- Singapore

- /

- Specialty Stores

- /

- SGX:AGS

3 Promising Penny Stocks With Over US$700M Market Cap

Reviewed by Simply Wall St

As global markets navigate a holiday-shortened week, major stock indexes have shown moderate gains despite fluctuations in consumer confidence and economic indicators. In such an environment, investors often look for opportunities that balance potential growth with financial stability. Penny stocks, although sometimes considered outdated as a term, continue to offer intriguing prospects by providing access to smaller or newer companies at lower price points. When these stocks are backed by strong fundamentals and sound financial health, they can present compelling opportunities for growth.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$141.28M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.095 | £789.32M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.78 | HK$43.17B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.425 | MYR1.17B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.976 | £153.96M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.42 | £180.84M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.55 | £67.7M | ★★★★☆☆ |

Click here to see the full list of 5,831 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

Beisen Holding (SEHK:9669)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Beisen Holding Limited is an investment holding company that offers cloud-based human capital management solutions for enterprises in China, with a market cap of HK$2.98 billion.

Operations: The company's revenue is primarily generated from providing cloud-based HCM solutions and related professional services, totaling CN¥890.79 million.

Market Cap: HK$2.98B

Beisen Holding, with a market cap of HK$2.98 billion, is experiencing revenue growth in its cloud-based human capital management solutions, reporting CN¥436.58 million for the half-year ending September 2024. Despite being unprofitable and forecasted to remain so for the next three years, it has reduced its net loss significantly from CN¥3,058.07 million to CN¥99.04 million year-on-year due to decreased losses from fair value changes and share-based payments. The company maintains a strong cash runway exceeding three years without debt but faces insider selling concerns and an inexperienced board with an average tenure of 2.5 years.

- Get an in-depth perspective on Beisen Holding's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Beisen Holding's future.

Hour Glass (SGX:AGS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: The Hour Glass Limited is an investment holding company involved in the retailing and distribution of watches, jewelry, and other luxury products across several countries including Singapore, Hong Kong, and Japan, with a market cap of SGD997.70 million.

Operations: The company generates SGD1.11 billion in revenue from its operations in the retailing and distribution of watches, jewelry, and luxury products.

Market Cap: SGD997.7M

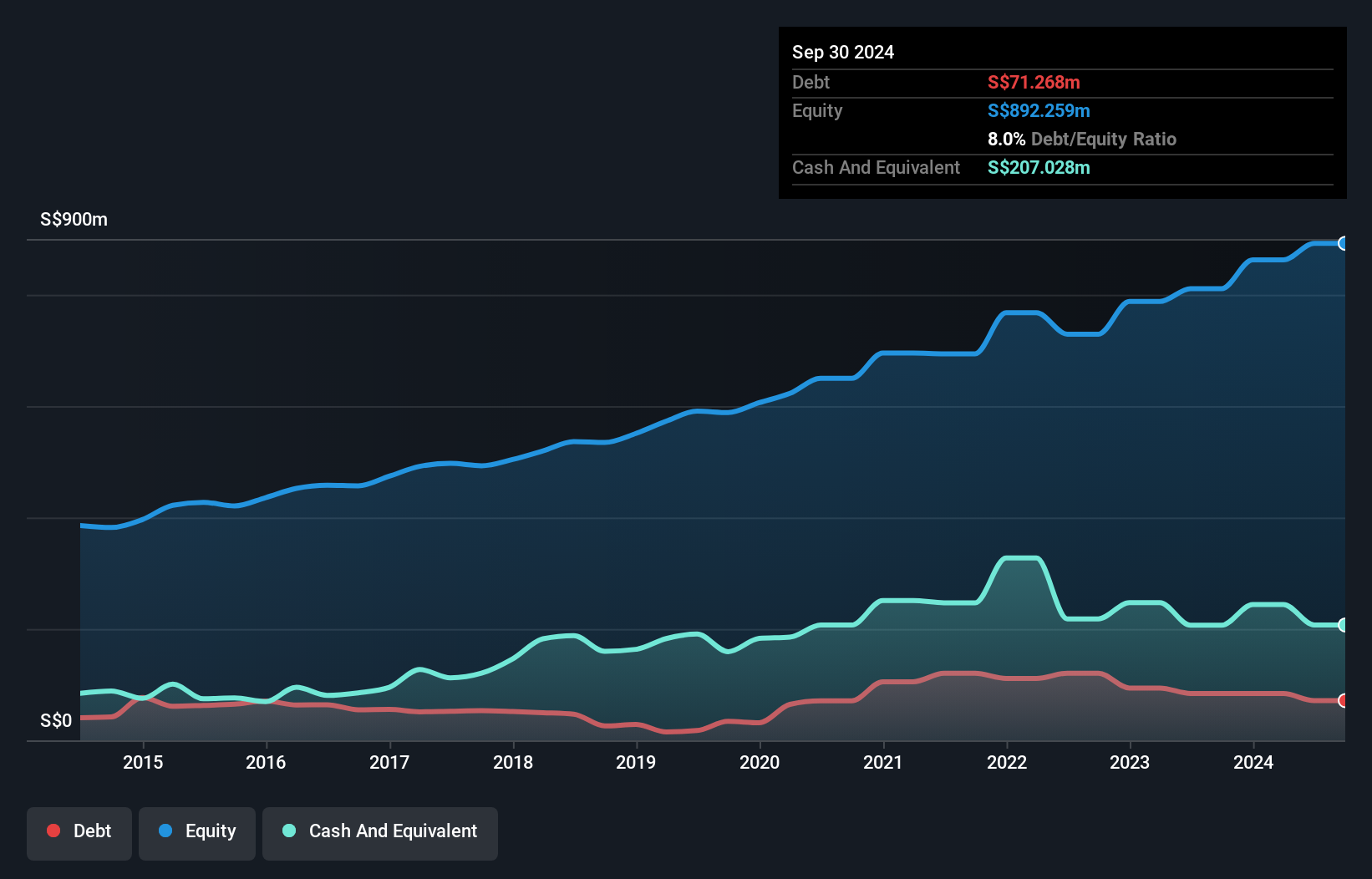

The Hour Glass Limited, with a market cap of SGD997.70 million, reported half-year revenue of SGD548.77 million, reflecting a slight decline from the previous year. The company's experienced management and board have maintained strong financial health with short-term assets significantly exceeding both short and long-term liabilities. Despite negative earnings growth over the past year and reduced net profit margins to 12.6%, its debt is well covered by operating cash flow at 192.5%. The Price-to-Earnings ratio of 7.2x suggests valuation below the Singapore market average, though dividend sustainability remains unstable despite recent affirmations.

- Click to explore a detailed breakdown of our findings in Hour Glass' financial health report.

- Understand Hour Glass' track record by examining our performance history report.

Global Top E-Commerce (SZSE:002640)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Global Top E-Commerce Co., Ltd. operates in the cross-border e-commerce sector both within China and internationally, with a market cap of CN¥6.57 billion.

Operations: Global Top E-Commerce Co., Ltd. does not report specific revenue segments.

Market Cap: CN¥6.57B

Global Top E-Commerce Co., Ltd. faces challenges as it remains unprofitable, with a net loss of CN¥17.76 million for the nine months ending September 2024, despite generating revenue of CN¥4.2 billion. The company benefits from a strong cash position, allowing for more than three years of operations without additional funding needs and has no debt burden, enhancing financial flexibility. Recent board changes and amendments to company bylaws may indicate strategic shifts aimed at addressing volatility concerns after its removal from the S&P Global BMI Index in December 2024. The stock trades significantly below estimated fair value, possibly offering speculative opportunities amidst high volatility.

- Navigate through the intricacies of Global Top E-Commerce with our comprehensive balance sheet health report here.

- Gain insights into Global Top E-Commerce's historical outcomes by reviewing our past performance report.

Key Takeaways

- Click here to access our complete index of 5,831 Penny Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hour Glass might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:AGS

Hour Glass

An investment holding company, engages in the retailing and distribution of watches, jewellry, and other luxury products in Singapore, Hong Kong, Japan, Australia, New Zealand, Malaysia, Thailand, and Vietnam.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives