- China

- /

- Retail Distributors

- /

- SHSE:600704

Wuchan Zhongda GroupLtd's (SHSE:600704) Shareholders Have More To Worry About Than Only Soft Earnings

The market rallied behind Wuchan Zhongda Group Co.,Ltd.'s (SHSE:600704) stock, leading do a rise in the share price after its recent weak earnings report. Sometimes, shareholders are willing to ignore soft numbers with the hope that they will improve, but our analysis suggests this is unlikely for Wuchan Zhongda GroupLtd.

See our latest analysis for Wuchan Zhongda GroupLtd

Examining Cashflow Against Wuchan Zhongda GroupLtd's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

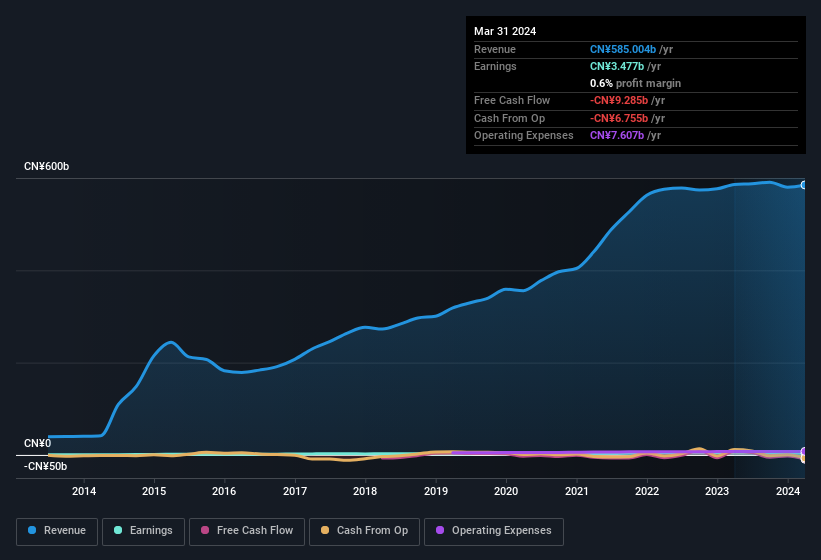

For the year to March 2024, Wuchan Zhongda GroupLtd had an accrual ratio of 0.20. Therefore, we know that it's free cashflow was significantly lower than its statutory profit, which is hardly a good thing. Over the last year it actually had negative free cash flow of CN¥9.3b, in contrast to the aforementioned profit of CN¥3.48b. It's worth noting that Wuchan Zhongda GroupLtd generated positive FCF of CN¥8.1b a year ago, so at least they've done it in the past. Having said that, there is more to the story. We can see that unusual items have impacted its statutory profit, and therefore the accrual ratio. One positive for Wuchan Zhongda GroupLtd shareholders is that it's accrual ratio was significantly better last year, providing reason to believe that it may return to stronger cash conversion in the future. Shareholders should look for improved cashflow relative to profit in the current year, if that is indeed the case.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Wuchan Zhongda GroupLtd.

How Do Unusual Items Influence Profit?

Given the accrual ratio, it's not overly surprising that Wuchan Zhongda GroupLtd's profit was boosted by unusual items worth CN¥1.1b in the last twelve months. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And, after all, that's exactly what the accounting terminology implies. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

Our Take On Wuchan Zhongda GroupLtd's Profit Performance

Wuchan Zhongda GroupLtd had a weak accrual ratio, but its profit did receive a boost from unusual items. For the reasons mentioned above, we think that a perfunctory glance at Wuchan Zhongda GroupLtd's statutory profits might make it look better than it really is on an underlying level. If you want to do dive deeper into Wuchan Zhongda GroupLtd, you'd also look into what risks it is currently facing. Case in point: We've spotted 3 warning signs for Wuchan Zhongda GroupLtd you should be mindful of and 2 of these make us uncomfortable.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

Valuation is complex, but we're here to simplify it.

Discover if Wuchan Zhongda GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600704

Wuchan Zhongda GroupLtd

Provides bulk commodity supply chain integration services in China and internationally.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives