- China

- /

- Real Estate

- /

- SZSE:000620

Macrolink Culturaltainment Development Co., Ltd.'s (SZSE:000620) Price Is Right But Growth Is Lacking

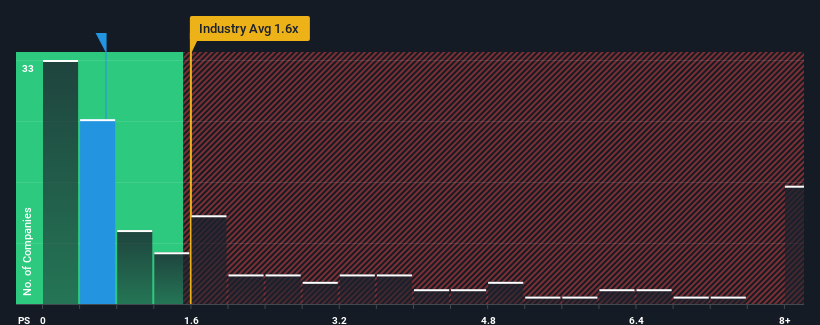

Macrolink Culturaltainment Development Co., Ltd.'s (SZSE:000620) price-to-sales (or "P/S") ratio of 0.7x might make it look like a buy right now compared to the Real Estate industry in China, where around half of the companies have P/S ratios above 1.6x and even P/S above 4x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Macrolink Culturaltainment Development

How Macrolink Culturaltainment Development Has Been Performing

For instance, Macrolink Culturaltainment Development's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Macrolink Culturaltainment Development will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Macrolink Culturaltainment Development?

In order to justify its P/S ratio, Macrolink Culturaltainment Development would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 39% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 52% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 9.3% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we understand why Macrolink Culturaltainment Development's P/S is lower than most of its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's no surprise that Macrolink Culturaltainment Development maintains its low P/S off the back of its sliding revenue over the medium-term. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

Before you settle on your opinion, we've discovered 2 warning signs for Macrolink Culturaltainment Development that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Winnovation Culturaltainment Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000620

Winnovation Culturaltainment Development

Engages in the development and sale of real estate properties in China.

Flawless balance sheet with minimal risk.

Similar Companies

Market Insights

Community Narratives