- China

- /

- Real Estate

- /

- SZSE:000069

Shenzhen Overseas Chinese Town Co.,Ltd.'s (SZSE:000069) Prospects Need A Boost To Lift Shares

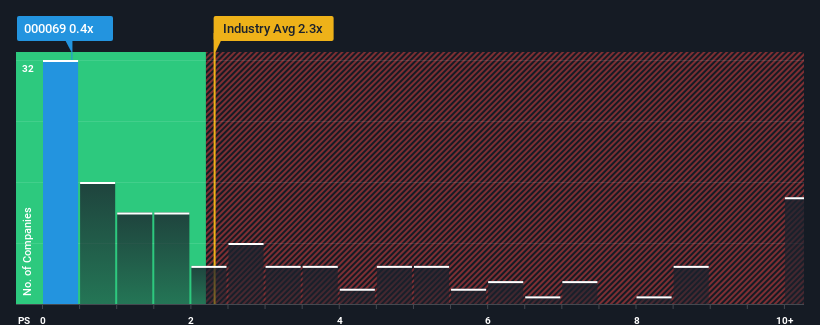

Shenzhen Overseas Chinese Town Co.,Ltd.'s (SZSE:000069) price-to-sales (or "P/S") ratio of 0.4x might make it look like a buy right now compared to the Real Estate industry in China, where around half of the companies have P/S ratios above 2.3x and even P/S above 6x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Shenzhen Overseas Chinese TownLtd

What Does Shenzhen Overseas Chinese TownLtd's P/S Mean For Shareholders?

With revenue that's retreating more than the industry's average of late, Shenzhen Overseas Chinese TownLtd has been very sluggish. Perhaps the market isn't expecting future revenue performance to improve, which has kept the P/S suppressed. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shenzhen Overseas Chinese TownLtd.Is There Any Revenue Growth Forecasted For Shenzhen Overseas Chinese TownLtd?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Shenzhen Overseas Chinese TownLtd's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 33% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 46% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 16% as estimated by the only analyst watching the company. Meanwhile, the broader industry is forecast to expand by 13%, which paints a poor picture.

With this information, we are not surprised that Shenzhen Overseas Chinese TownLtd is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Shenzhen Overseas Chinese TownLtd's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. As other companies in the industry are forecasting revenue growth, Shenzhen Overseas Chinese TownLtd's poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Shenzhen Overseas Chinese TownLtd that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000069

Shenzhen Overseas Chinese TownLtd

Engages in the investment and operation of theme parks, hotels, and real estate properties in China.

Undervalued with imperfect balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026