- China

- /

- Specialty Stores

- /

- SHSE:600655

Many Still Looking Away From Shanghai Yuyuan Tourist Mart (Group) Co., Ltd. (SHSE:600655)

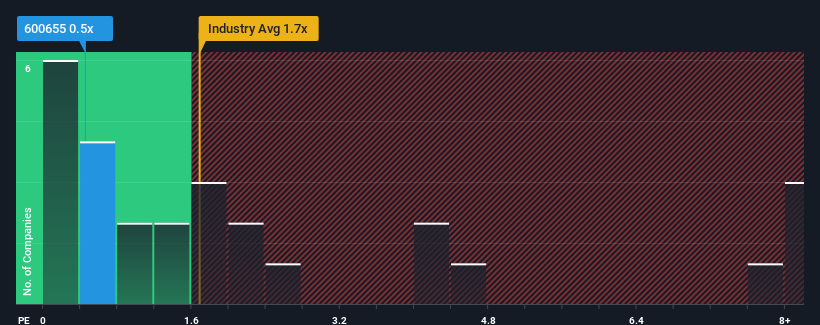

When close to half the companies operating in the Specialty Retail industry in China have price-to-sales ratios (or "P/S") above 1.7x, you may consider Shanghai Yuyuan Tourist Mart (Group) Co., Ltd. (SHSE:600655) as an attractive investment with its 0.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Shanghai Yuyuan Tourist Mart (Group)

How Has Shanghai Yuyuan Tourist Mart (Group) Performed Recently?

Shanghai Yuyuan Tourist Mart (Group) has been doing a reasonable job lately as its revenue hasn't declined as much as most other companies. It might be that many expect the comparatively superior revenue performance to degrade substantially, which has repressed the P/S. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. In saying that, existing shareholders probably aren't pessimistic about the share price if the company's revenue continues outplaying the industry.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shanghai Yuyuan Tourist Mart (Group).What Are Revenue Growth Metrics Telling Us About The Low P/S?

Shanghai Yuyuan Tourist Mart (Group)'s P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 1.5%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 12% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 15% as estimated by the four analysts watching the company. With the industry predicted to deliver 16% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Shanghai Yuyuan Tourist Mart (Group)'s P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It looks to us like the P/S figures for Shanghai Yuyuan Tourist Mart (Group) remain low despite growth that is expected to be in line with other companies in the industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

Plus, you should also learn about these 4 warning signs we've spotted with Shanghai Yuyuan Tourist Mart (Group) (including 1 which is concerning).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600655

Shanghai Yuyuan Tourist Mart (Group)

Shanghai Yuyuan Tourist Mart (Group) Co., Ltd.

Fair value with moderate growth potential.

Market Insights

Community Narratives