- China

- /

- Semiconductors

- /

- SHSE:600363

The Price Is Right For Jiangxi Lian Chuang Optoelectronic Science And Technology Co.,lTd. (SHSE:600363)

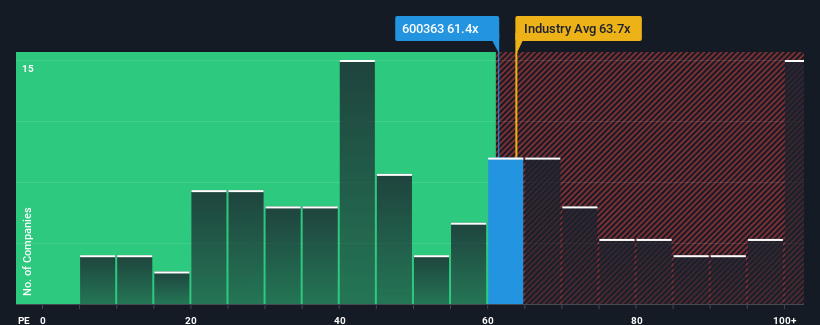

When close to half the companies in China have price-to-earnings ratios (or "P/E's") below 34x, you may consider Jiangxi Lian Chuang Optoelectronic Science And Technology Co.,lTd. (SHSE:600363) as a stock to avoid entirely with its 61.4x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

The recently shrinking earnings for Jiangxi Lian Chuang Optoelectronic Science And TechnologylTd have been in line with the market. It might be that many expect the company's earnings to strengthen positively despite the tough market conditions, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Jiangxi Lian Chuang Optoelectronic Science And TechnologylTd

How Is Jiangxi Lian Chuang Optoelectronic Science And TechnologylTd's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Jiangxi Lian Chuang Optoelectronic Science And TechnologylTd's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 2.2%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 15% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 55% during the coming year according to the two analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 38%, which is noticeably less attractive.

With this information, we can see why Jiangxi Lian Chuang Optoelectronic Science And TechnologylTd is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Jiangxi Lian Chuang Optoelectronic Science And TechnologylTd's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Jiangxi Lian Chuang Optoelectronic Science And TechnologylTd's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

You always need to take note of risks, for example - Jiangxi Lian Chuang Optoelectronic Science And TechnologylTd has 1 warning sign we think you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600363

Jiangxi Lian Chuang Optoelectronic Science And TechnologylTd

Jiangxi Lian Chuang Optoelectronic Science And Technology Co.,lTd.

High growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026