- China

- /

- Electrical

- /

- SZSE:002340

Asian Market Highlights 3 Stocks Possibly Trading Below Intrinsic Value Estimates

Reviewed by Simply Wall St

As Asian markets experience a notable upswing, with China's technology sector showing strength despite underlying economic challenges, investors are increasingly on the lookout for stocks that may be trading below their intrinsic value. In this environment, identifying undervalued stocks can provide opportunities for growth, especially when these companies demonstrate strong fundamentals and potential resilience amid fluctuating market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Teikoku Sen-i (TSE:3302) | ¥3395.00 | ¥6733.15 | 49.6% |

| Takara Bio (TSE:4974) | ¥908.00 | ¥1797.63 | 49.5% |

| Ningxia Building Materials GroupLtd (SHSE:600449) | CN¥13.36 | CN¥26.41 | 49.4% |

| Japan Eyewear Holdings (TSE:5889) | ¥2058.00 | ¥4033.59 | 49% |

| IbidenLtd (TSE:4062) | ¥13575.00 | ¥26808.09 | 49.4% |

| EVE Energy (SZSE:300014) | CN¥83.59 | CN¥163.47 | 48.9% |

| COVER (TSE:5253) | ¥1852.00 | ¥3688.51 | 49.8% |

| CICT Mobile Communication Technology (SHSE:688387) | CN¥6.84 | CN¥13.42 | 49% |

| Andes Technology (TWSE:6533) | NT$268.00 | NT$529.55 | 49.4% |

| Aecc Aero Science and TechnologyLtd (SHSE:600391) | CN¥27.38 | CN¥54.10 | 49.4% |

We'll examine a selection from our screener results.

GEM (SZSE:002340)

Overview: GEM Co., Ltd. operates in the waste resource comprehensive utilization industry both in China and internationally, with a market cap of CN¥42.98 billion.

Operations: The company's revenue segments include New Energy Battery Materials, which generated CN¥25.82 billion.

Estimated Discount To Fair Value: 32.3%

GEM Co., Ltd. is trading at CNY 8.43, significantly below its estimated fair value of CNY 12.46, indicating it is undervalued based on cash flows. Despite a modest dividend yield of 0.78% not well covered by free cash flows and debt levels not ideally supported by operating cash flow, the company anticipates earnings growth of 37.4% annually—outpacing the broader Chinese market's expected growth rate—and has engaged in strategic alliances to bolster its position in battery materials production and recycling in Europe and Indonesia.

- The growth report we've compiled suggests that GEM's future prospects could be on the up.

- Dive into the specifics of GEM here with our thorough financial health report.

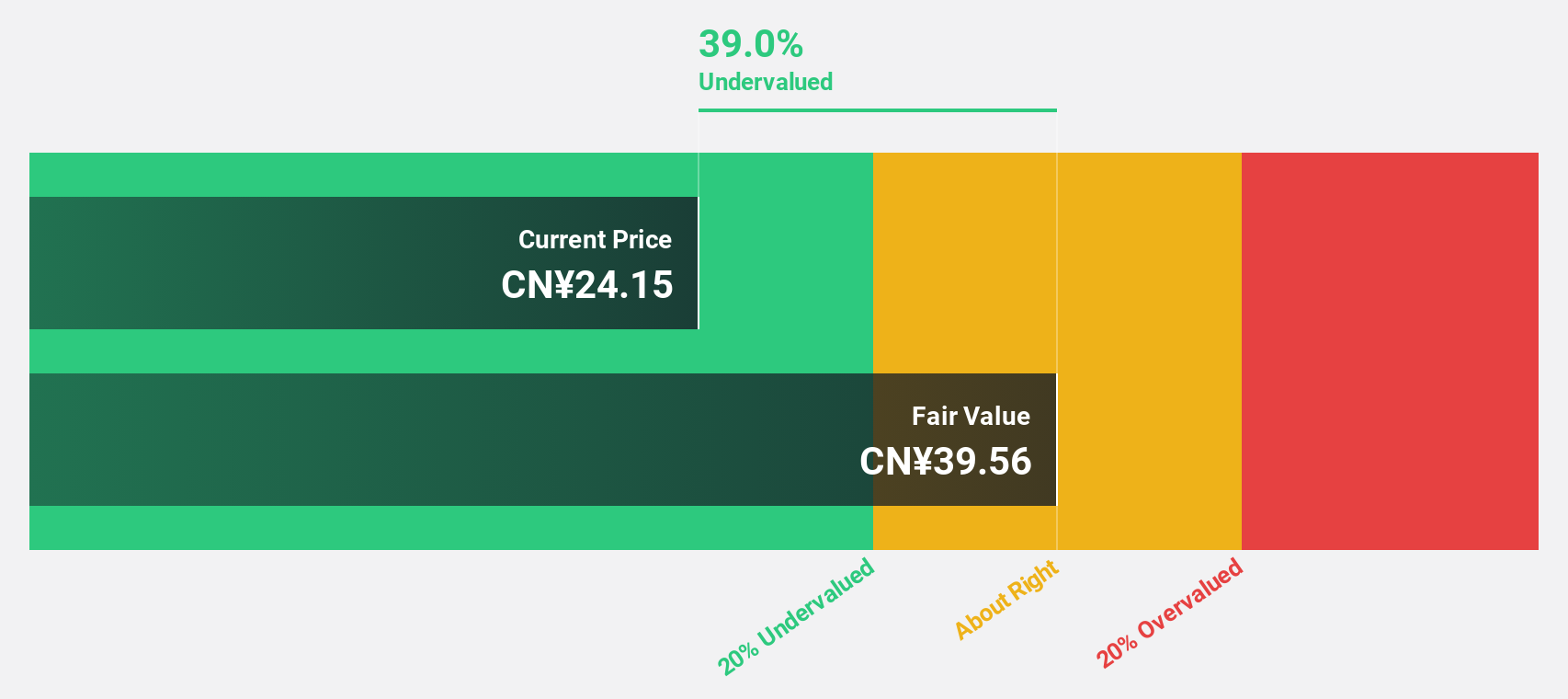

Sailvan Times (SZSE:301381)

Overview: Sailvan Times Co., Ltd. engages in the sale of lifestyle products via third-party e-commerce platforms both in China and internationally, with a market cap of CN¥10.09 billion.

Operations: Sailvan Times generates its revenue by selling lifestyle products through third-party e-commerce platforms across China and international markets.

Estimated Discount To Fair Value: 36.9%

Sailvan Times Co., Ltd. is trading at CN¥25.02, below its estimated fair value of CN¥39.67, suggesting it is undervalued based on cash flows. Despite a dividend yield of 1% not well covered by earnings and a decline in profit margins from 3.4% to 2%, the company expects significant annual earnings growth of over 30%, surpassing market expectations, with revenue growth forecasted at 16.4% per year—above the Chinese market average.

- Upon reviewing our latest growth report, Sailvan Times' projected financial performance appears quite optimistic.

- Navigate through the intricacies of Sailvan Times with our comprehensive financial health report here.

Phison Electronics (TPEX:8299)

Overview: Phison Electronics Corp. designs, manufactures, and sells flash memory controllers and peripheral system applications globally, with a market cap of NT$215.93 billion.

Operations: The company's revenue primarily comes from its Flash Memory Control Chip Design segment, which generated NT$58.24 billion.

Estimated Discount To Fair Value: 28.9%

Phison Electronics is trading at NT$1045, significantly below its fair value estimate of NT$1470.39, highlighting an undervaluation based on cash flows. Despite a volatile share price and declining profit margins from 12.9% to 8.5%, the company anticipates robust annual earnings growth of over 29%, outpacing the TW market average. Recent strategic partnerships with RedData and Supermicro enhance Phison's position in high-performance storage solutions, potentially bolstering future revenue growth expected to exceed 20% annually.

- Our earnings growth report unveils the potential for significant increases in Phison Electronics' future results.

- Get an in-depth perspective on Phison Electronics' balance sheet by reading our health report here.

Make It Happen

- Access the full spectrum of 269 Undervalued Asian Stocks Based On Cash Flows by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002340

GEM

Operates in the waste resource comprehensive utilization industry in China and internationally.

Good value with reasonable growth potential.

Market Insights

Community Narratives