- China

- /

- Real Estate

- /

- SZSE:000863

Undervalued Penny Stocks To Watch In February 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of tariff uncertainties and mixed economic signals, investors are keenly observing potential opportunities in various sectors. Penny stocks, often misunderstood as relics of past trading days, continue to offer intriguing prospects for those willing to explore smaller or newer companies with solid financial foundations. By focusing on firms with robust balance sheets and growth potential, investors can uncover hidden value in these under-the-radar stocks; we've identified three such candidates that stand out for their financial strength and promise.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.55 | MYR2.73B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.945 | £476.68M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £3.99 | £321.93M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.345 | MYR959.84M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.90 | HK$44.77B | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.934 | £148.85M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.855 | MYR283.81M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR414.16M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.13 | HK$717.31M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

Click here to see the full list of 5,698 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Shanghai Trendzone Holdings GroupLtd (SHSE:603030)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shanghai Trendzone Holdings Group Co., Ltd, with a market cap of CN¥3.42 billion, offers integrated solutions in design, construction, production, and services both within China and internationally.

Operations: Shanghai Trendzone Holdings Group Co., Ltd has not reported specific revenue segments.

Market Cap: CN¥3.42B

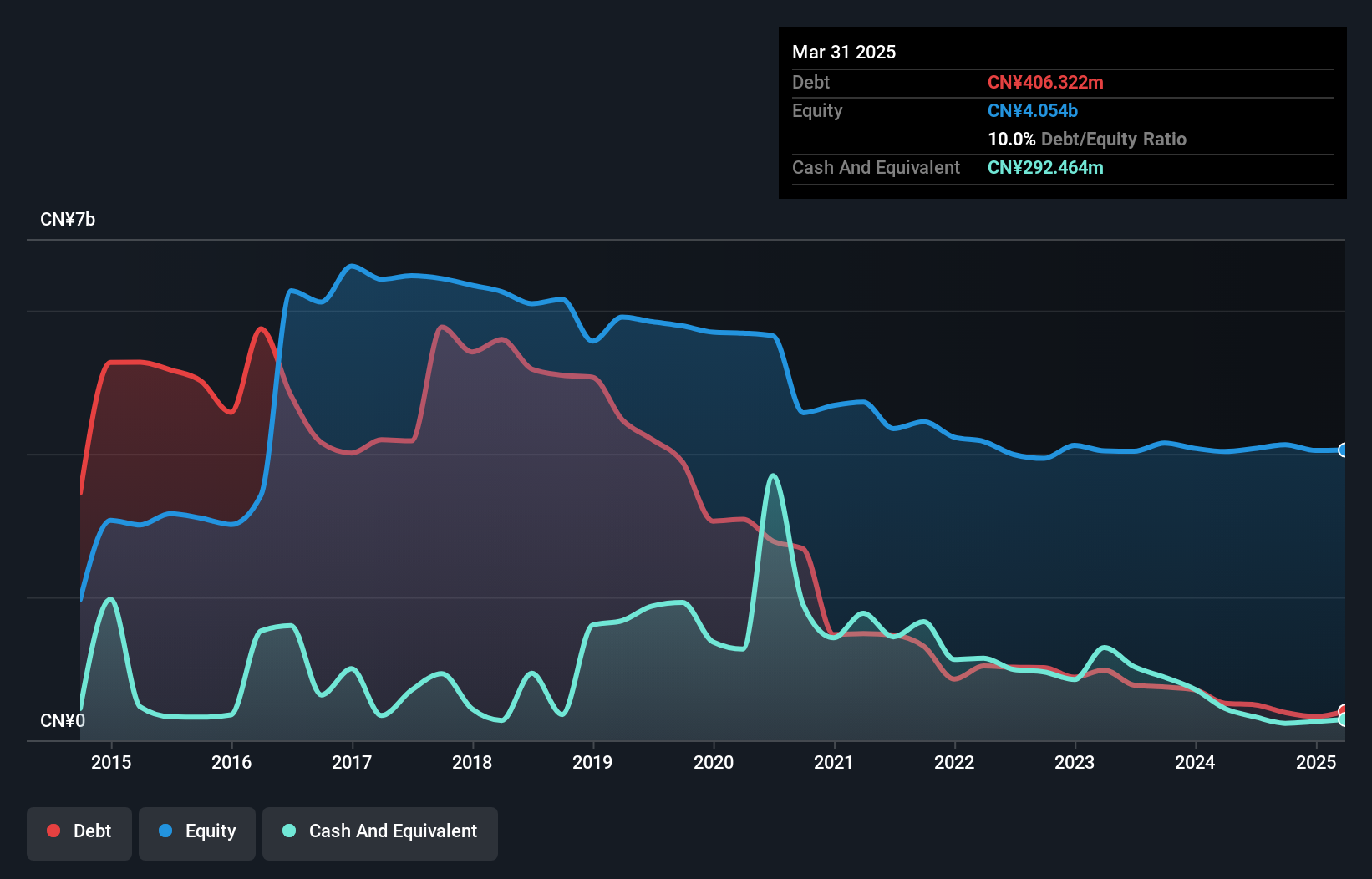

Shanghai Trendzone Holdings Group Co., Ltd, with a market cap of CN¥3.42 billion, has recently become profitable and shows satisfactory debt management with a net debt to equity ratio of 37.2%. The company's short-term assets exceed both its short-term and long-term liabilities, indicating solid financial positioning. However, the operating cash flow is negative, suggesting potential challenges in covering debt through operations. Despite having high non-cash earnings and an experienced board with an average tenure of 4.9 years, the stock exhibits high volatility over the past three months and a low return on equity at 2.1%.

- Get an in-depth perspective on Shanghai Trendzone Holdings GroupLtd's performance by reading our balance sheet health report here.

- Gain insights into Shanghai Trendzone Holdings GroupLtd's past trends and performance with our report on the company's historical track record.

Sanxiang Impression (SZSE:000863)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sanxiang Impression Co., Ltd. focuses on real estate development in China and has a market cap of CN¥4.75 billion.

Operations: The company generates revenue of CN¥1.20 billion from its operations within China.

Market Cap: CN¥4.75B

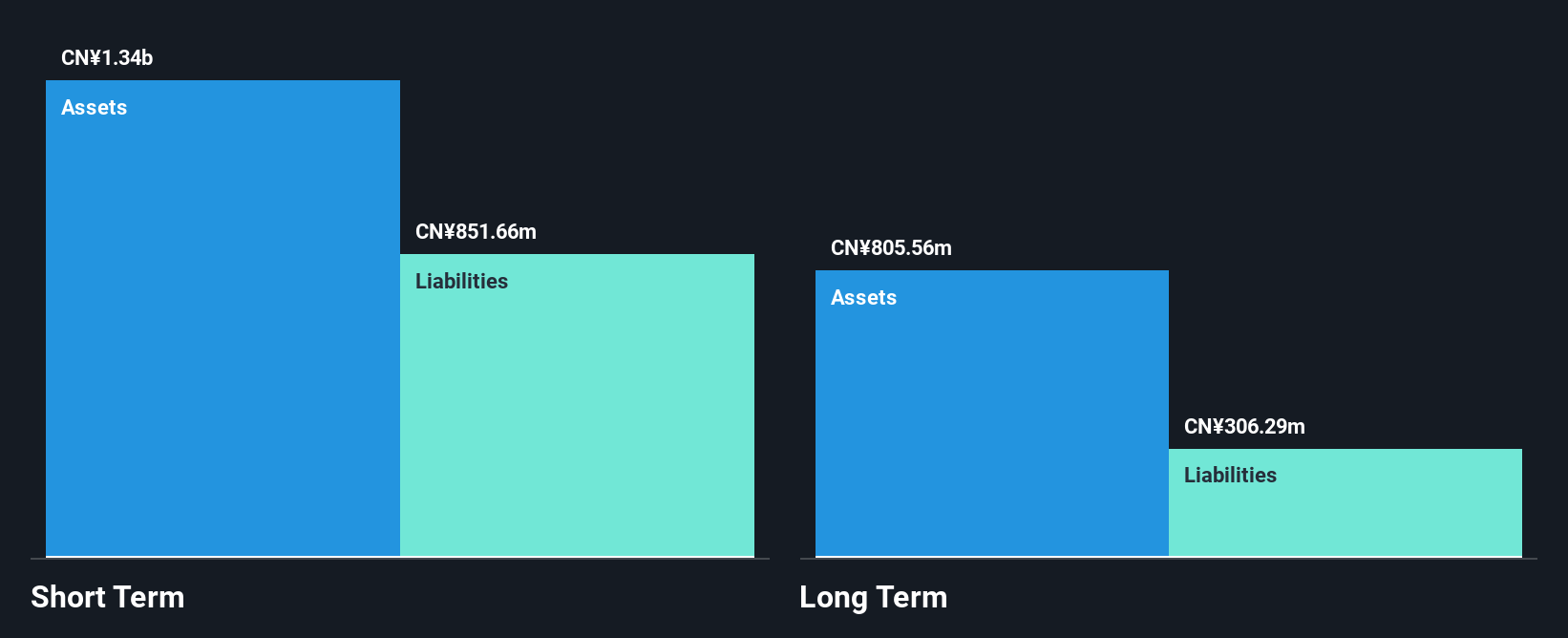

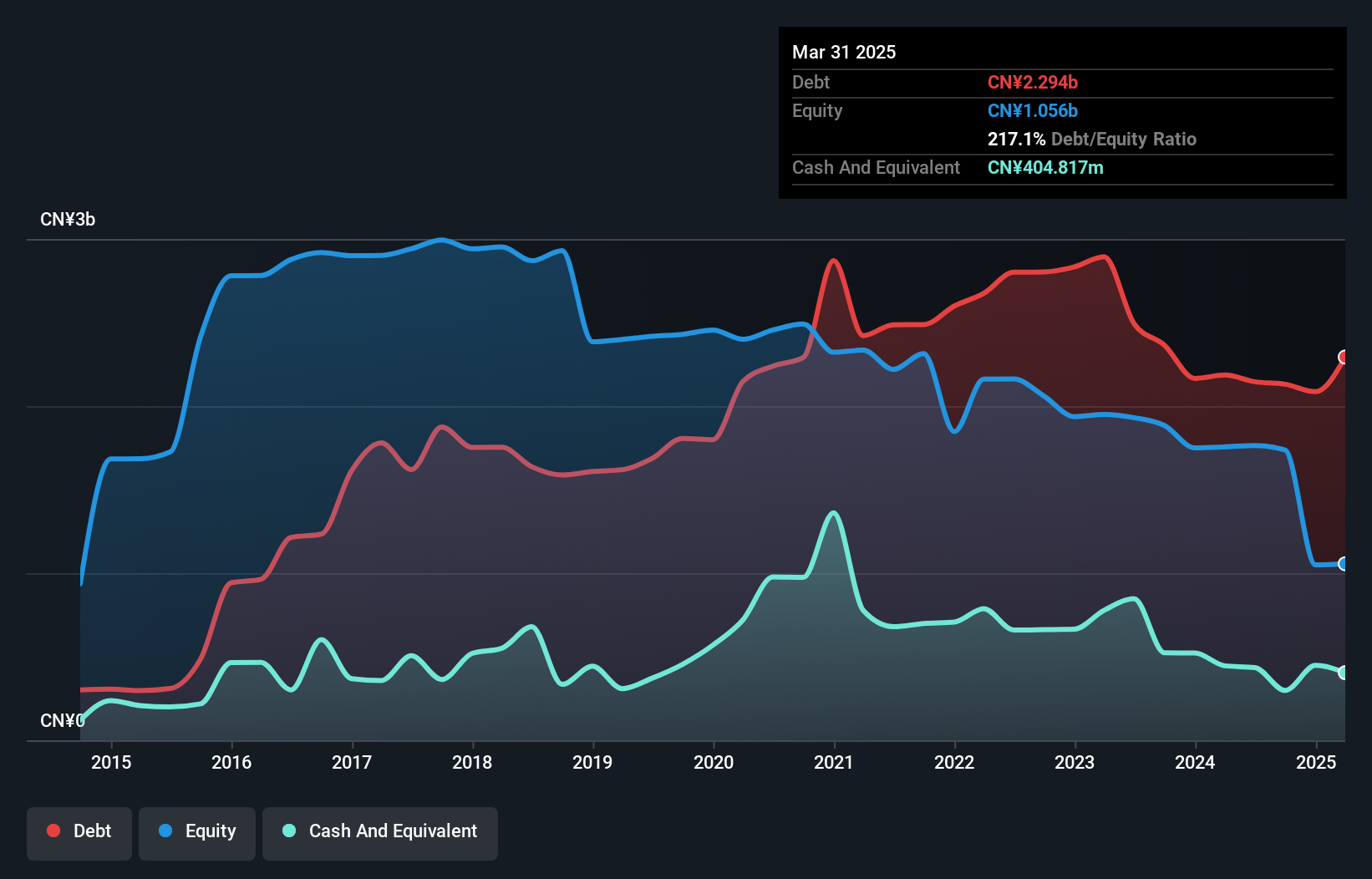

Sanxiang Impression Co., Ltd. has a market cap of CN¥4.75 billion and generates revenue of CN¥1.20 billion from its real estate operations in China. The company has reduced its debt to equity ratio significantly over the past five years, now standing at a satisfactory 3.6%. Its short-term assets of CN¥4.8 billion comfortably cover both short and long-term liabilities, indicating strong liquidity management despite negative operating cash flow which challenges debt coverage through operations. The stock's volatility remains high, with recent financial results impacted by large one-off losses, contributing to lower profit margins compared to the previous year.

- Navigate through the intricacies of Sanxiang Impression with our comprehensive balance sheet health report here.

- Examine Sanxiang Impression's past performance report to understand how it has performed in prior years.

Royal GroupLtd (SZSE:002329)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Royal Group Co., Ltd. operates in China, focusing on the processing, production, and sale of dairy products with a market capitalization of CN¥2.93 billion.

Operations: The company's revenue from the China segment is CN¥2.16 billion.

Market Cap: CN¥2.93B

Royal Group Co., Ltd. operates with a market cap of CN¥2.93 billion, focusing on dairy products in China, generating revenue of CN¥2.16 billion from this segment. Despite being unprofitable, the company maintains a positive free cash flow and has a cash runway exceeding three years if current conditions persist. Short-term assets cover both short and long-term liabilities, although the debt to equity ratio has risen significantly to 122.7%, indicating high leverage with a net debt to equity ratio at 105.5%. The stock is volatile and recently dropped from the S&P Global BMI Index, impacting investor sentiment.

- Jump into the full analysis health report here for a deeper understanding of Royal GroupLtd.

- Learn about Royal GroupLtd's historical performance here.

Summing It All Up

- Navigate through the entire inventory of 5,698 Penny Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000863

Sanxiang Impression

Engages in the development of real estate properties in China.

Adequate balance sheet with minimal risk.

Market Insights

Community Narratives