Stock Analysis

- China

- /

- Healthcare Services

- /

- SZSE:300143

Exploring Undiscovered Chinese Stocks July 2024

Reviewed by Simply Wall St

As of July 2024, the Chinese stock market has shown resilience with the Shanghai Composite Index experiencing modest gains despite broader economic challenges and subdued growth in key sectors. This context sets an intriguing stage for investors to explore lesser-known stocks that may offer potential in a market leaning towards value and small-cap shares. In this landscape, identifying stocks with solid fundamentals and strategic positioning becomes crucial, especially those that could leverage current economic dynamics to their advantage.

Top 10 Undiscovered Gems With Strong Fundamentals In China

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sublime China Information | NA | 7.08% | 0.15% | ★★★★★★ |

| Yantai Ishikawa Sealing Technology | NA | -4.71% | -12.70% | ★★★★★★ |

| Xuchang Yuandong Drive ShaftLtd | NA | -10.22% | -26.80% | ★★★★★★ |

| Beilong Precision Technology | 14.94% | 15.35% | 2.32% | ★★★★★★ |

| Shaanxi International TrustLtd | 0.10% | 11.26% | 16.24% | ★★★★★☆ |

| Poly Plastic Masterbatch (SuZhou)Ltd | 0.48% | 18.33% | -9.98% | ★★★★★☆ |

| Shanghai Haixin Group | 0.90% | 5.42% | 6.21% | ★★★★★☆ |

| Beijing Jingyi Automation Equipment | 0.13% | 20.24% | 45.20% | ★★★★★☆ |

| Ningbo Henghe Precision IndustryLtd | 57.08% | 5.10% | 33.23% | ★★★★☆☆ |

| Yuan Cheng CableLtd | 88.62% | 3.34% | 66.80% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Tibet Development (SZSE:000752)

Simply Wall St Value Rating: ★★★★★★

Overview: Tibet Development Co., Ltd. is a Chinese company focused on the production and sale of beer, with a market capitalization of CN¥1.91 billion.

Operations: The company primarily generates its revenue from the beer segment, contributing CN¥335.39 million, with a minor adjustment of CN¥0.86 million. Its operations involve significant costs related to goods sold and operational expenses, impacting net income figures across various reporting periods.

Tibet Development, a lesser-known entity in China's market, recently showcased a remarkable turnaround by posting a net income of CNY 0.78 million for Q1 2024, rebounding from a net loss of CNY 28.44 million the previous year. This shift to profitability aligns with its strategic improvements and financial health: the company has more cash than total debt and has reduced its debt-to-equity ratio from 71.5% to 56.8% over five years. Additionally, interest payments are comfortably covered by EBIT at 7.3 times coverage, underscoring robust earnings quality and financial stability.

Chengdu Fusen Noble-House IndustrialLtd (SZSE:002818)

Simply Wall St Value Rating: ★★★★★★

Overview: Chengdu Fusen Noble-House Industrial Co., Ltd. is a diversified company engaged in the production and sale of furniture and related products, with a market capitalization of CN¥8.81 billion.

Operations: Fusen Noble-House IndustrialLtd generates its revenue primarily from four segments: Fusen Shares (CN¥666.55 million), Fusen Industrial (CN¥250.60 million), and Fusen Investment (CN¥246.43 million). The company's business operations show a consistent gross profit margin trend, averaging approximately 70% over recent years, highlighting efficient cost management relative to revenue generation across its diversified portfolio.

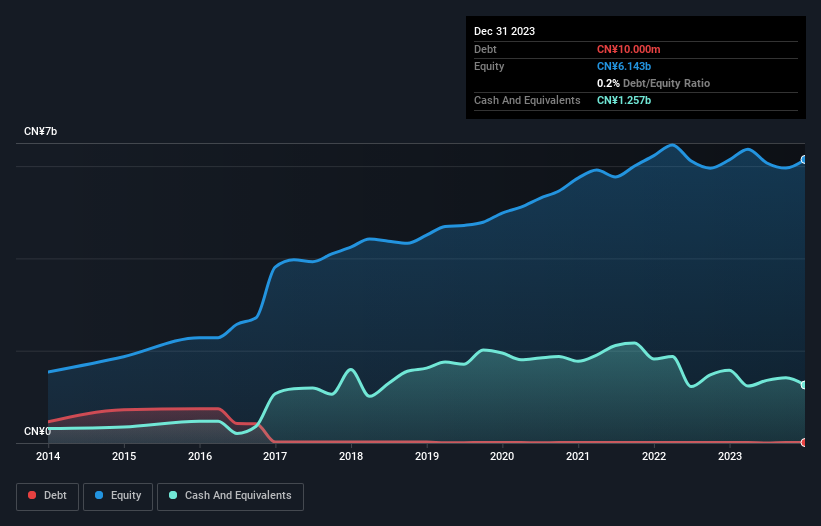

Chengdu Fusen Noble-House Industrial Co., Ltd. emerges as a notable contender among lesser-known Chinese stocks, trading 4.5% below its estimated fair value. Over the past five years, its earnings have expanded by 2.3% annually, although recent performance did not surpass the Specialty Retail industry's growth of 5.2%. Noteworthy is its improved financial health; the debt-to-equity ratio has halved from 0.4% to 0.2%. Additionally, the company declared a cash dividend of CNY 6.80 per ten shares for 2023, underscoring its commitment to shareholder returns despite modest industry-relative growth rates.

INKON Life Technology (SZSE:300143)

Simply Wall St Value Rating: ★★★★★★

Overview: INKON Life Technology Co., Ltd. is a company that specializes in creating an ecological platform for a chain of medical services encompassing pre-diagnosis, treatment, and health maintenance for tumors, operating both domestically in China and internationally, with a market capitalization of CN¥4.83 billion.

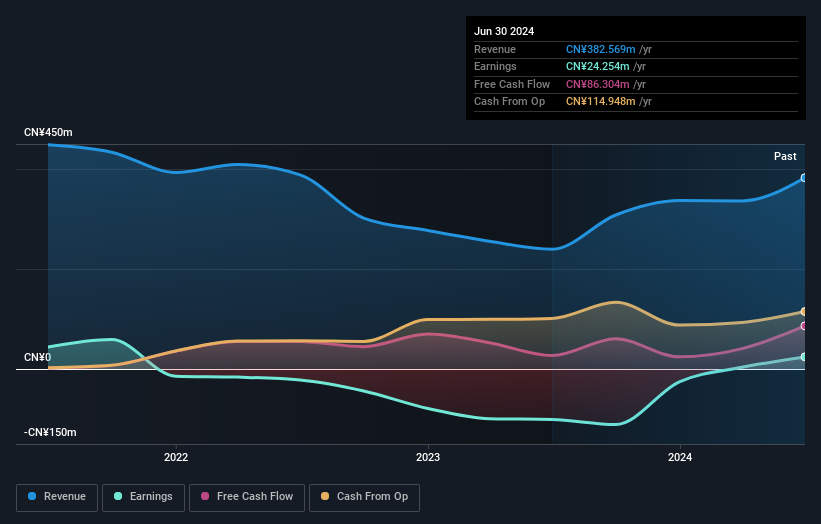

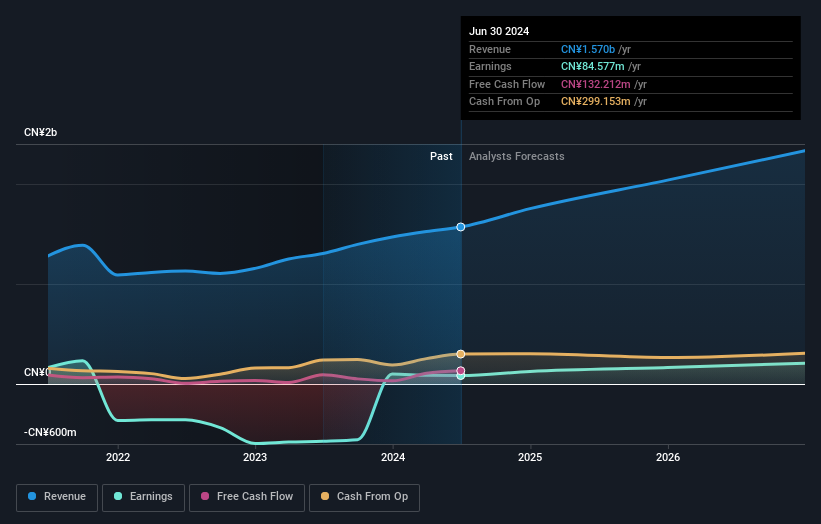

Operations: INKON Life Technology generates revenue primarily through the sale of goods and services, evidenced by a consistent increase in gross profit over the periods analyzed. The company's cost structure is heavily influenced by its cost of goods sold (COGS) and operating expenses, which include significant allocations to sales & marketing and general & administrative expenses. Despite fluctuations in net income, including periods of significant losses, INKON has managed to maintain a gross profit margin that highlights its ability to control production costs relative to revenue generation.

INKON Life Technology, a relatively lesser-known entity in China's healthcare sector, has shown promising financial and operational progress. Recently reporting a first-quarter revenue increase to CNY 416.23 million from CNY 361.42 million the previous year, the company also saw net income of CNY 26.23 million. Despite a slight dip in earnings per share, INKON's debt-to-equity ratio improved from 19.3% to 18.4% over five years, signaling stronger financial health. With earnings expected to grow by 28.5% annually and trading at 48% below its estimated fair value, INKON is positioned as an attractive prospect for growth-focused investors.

Seize The Opportunity

- Click this link to deep-dive into the 996 companies within our Chinese Undiscovered Gems With Strong Fundamentals screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300143

INKON Life Technology

Focuses on building an ecological platform for chain of pre-diagnosis/treatment/health providing medical services for tumors in China and internationally.

Flawless balance sheet with reasonable growth potential.