- China

- /

- Real Estate

- /

- SZSE:000560

3 Asian Penny Stocks With Market Caps Under US$2B To Consider

Reviewed by Simply Wall St

Amidst a backdrop of cautious sentiment in global markets, particularly with the U.S. Federal Reserve's hawkish stance impacting investor optimism, Asian markets continue to present unique opportunities for discerning investors. Penny stocks, though often associated with speculative trading, can still hold significant potential when underpinned by robust financials and growth prospects. This article will explore three such penny stocks in Asia that exemplify balance sheet strength and offer intriguing possibilities for those seeking to uncover hidden value in smaller companies.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB3.90 | THB3.85B | ✅ 4 ⚠️ 0 View Analysis > |

| JBM (Healthcare) (SEHK:2161) | HK$2.99 | HK$2.43B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.52 | HK$940.15M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.55 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.11 | SGD449.87M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.80 | THB2.88B | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.37 | SGD13.26B | ✅ 5 ⚠️ 1 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB0.96 | THB1.41B | ✅ 2 ⚠️ 2 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.98 | NZ$139.5M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.84 | THB9.78B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 979 stocks from our Asian Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Viva Biotech Holdings (SEHK:1873)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Viva Biotech Holdings is an investment holding company that provides structure-based drug discovery services to biotechnology and pharmaceutical clients globally, with a market cap of HK$5.57 billion.

Operations: The company's revenue is primarily generated through its Drug Discovery Services, which contributed CN¥853.38 million, and its Contract Development Manufacture Organisation (CDMO) and Commercialisation Services, which brought in CN¥995.92 million, alongside a smaller contribution from Viva Bioinnovator at CN¥15.58 million.

Market Cap: HK$5.57B

Viva Biotech Holdings, with a market cap of HK$5.57 billion, has shown promising financial performance recently by becoming profitable and achieving high-quality earnings. The company’s revenue streams are diversified across Drug Discovery Services and CDMO services, contributing significantly to its income. Despite a forecasted decline in earnings over the next three years, Viva Biotech's debt is well-managed with satisfactory net debt to equity levels and strong interest coverage. Recent inclusion in the S&P Global BMI Index reflects growing recognition. However, short-term assets do not cover long-term liabilities fully, indicating potential financial constraints ahead.

- Click to explore a detailed breakdown of our findings in Viva Biotech Holdings' financial health report.

- Learn about Viva Biotech Holdings' future growth trajectory here.

China Dongxiang (Group) (SEHK:3818)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: China Dongxiang (Group) Co., Ltd. and its subsidiaries focus on designing, developing, marketing, and selling sport-related apparel, footwear, and accessories both in China and internationally with a market cap of approximately HK$3.05 billion.

Operations: The company generates revenue primarily from its China sporting goods segment, which accounted for CN¥1.68 billion.

Market Cap: HK$3.05B

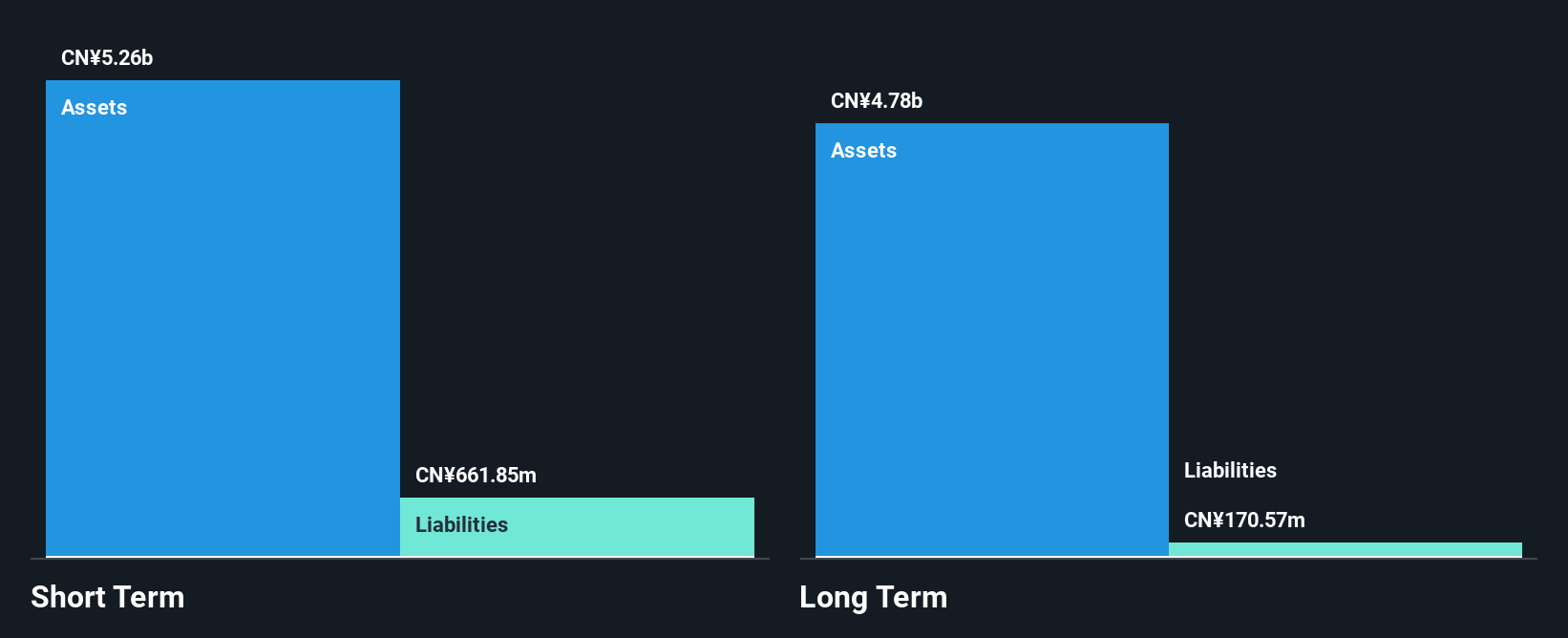

China Dongxiang (Group) Co., Ltd. has recently become profitable, marking a significant turnaround in its financial performance. The company is debt-free, with short-term assets of CN¥5.3 billion comfortably covering both short and long-term liabilities. Despite the low return on equity at 2.2%, the firm's earnings are considered high quality, although they have declined by 32.8% annually over the past five years. A special dividend was announced alongside a decrease in regular dividends, reflecting cautious cash flow management amidst stable weekly volatility of 7%. The experienced board and management team further support operational stability.

- Take a closer look at China Dongxiang (Group)'s potential here in our financial health report.

- Assess China Dongxiang (Group)'s previous results with our detailed historical performance reports.

5i5j Holding Group (SZSE:000560)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: 5i5j Holding Group Co., Ltd. operates as a real estate brokerage service provider in China and internationally, with a market cap of CN¥7.18 billion.

Operations: The company's revenue is primarily derived from Asset Management (CN¥5.56 billion), Brokerage (CN¥4.35 billion), New Home Business (CN¥1.25 billion), and Commercial Leasing and Services (CN¥446 million).

Market Cap: CN¥7.18B

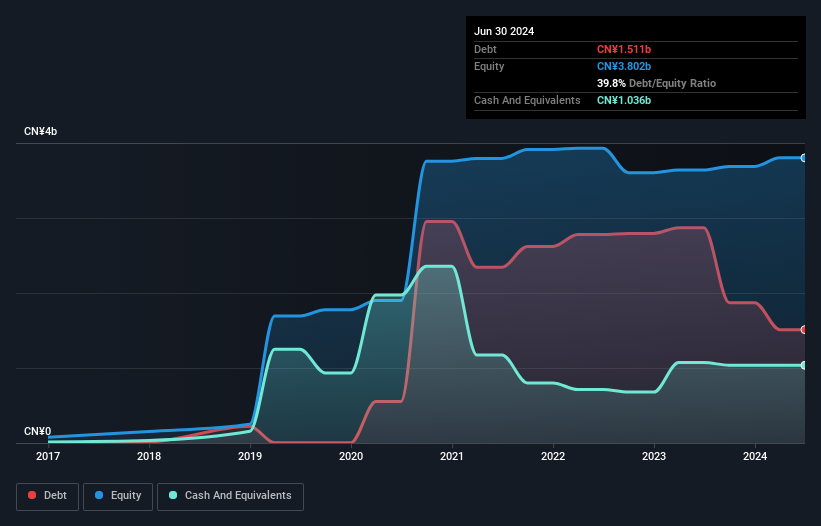

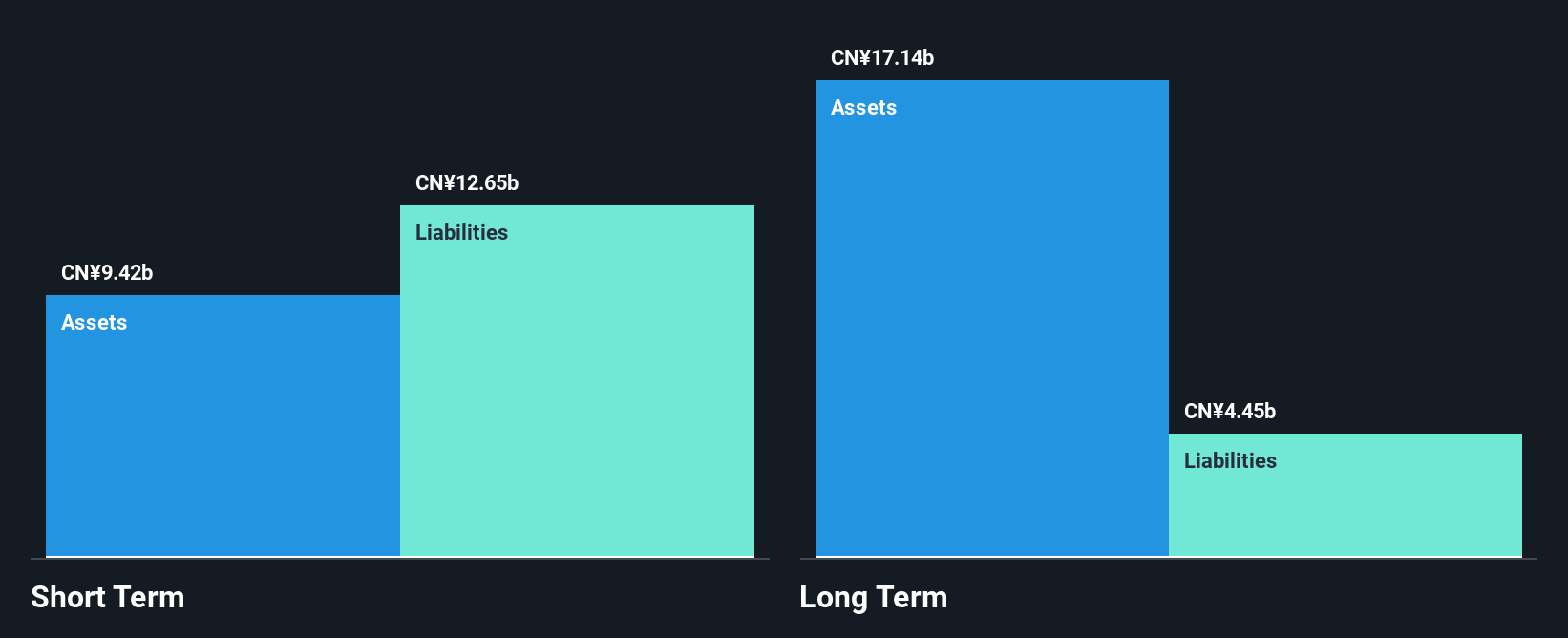

5i5j Holding Group Co., Ltd. has recently achieved profitability, with a net income of CN¥38.4 million for the first half of 2025, despite a slight decline in revenue compared to the previous year. The company holds more cash than its total debt, and its operating cash flow covers its debt well. However, short-term liabilities exceed short-term assets by CN¥3.3 billion, which could pose liquidity challenges. Earnings have been impacted by a significant one-off gain of CN¥1.2 billion over the past year. Recent amendments to company bylaws indicate ongoing structural adjustments within the organization to enhance governance and management systems.

- Click here to discover the nuances of 5i5j Holding Group with our detailed analytical financial health report.

- Review our growth performance report to gain insights into 5i5j Holding Group's future.

Seize The Opportunity

- Click through to start exploring the rest of the 976 Asian Penny Stocks now.

- Ready To Venture Into Other Investment Styles? Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000560

5i5j Holding Group

Provides real estate brokerage services in China and internationally.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives