varying economic signals, Chinese stocks have recently experienced a downturn amid concerns about the country's slowing economy. In such an environment, focusing on growth companies with high insider ownership like Hangzhou Lion Electronics Ltd can offer investors potential resilience and alignment of interests between shareholders and management.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 24% | 22.3% |

| KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

| Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 25.8% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 63.4% |

| Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

| Ningbo Deye Technology Group (SHSE:605117) | 23.4% | 28.5% |

| Fujian Wanchen Biotechnology Group (SZSE:300972) | 14.9% | 75.9% |

| UTour Group (SZSE:002707) | 23% | 33.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

Hangzhou Lion ElectronicsLtd (SHSE:605358)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hangzhou Lion Electronics Co., Ltd specializes in the research, development, production, and sale of semiconductor silicon wafers, power devices, and compound semiconductor radio frequency chips in China, with a market capitalization of approximately CN¥15.60 billion.

Operations: The company's revenue is primarily derived from the sale of semiconductor silicon wafers, power devices, and compound semiconductor radio frequency chips.

Insider Ownership: 18.9%

Hangzhou Lion Electronics Ltd., a growth-focused company in China, is expected to experience significant revenue expansion at 24.8% annually, outpacing the broader Chinese market's 13.7% growth rate. Despite recent challenges, including being removed from the SSE 180 Index and posting a net loss in Q1 2024 (CNY 63.15 million), the company is on track to become profitable within three years. Additionally, substantial share buybacks indicate strong insider confidence, with CNY 119.99 million spent to repurchase shares. However, its projected Return on Equity of only 5.7% suggests potential concerns about future profitability efficiency.

- Click here and access our complete growth analysis report to understand the dynamics of Hangzhou Lion ElectronicsLtd.

- According our valuation report, there's an indication that Hangzhou Lion ElectronicsLtd's share price might be on the expensive side.

Teyi Pharmaceutical GroupLtd (SZSE:002728)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Teyi Pharmaceutical Group Co., Ltd specializes in the research, development, production, and sale of proprietary Chinese medicines and chemical products within the People's Republic of China, with a market capitalization of approximately CN¥4.22 billion.

Operations: The company generates revenue primarily through the sale of proprietary Chinese medicines and chemical products.

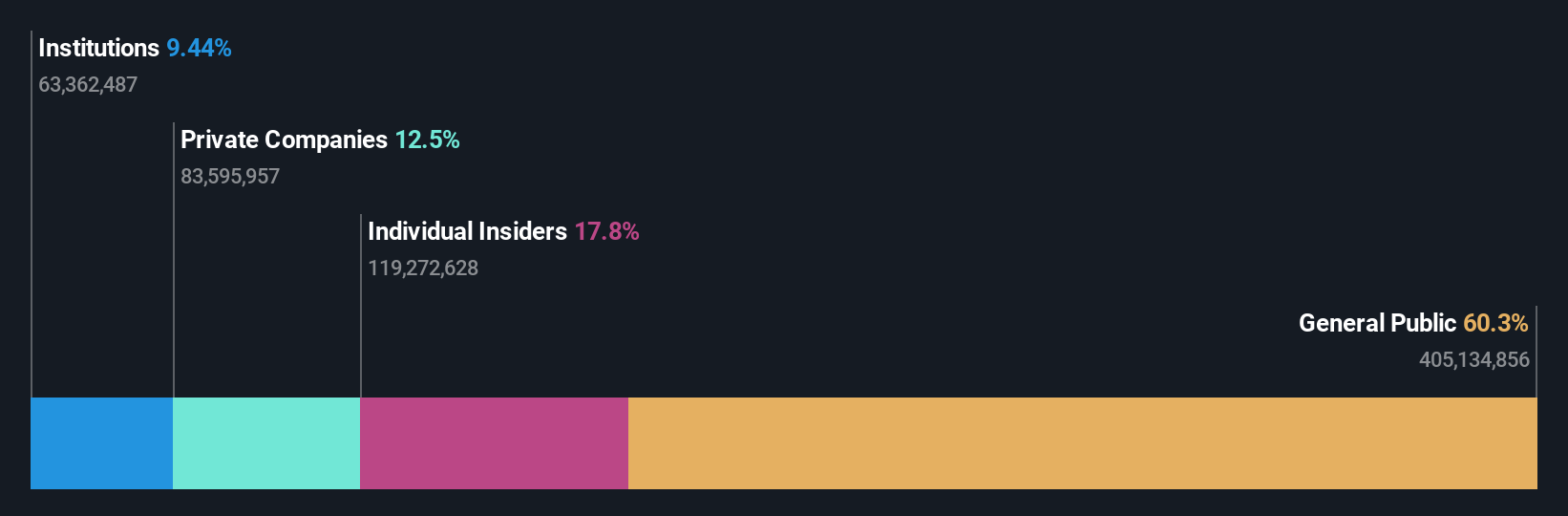

Insider Ownership: 39.2%

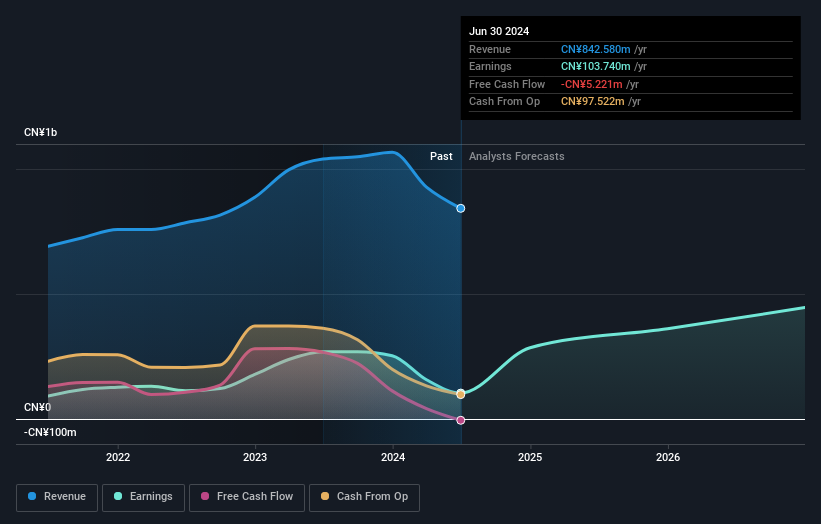

Teyi Pharmaceutical GroupLtd, amidst a challenging financial quarter with significant revenue and net income declines, has launched an aggressive share buyback program, repurchasing shares worth CNY 4.15 million. This move underlines insider confidence and aligns with plans for employee stock ownership, suggesting a strategic push to stabilize the stock value. Despite recent performance dips, Teyi's earnings are projected to grow robustly at 32.2% annually over the next three years, outperforming the broader Chinese market forecast of 22.2%. However, its Return on Equity is expected to remain modest at 16.5%.

- Delve into the full analysis future growth report here for a deeper understanding of Teyi Pharmaceutical GroupLtd.

- Our expertly prepared valuation report Teyi Pharmaceutical GroupLtd implies its share price may be lower than expected.

Winall Hi-tech Seed (SZSE:300087)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Winall Hi-tech Seed Co., Ltd. specializes in the breeding of various crop seeds in China, with a market capitalization of approximately CN¥6.15 billion.

Operations: The company generates its revenue primarily through the cultivation and sale of diverse agricultural seeds.

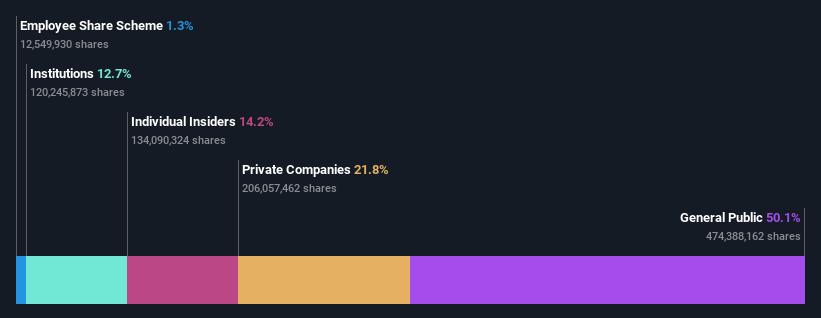

Insider Ownership: 14.2%

Winall Hi-tech Seed Co., Ltd. is poised for substantial growth with forecasted revenue increases at 22.6% annually, outpacing the broader Chinese market's 13.7%. Despite a recent dip in net income and earnings per share as reported in Q1 2024, the company maintains a competitive edge with its below-market Price-To-Earnings ratio of 23.6x. However, its Return on Equity is expected to be relatively low at 15.1%, and dividends appear inadequately covered by cash flows, reflecting some financial vulnerabilities amidst its growth trajectory.

- Unlock comprehensive insights into our analysis of Winall Hi-tech Seed stock in this growth report.

- Upon reviewing our latest valuation report, Winall Hi-tech Seed's share price might be too pessimistic.

Summing It All Up

- Unlock more gems! Our Fast Growing Chinese Companies With High Insider Ownership screener has unearthed 365 more companies for you to explore.Click here to unveil our expertly curated list of 368 Fast Growing Chinese Companies With High Insider Ownership.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Winall Hi-tech Seed might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300087

Winall Hi-tech Seed

Engages in the research and development, breeding, promotion, and service of various crop seeds in China and internationally.

High growth potential with adequate balance sheet.