- China

- /

- Real Estate

- /

- SZSE:000558

There's Reason For Concern Over Chengdu New Tianfu Culture Tourism Development Co., Ltd.'s (SZSE:000558) Price

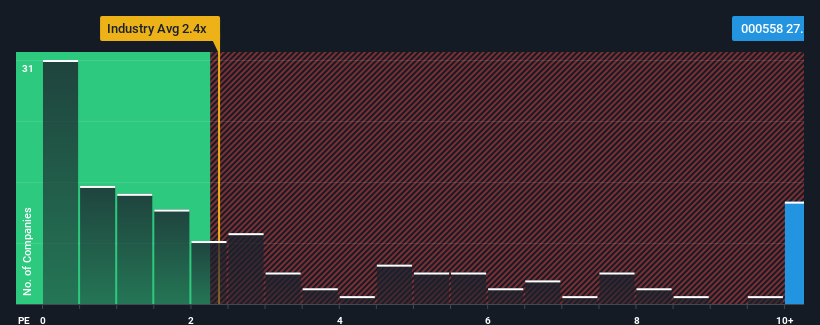

When close to half the companies in the Real Estate industry in China have price-to-sales ratios (or "P/S") below 2.4x, you may consider Chengdu New Tianfu Culture Tourism Development Co., Ltd. (SZSE:000558) as a stock to avoid entirely with its 27.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Chengdu New Tianfu Culture Tourism Development

How Has Chengdu New Tianfu Culture Tourism Development Performed Recently?

For instance, Chengdu New Tianfu Culture Tourism Development's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Chengdu New Tianfu Culture Tourism Development's earnings, revenue and cash flow.How Is Chengdu New Tianfu Culture Tourism Development's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Chengdu New Tianfu Culture Tourism Development's is when the company's growth is on track to outshine the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 58%. Regardless, revenue has managed to lift by a handy 17% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the industry, which is expected to grow by 8.2% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it concerning that Chengdu New Tianfu Culture Tourism Development is trading at a P/S higher than the industry. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Bottom Line On Chengdu New Tianfu Culture Tourism Development's P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

The fact that Chengdu New Tianfu Culture Tourism Development currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Chengdu New Tianfu Culture Tourism Development with six simple checks.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000558

Chengdu New Tianfu Culture Tourism Development

Chengdu New Tianfu Culture Tourism Development Co., Ltd.

Imperfect balance sheet with very low risk.

Market Insights

Community Narratives