- China

- /

- Real Estate

- /

- SZSE:300947

Shanghai DOBE Cultural & Creative Industry Development (Group)Co. LTD. (SZSE:300947) Looks Just Right With A 27% Price Jump

Shanghai DOBE Cultural & Creative Industry Development (Group)Co. LTD. (SZSE:300947) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Unfortunately, despite the strong performance over the last month, the full year gain of 6.8% isn't as attractive.

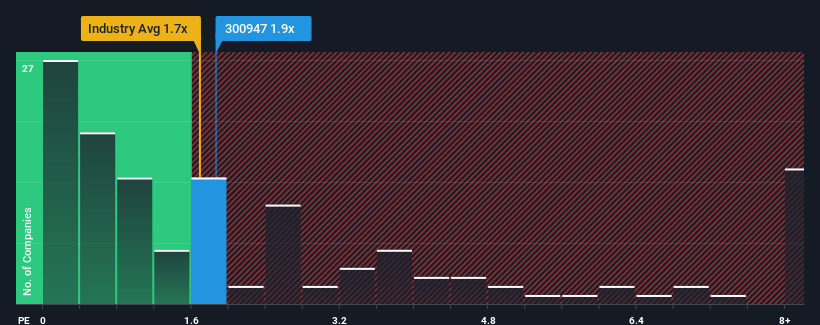

In spite of the firm bounce in price, there still wouldn't be many who think Shanghai DOBE Cultural & Creative Industry Development (Group)Co's price-to-sales (or "P/S") ratio of 1.9x is worth a mention when the median P/S in China's Real Estate industry is similar at about 1.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Shanghai DOBE Cultural & Creative Industry Development (Group)Co

What Does Shanghai DOBE Cultural & Creative Industry Development (Group)Co's Recent Performance Look Like?

Shanghai DOBE Cultural & Creative Industry Development (Group)Co certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. It might be that many expect the strong revenue performance to wane, which has kept the share price, and thus the P/S ratio, from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Shanghai DOBE Cultural & Creative Industry Development (Group)Co's earnings, revenue and cash flow.How Is Shanghai DOBE Cultural & Creative Industry Development (Group)Co's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Shanghai DOBE Cultural & Creative Industry Development (Group)Co's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 43% gain to the company's top line. Pleasingly, revenue has also lifted 43% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is predicted to deliver 11% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this in consideration, it's clear to see why Shanghai DOBE Cultural & Creative Industry Development (Group)Co's P/S matches up closely to its industry peers. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

The Bottom Line On Shanghai DOBE Cultural & Creative Industry Development (Group)Co's P/S

Shanghai DOBE Cultural & Creative Industry Development (Group)Co's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we've seen, Shanghai DOBE Cultural & Creative Industry Development (Group)Co's three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Shanghai DOBE Cultural & Creative Industry Development (Group)Co (2 are a bit unpleasant) you should be aware of.

If you're unsure about the strength of Shanghai DOBE Cultural & Creative Industry Development (Group)Co's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300947

Shanghai DOBE Cultural & Creative Industry Development (Group)Co

Shanghai DOBE Cultural & Creative Industry Development (Group)Co.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives