Uncovering February 2025's Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

As global markets continue to navigate the complexities of higher-than-expected inflation and the U.S. stock indexes approach record highs, small-cap stocks have lagged behind their larger counterparts, with the Russell 2000 Index trailing the S&P 500 by notable margins. In this environment, identifying stocks with strong fundamentals and resilience to economic fluctuations becomes crucial for uncovering potential opportunities in February 2025's undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Formula Systems (1985) | 37.70% | 9.99% | 13.08% | ★★★★★★ |

| Analyst I.M.S. Investment Management Services | NA | 20.75% | 18.12% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Segar Kumala Indonesia | NA | 21.81% | 18.21% | ★★★★★★ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Primadaya Plastisindo | 10.46% | 15.41% | 23.92% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

Flow Traders (ENXTAM:FLOW)

Simply Wall St Value Rating: ★★★★☆☆

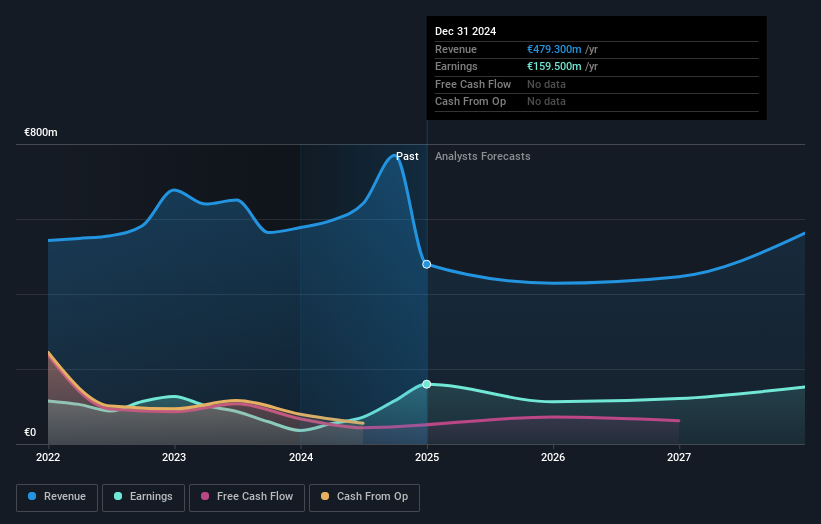

Overview: Flow Traders Ltd. is a financial technology-enabled multi-asset class liquidity provider operating in Europe, the Americas, and Asia with a market cap of €1.14 billion.

Operations: Flow Traders generates revenue primarily through its role as a liquidity provider across various asset classes, leveraging financial technology to facilitate trading activities. The company's net profit margin reflects its ability to manage costs and optimize operational efficiency in diverse markets.

Flow Traders, a nimble player in the financial sector, has showcased impressive earnings growth of 341.2% over the past year, outpacing the industry average of 23.8%. Recent results reveal a net income surge to €63.2 million for Q4 2024 from €6.4 million a year ago, with basic earnings per share climbing to €1.47 from €0.15. Despite an increased debt-to-equity ratio now at 428.6%, interest payments are well-covered by EBIT at 179 times over, suggesting robust operational efficiency and fiscal health amidst market fluctuations and competitive pressures in capital markets trading.

- Click here and access our complete health analysis report to understand the dynamics of Flow Traders.

Explore historical data to track Flow Traders' performance over time in our Past section.

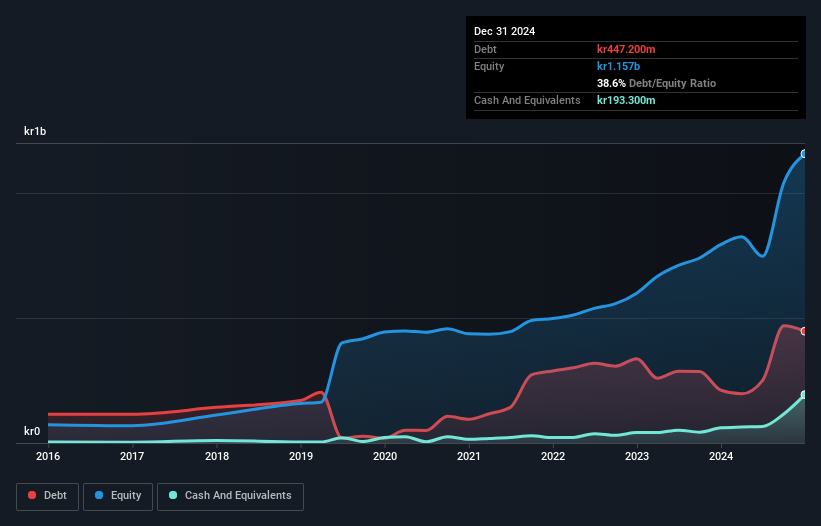

Norbit (OB:NORBT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Norbit ASA offers technology products and solutions with a market cap of NOK6.99 billion.

Operations: Norbit ASA generates revenue through its technology products and solutions. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

Norbit, a promising player in the electronics sector, has shown robust growth with earnings rising 31.3% over the past year, outpacing industry trends. Trading at 25.4% below its estimated fair value, it offers potential upside for investors. The company's net debt to equity ratio stands at a satisfactory 21.9%, indicating sound financial health despite an increase from 4.3% over five years. Recent results highlight strong performance with Q4 sales reaching NOK 556 million and net income of NOK 106 million, nearly doubling from the previous year. A proposed dividend of NOK 3 per share reflects confidence in future prospects.

- Dive into the specifics of Norbit here with our thorough health report.

Review our historical performance report to gain insights into Norbit's's past performance.

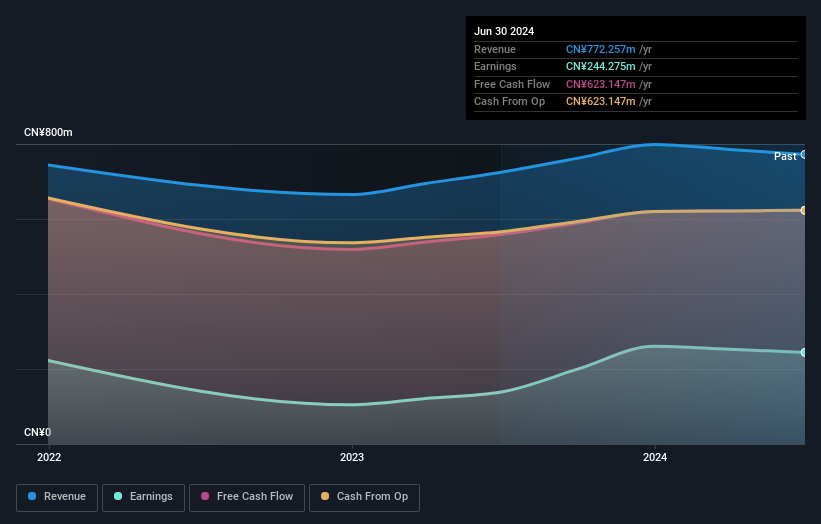

Ping An Guangzhou Comm Invest Guanghe Expressway (SZSE:180201)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ping An Guangzhou Comm Invest Guanghe Expressway Close-end Infrastructure Fund operates as an infrastructure fund with a market cap of CN¥6.67 billion.

Operations: The fund generates revenue primarily from its transportation infrastructure segment, amounting to CN¥772.26 million.

Guanghe Expressway, a relatively small player in the infrastructure sector, has demonstrated impressive earnings growth of 76.4% over the past year, outpacing its industry peers. The company is trading at a significant discount of 54.1% below its estimated fair value, suggesting potential upside for investors seeking undervalued opportunities. Its financial health appears robust with a net debt to equity ratio of 8.1%, considered satisfactory by industry standards, and interest payments are well covered by EBIT at 8.8 times coverage. A recent cash dividend of CNY0.38 further underscores its commitment to shareholder returns.

Seize The Opportunity

- Reveal the 4695 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norbit might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NORBT

Norbit

Provides technology solutions to customers in a range of industries.

Outstanding track record with high growth potential.

Similar Companies

Market Insights

Community Narratives