- China

- /

- Real Estate

- /

- SZSE:000514

Subdued Growth No Barrier To Chongqing Yukaifa Co., Ltd (SZSE:000514) With Shares Advancing 37%

Chongqing Yukaifa Co., Ltd (SZSE:000514) shares have had a really impressive month, gaining 37% after a shaky period beforehand. Notwithstanding the latest gain, the annual share price return of 9.8% isn't as impressive.

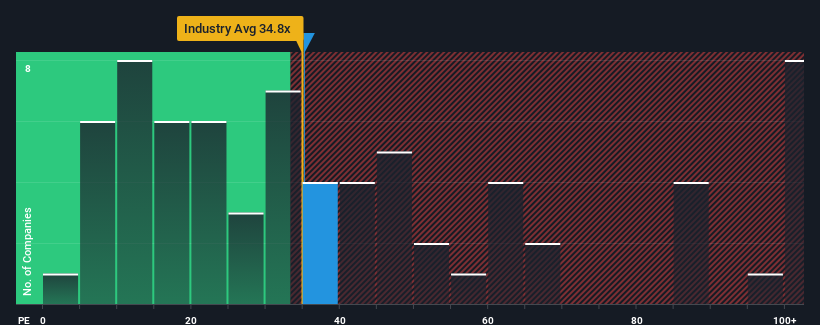

Although its price has surged higher, there still wouldn't be many who think Chongqing Yukaifa's price-to-earnings (or "P/E") ratio of 35.2x is worth a mention when the median P/E in China is similar at about 33x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

As an illustration, earnings have deteriorated at Chongqing Yukaifa over the last year, which is not ideal at all. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Chongqing Yukaifa

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Chongqing Yukaifa's is when the company's growth is tracking the market closely.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 36%. The last three years don't look nice either as the company has shrunk EPS by 30% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 38% shows it's an unpleasant look.

With this information, we find it concerning that Chongqing Yukaifa is trading at a fairly similar P/E to the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

The Bottom Line On Chongqing Yukaifa's P/E

Chongqing Yukaifa's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Chongqing Yukaifa currently trades on a higher than expected P/E since its recent earnings have been in decline over the medium-term. Right now we are uncomfortable with the P/E as this earnings performance is unlikely to support a more positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you settle on your opinion, we've discovered 2 warning signs for Chongqing Yukaifa that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000514

Chongqing Yukaifa

Engages in the development and sale of real estate properties in China.

Acceptable track record with mediocre balance sheet.

Market Insights

Community Narratives